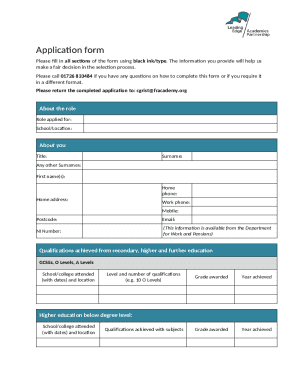

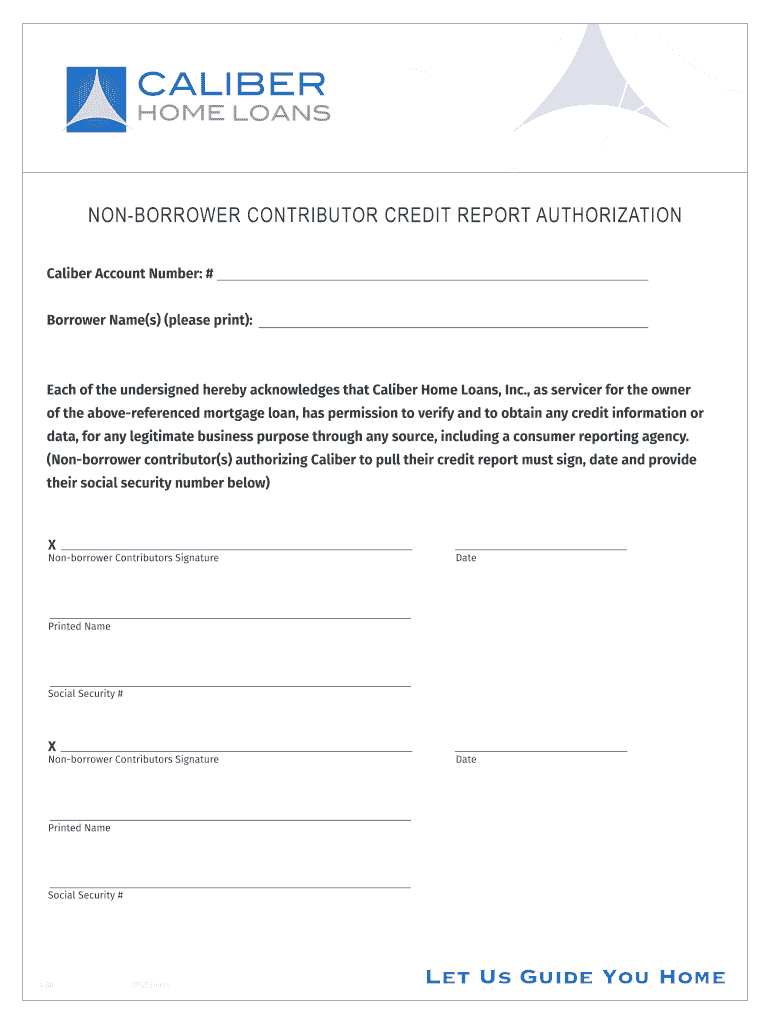

Get the free NON-BORROWER CONTRIBUTOR CREDIT REPORT AUTHORIZATION

Show details

BORROWER CONTRIBUTOR CREDIT REPORT AUTHORIZATION

Caliber Account Number: #

Borrower Name(s) (please print):Each of the undersigned hereby acknowledges that Caliber Home Loans, Inc., as service for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-borrower contributor credit report

Edit your non-borrower contributor credit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-borrower contributor credit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-borrower contributor credit report online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non-borrower contributor credit report. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-borrower contributor credit report

How to fill out a non-borrower contributor credit report:

01

Obtain the necessary forms: Begin by accessing the non-borrower contributor credit report form. This form can usually be obtained from the credit reporting agency or lender that requires the report. Make sure you have the most recent version of the form.

02

Provide personal information: Start filling out the form by providing your personal information. This may include your full name, date of birth, social security number, current address, and contact information. Ensure that all the information provided is accurate and up to date.

03

Specify the relationship: Indicate your relationship to the borrower for whom you are a non-borrower contributor. This relationship could be as a spouse, family member, business partner, or any other relevant connection. Clearly state your role and how it relates to the borrower.

04

Provide financial details: Fill in your financial details on the form. This may include your income, assets, liabilities, and any other relevant financial information. Be prepared to provide supporting documentation, such as bank statements, tax returns, or pay stubs, to verify the information provided.

05

Discuss credit history: Include information about your credit history on the form. Specify any outstanding loans, credit cards, or other debts that you may have. Be transparent about any late payments, defaults, or bankruptcies that may have affected your credit history. Provide supporting documentation, such as credit reports or payment records, if requested.

06

Sign and submit the form: Once you have filled out all the required sections, review the form for accuracy and completeness. Ensure that all necessary fields have been filled out and all supporting documentation attached. Sign and date the form, acknowledging that the information provided is true and accurate to the best of your knowledge. Submit the completed form to the appropriate credit reporting agency or lender.

Who needs a non-borrower contributor credit report?

A non-borrower contributor credit report may be required in various situations where the creditworthiness of an individual other than the borrower needs to be assessed or considered. Some common scenarios where a non-borrower contributor credit report may be necessary include:

01

Co-signed loans: When someone cosigns a loan for another individual, the lender may request a non-borrower contributor credit report on the cosigner to evaluate their creditworthiness and ability to repay the loan if the primary borrower defaults.

02

Joint applicants: In cases where two or more individuals apply for credit together, such as a joint mortgage or business loan, the lender may request non-borrower contributor credit reports on all applicants to assess the overall creditworthiness of the group.

03

Guarantors or sureties: When an individual guarantees or acts as a surety for another's debt, a non-borrower contributor credit report may be required. This helps the lender evaluate the guarantor's ability to fulfill the financial obligation in the event the primary borrower fails to make payments.

04

Authorized users: For certain credit accounts, such as credit cards, individuals can be added as authorized users without being responsible for repayment. However, in some cases, the primary account holder may need to provide a non-borrower contributor credit report to prove the authorized user's creditworthiness.

It's important to consult with the relevant lender or credit reporting agency to confirm whether a non-borrower contributor credit report is needed and to understand their specific requirements and guidelines for filling out the report.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find non-borrower contributor credit report?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific non-borrower contributor credit report and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit non-borrower contributor credit report online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your non-borrower contributor credit report to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in non-borrower contributor credit report without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing non-borrower contributor credit report and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your non-borrower contributor credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Borrower Contributor Credit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.