Get the free Orality and Microsavings - microsave

Show details

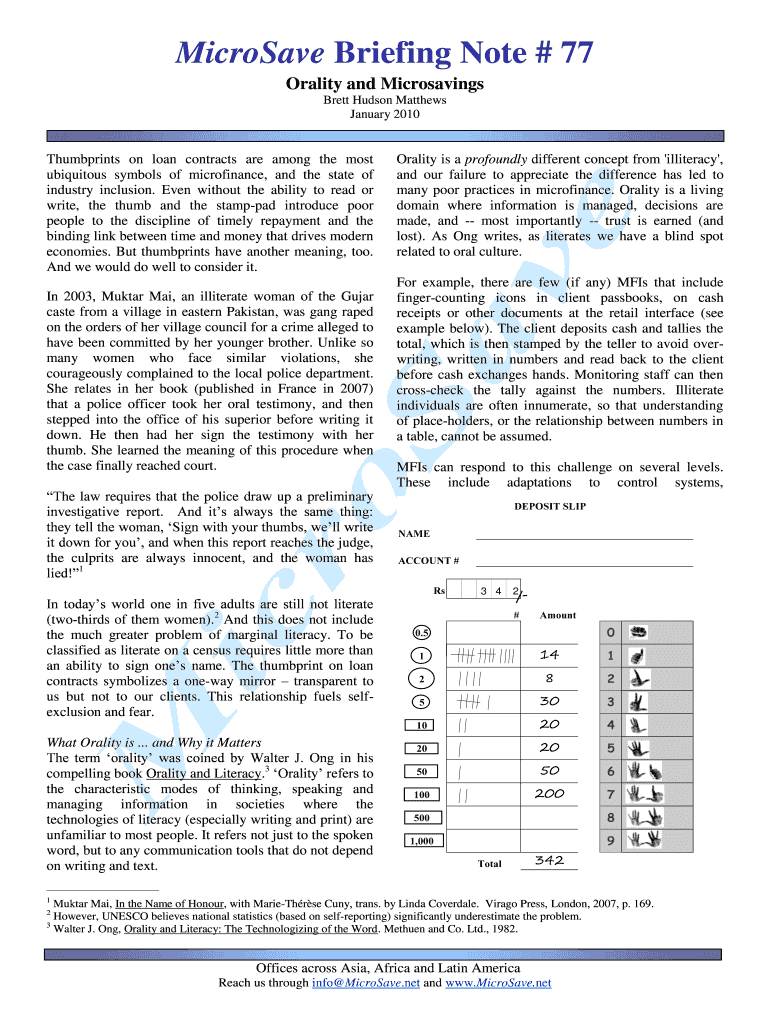

Microwave Briefing Note # 77 Orality and Microsavings Brett Hudson Matthews January 2010 Thumbprints on loan contracts are among the most ubiquitous symbols of microfinance, and the state of industry

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign orality and microsavings

Edit your orality and microsavings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your orality and microsavings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing orality and microsavings online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit orality and microsavings. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out orality and microsavings

How to fill out orality and microsavings?

01

Start by understanding the concept of orality and microsavings. Orality refers to the use of verbal communication or storytelling as a means of sharing information, particularly in communities with limited access to written resources. Microsavings, on the other hand, involves saving small amounts of money over time, often with the help of financial institutions or mobile money platforms.

02

Determine your goals and objectives for utilizing orality and microsavings. Are you looking to promote financial inclusion in underserved communities? Or are you interested in developing innovative financial literacy programs for specific target groups? Clearly defining your objectives will guide your approach to filling out orality and microsavings.

03

Research and identify existing resources or initiatives related to orality and microsavings. Look for organizations, NGOs, or academic institutions that have expertise in this area. Study their documentation, case studies, and best practices to gain insights and gather ideas.

04

Develop a strategy or action plan. Consider the specific needs and challenges of the target community or group you aim to serve. Determine the methods and tools you will use to promote orality, such as storytelling, community events, or radio programs. For microsavings, explore options like partnering with financial institutions, establishing savings groups, or leveraging mobile money platforms.

05

Execute your strategy by implementing the planned activities. Train facilitators or volunteers who will help engage the community in orality and microsavings initiatives. Organize workshops, seminars, or interactive sessions to educate community members and dispel any misconceptions or fears they may have.

06

Monitor and evaluate the impact of your orality and microsavings efforts. Regularly collect data on metrics such as the number of participants, savings amounts, and changes in financial behavior. Use this feedback to assess the effectiveness of your initiatives and make any necessary improvements or adjustments.

Who needs orality and microsavings?

01

Individuals in underserved or marginalized communities who have limited access to formal financial institutions or education.

02

Small business owners or entrepreneurs who want to save and grow their income but lack the necessary resources or knowledge.

03

Organizations or institutions working on financial inclusion, development, or poverty alleviation initiatives that aim to empower communities with financial knowledge and tools.

04

Governments or policymakers interested in promoting sustainable economic growth and reducing poverty rates through initiatives that encourage savings habits and financial education.

Overall, orality and microsavings can benefit a wide range of individuals and communities by improving their financial literacy, promoting savings habits, and providing greater access to financial services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send orality and microsavings for eSignature?

Once your orality and microsavings is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit orality and microsavings straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing orality and microsavings.

How do I complete orality and microsavings on an Android device?

Use the pdfFiller app for Android to finish your orality and microsavings. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is orality and microsavings?

Orality refers to the practice of passing down knowledge and information through spoken word rather than written text. Microsavings are small deposits made by individuals into a savings account, typically with minimal fees and low minimum balance requirements.

Who is required to file orality and microsavings?

Individuals who engage in oral traditions or practices, as well as those who participate in microsaving activities, may be required to file reports related to orality and microsavings.

How to fill out orality and microsavings?

To fill out reports related to orality and microsavings, individuals should provide details about their oral traditions or practices, as well as information about their microsaving activities, including amounts saved and frequency of deposits.

What is the purpose of orality and microsavings?

The purpose of tracking orality and microsavings is to preserve cultural heritage and promote financial inclusion by encouraging individuals to save money and build assets.

What information must be reported on orality and microsavings?

Information that must be reported on orality and microsavings may include details about specific oral traditions or practices, as well as data on individuals' savings habits and account balances.

Fill out your orality and microsavings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Orality And Microsavings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.