Get the free FORM E-1 - rochestermn

Show details

This document presents the comparative balance sheets for the Law Enforcement Block Grants Fund of the City of Rochester, Minnesota, for the years ending December 31, 2001 and 2000, detailing assets

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form e-1 - rochestermn

Edit your form e-1 - rochestermn form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e-1 - rochestermn form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form e-1 - rochestermn online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form e-1 - rochestermn. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form e-1 - rochestermn

How to fill out FORM E-1

01

Start by downloading the FORM E-1 from the official website.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information in the designated sections, including your name, address, and contact details.

04

Complete the sections related to your income sources, ensuring all figures are accurate and up-to-date.

05

Attach any required documentation that supports your application, as specified in the instructions.

06

Review the form for completeness and accuracy before submitting.

07

Submit the completed FORM E-1 to the appropriate processing center as indicated in the instructions.

Who needs FORM E-1?

01

Individuals or businesses applying for specific permits or benefits requiring FORM E-1.

02

Anyone seeking to report income or for tax purposes as mandated by relevant authorities.

Fill

form

: Try Risk Free

People Also Ask about

What is an E-1 form?

Form E-1 is a tax return used by a resident individual taxpayer, regardless of the location of their employer, or a non-resident working in the City of St. Louis to file and pay the earnings tax of 1% due and not withheld by the employer.

What is the form E in English?

Form E, also known as Borang E in Malay, is an annual report that employers in Malaysia must submit to the Inland Revenue Board of Malaysia (LHDN). This form provides a comprehensive summary of employment information, including employee salaries, bonuses, and deductions for the previous year.

What is the E1 form?

Form E1: Financial statement for a financial remedy (other than a financial order or financial relief after an overseas divorce or dissolution etc) in the family court or High Court.

What is form E in customs?

The Customs Authority of the importing Party shall accept a Certificate of Origin (Form E) in cases where the sales invoice is issued either by a company located in a third country or by an ACFTA exporter for the account of the said company, provided that the product meets the requirements of the Rules of Origin for

What is the form e for?

A form E is required for the court to determine a fair settlement. If parties are mutually agreeing financial settlement without financial disclosure, then financial form is not compulsory. It is however advisable to exchange Form E's. This highlights all the elements to be considered before reaching an agreement.

What is the e form used for?

Electronic forms (eforms) provide a series of fields where data is collected, often using a Web browser. They take the place of paper forms and are designed to capture, validate, and submit data to a recipient for forms processing in a more efficient manner.

What tax form do I use for a non-resident in Missouri?

Filing Form MO-CR or Form MO-NRI Missouri residents with income from another state, nonresidents, and part-year residents need to file Form MO-CR or Form MO-NRI with Form MO-1040 (long form).

What happens if you don't fill in form E?

If you, or your partner, opt not to fill in and submit Form E following a court order, you could face serious consequences. Initially, you may receive a fine. However, the longer you avoid completing and submitting the form, the more serious the penalty becomes to the extent that you may face prison.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM E-1?

FORM E-1 is a document used for reporting certain financial information to regulatory authorities, typically related to employment or business operations.

Who is required to file FORM E-1?

Entities and individuals involved in specific business activities or employment situations as defined by the regulations are required to file FORM E-1.

How to fill out FORM E-1?

To fill out FORM E-1, one should collect all necessary financial information, follow the provided guidelines for the format and sections, and ensure accuracy before submission.

What is the purpose of FORM E-1?

The purpose of FORM E-1 is to provide a standardized method for reporting financial data to ensure compliance with regulations and to aid in oversight.

What information must be reported on FORM E-1?

FORM E-1 must report relevant financial data, including but not limited to income statements, balance sheets, and specific details about employment or business transactions as mandated by the guidelines.

Fill out your form e-1 - rochestermn online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form E-1 - Rochestermn is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

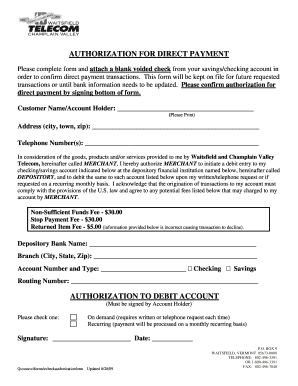

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.