Get the free SEC Adopts New FINRA Rule

Show details

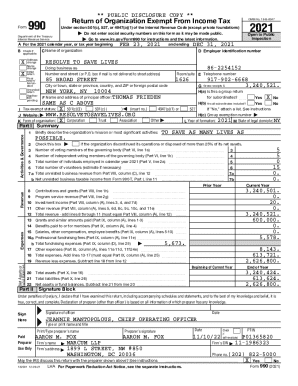

News Bulletin June 27, 2012SEC Adopts New FINRA Rule

Governing Communications with

the Public

The Securities and Exchange Commission (the SEC) has approved the proposed new rules of the Financial

Industry

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sec adopts new finra

Edit your sec adopts new finra form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sec adopts new finra form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sec adopts new finra online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sec adopts new finra. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sec adopts new finra

How to fill out SEC adopts new FINRA:

01

Understand the reason for the new FINRA regulations: It is important to familiarize yourself with the purpose of the SEC adopting new FINRA regulations. This will help you understand why certain information is required and how to accurately complete the forms.

02

Collect all the necessary information: Before filling out the forms, gather all the required information and documentation. This may include personal details, financial statements, employment history, disciplinary actions, and any other relevant information that needs to be provided.

03

Read the instructions carefully: The SEC provides detailed instructions on how to fill out the forms. It is crucial to read and understand these instructions thoroughly before proceeding. Pay attention to any specific requirements or additional documents that need to be attached.

04

Complete the necessary forms: Based on the SEC's new FINRA regulations, fill out the required forms accurately and legibly. Take your time to ensure all the information provided is correct and up-to-date. Double-check your forms for any errors or missing information before submitting.

05

Keep copies for your records: Make copies of the completed forms, along with any supporting documentation, for your personal records. This will serve as proof of your submission and can be helpful in case of any future audits or inquiries.

Who needs SEC adopts new FINRA:

01

Financial professionals: Individuals working in the financial industry, such as brokers, investment advisers, and brokerage firms, may need to fill out SEC adopts new FINRA forms. These forms are designed to regulate and monitor the activities of financial professionals to protect investors and maintain market integrity.

02

Companies offering securities: Companies that issue securities, such as stocks or bonds, may also be required to fill out SEC adopts new FINRA forms. These forms help ensure that accurate and timely information is disclosed to investors and that the securities offered comply with regulatory standards.

03

Investors: While investors themselves may not directly fill out SEC adopts new FINRA forms, these regulations ultimately aim to protect them. By requiring financial professionals and companies to provide complete and accurate information, investors are better informed and can make more informed decisions when investing in the financial markets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sec adopts new finra from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including sec adopts new finra. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute sec adopts new finra online?

Completing and signing sec adopts new finra online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out sec adopts new finra on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your sec adopts new finra. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is sec adopts new finra?

SEC adopting new FINRA rules means that the Securities and Exchange Commission has approved new rules proposed by the Financial Industry Regulatory Authority.

Who is required to file sec adopts new finra?

Firms and individuals regulated by FINRA are required to adhere to the new rules adopted by the SEC.

How to fill out sec adopts new finra?

To fill out the new FINRA rules adopted by the SEC, firms and individuals must carefully review the requirements and submit the necessary information through the appropriate channels.

What is the purpose of sec adopts new finra?

The purpose of SEC adopting new FINRA rules is to enhance investor protection and market integrity by enforcing stricter regulations within the financial industry.

What information must be reported on sec adopts new finra?

The information that must be reported on the new FINRA rules adopted by the SEC includes details of transactions, account information, and compliance with regulatory standards.

Fill out your sec adopts new finra online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sec Adopts New Finra is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.