Get the free Affidavit of Gross Receipts Form - City of Hannibal - hannibal-mo

Show details

City of Hannibal Office of City Clerk 320 Broadway Hannibal MO 63401 Phone 573-221-0111 Fax 573-221-8191 AFFIDAVIT OF GROSS RECEIPTS Business Name Business License Number Rec d on File State of Missouri being duly sworn his oath says that the gross Name of Authorized Person Amount received by during the license year ending Name of Business on the 30th day of June 20 From or through its business location or occupation at Address of Business has ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign affidavit of gross receipts

Edit your affidavit of gross receipts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit of gross receipts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit of gross receipts online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit affidavit of gross receipts. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out affidavit of gross receipts

To fill out the affidavit of gross receipts, follow these steps:

01

Start by downloading the affidavit of gross receipts form from a trusted source, such as a government website or a legal forms provider.

02

Begin filling out the form by providing your personal information, such as your name, address, and contact details. Some forms may also require you to provide your social security number or taxpayer identification number.

03

Next, provide the details of your business, including the name, address, and the type of business entity (sole proprietorship, partnership, corporation, etc.).

04

Enter the reporting period for which you are providing the gross receipts information. This typically includes the start and end dates of the period.

05

Calculate and enter the total gross receipts for the reporting period. This includes the total amount of revenue generated by your business during that time. Ensure that you accurately calculate this figure by including all types of income, such as sales, services, rentals, or any other sources of revenue.

06

Some forms may require you to provide additional information or attach supporting documents. These may include invoices, sales receipts, or any other relevant financial records that validate the reported gross receipts.

07

Carefully review the completed form to ensure that all the entered information is accurate and complete. Check for any errors or missing details, as these may delay the processing of your affidavit.

08

Once satisfied, sign the affidavit of gross receipts form. Some forms may require additional signatures from other individuals, such as a notary public or a witness.

09

Keep a copy of the filled-out form for your records before submitting it to the designated authority, as required by the relevant jurisdiction or governing regulations.

10

The affidavit of gross receipts is commonly required by small business owners, self-employed individuals, or freelancers for various purposes. It provides a declaration of the business's income and helps maintain accurate financial records. This document may be needed for tax reporting, obtaining loans, applying for licenses or permits, or during legal proceedings. Always consult with a legal or financial professional to determine your specific requirements for submitting an affidavit of gross receipts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

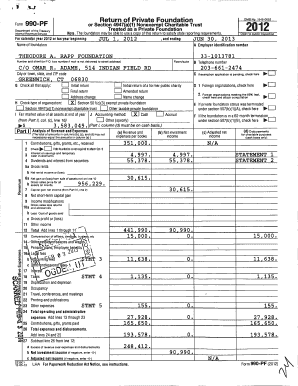

What is affidavit of gross receipts?

The affidavit of gross receipts is a legal document that reports the total amount of income or revenue generated by a business within a specific period of time.

Who is required to file affidavit of gross receipts?

The requirement to file an affidavit of gross receipts varies by jurisdiction and business type. Generally, most businesses, especially those engaged in retail, wholesale, or professional services, are required to file this document.

How to fill out affidavit of gross receipts?

To fill out an affidavit of gross receipts, you will typically need to provide your business information, such as the business name, address, tax identification number, and the specific reporting period. You will also need to accurately report the amount of gross receipts or income earned during that period.

What is the purpose of affidavit of gross receipts?

The purpose of the affidavit of gross receipts is to provide accurate information about a business's income or revenue to tax authorities, regulatory agencies, or other relevant entities. It helps in assessing taxes, monitoring compliance, and making informed decisions.

What information must be reported on affidavit of gross receipts?

The information that must be reported on an affidavit of gross receipts typically includes the business name, address, tax identification number, reporting period, and the total amount of gross receipts or income generated during that period.

How can I send affidavit of gross receipts to be eSigned by others?

affidavit of gross receipts is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute affidavit of gross receipts online?

pdfFiller makes it easy to finish and sign affidavit of gross receipts online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out affidavit of gross receipts on an Android device?

On Android, use the pdfFiller mobile app to finish your affidavit of gross receipts. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your affidavit of gross receipts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit Of Gross Receipts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.