MO RD-109 - Kansas City 2012 free printable template

Show details

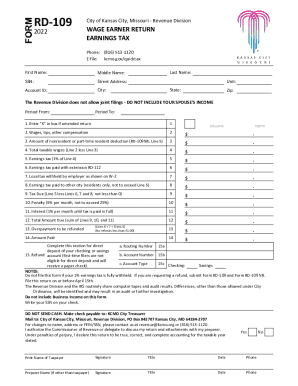

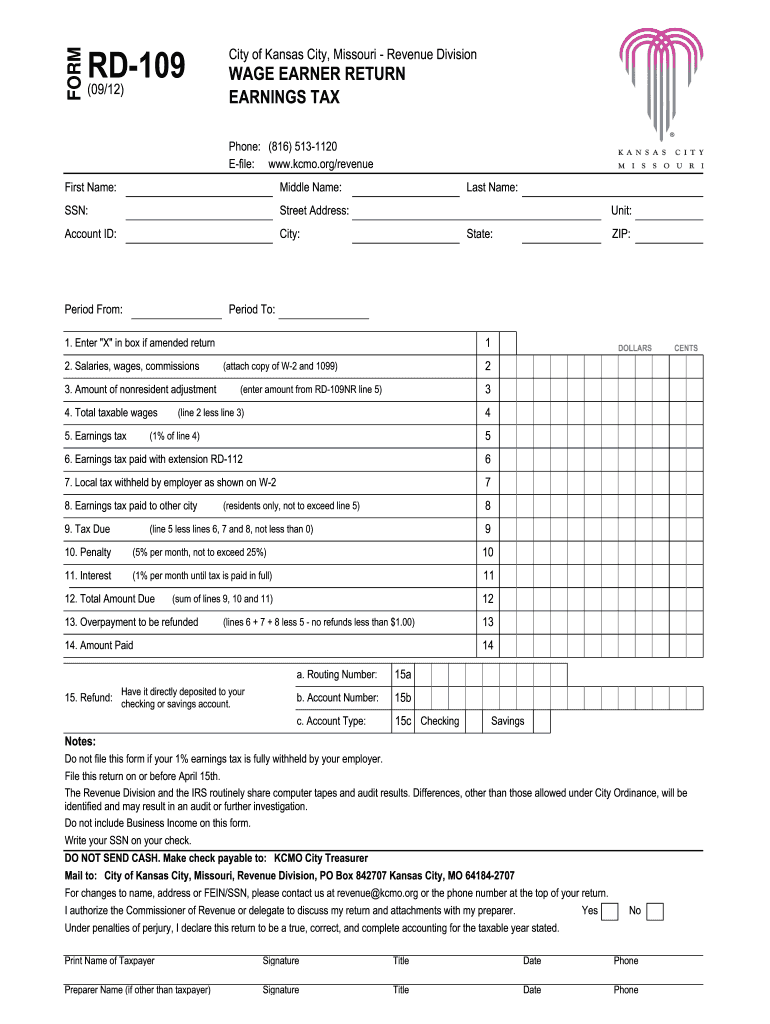

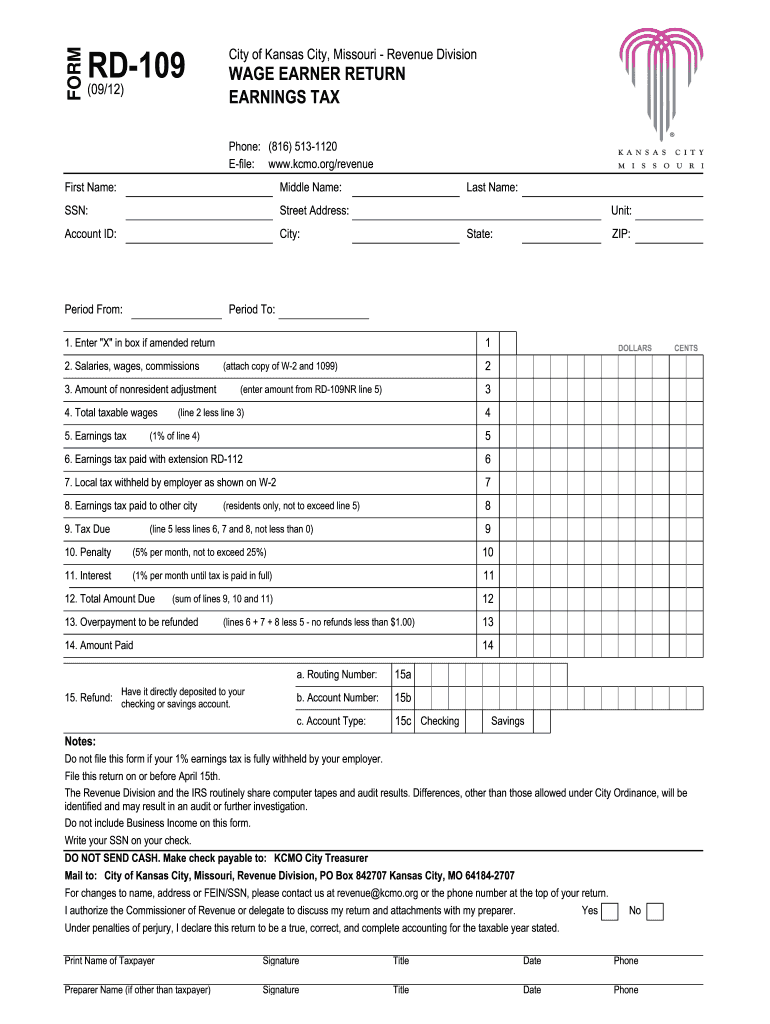

FORM RD-109 09/12 City of Kansas City Missouri - Revenue Division WAGE EARNER RETURN EARNINGS TAX Phone 816 513-1120 E-file www. This form is used in conjunction with the RD-109 Wage Earner Return - Earnings Tax Form to calculate a refund or an overpayment of taxes for services performed outside of Kansas City Missouri. Please file electronically at www. kcmo. org/revenue. b Extension--An extension of time to file the Kansas City MO Wage Earner Return RD-109 may be obtained by filing form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO RD-109 - Kansas City

Edit your MO RD-109 - Kansas City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO RD-109 - Kansas City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO RD-109 - Kansas City online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MO RD-109 - Kansas City. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO RD-109 - Kansas City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO RD-109 - Kansas City

How to fill out MO RD-109 - Kansas City

01

Gather all necessary personal information including your name, address, and identification.

02

Obtain the MO RD-109 form from the official Kansas City website or local government office.

03

Carefully read the instructions provided on the form to ensure accurate completion.

04

Fill out the form, providing all required details as specified, such as income and expenses.

05

Review the completed form for any errors or omissions.

06

Submit the form via the designated method (online, in-person, or by mail) by the deadline.

Who needs MO RD-109 - Kansas City?

01

Individuals or businesses that are seeking to report their earnings or financial information to the relevant authorities in Kansas City.

02

Residents of Kansas City who are required to complete tax or regulatory submissions as specified by local laws.

Fill

form

: Try Risk Free

People Also Ask about

What is Kansas City RD 109 for taxpayer taxes?

Form RD-109 is a tax return used by a resident individual taxpayer or a non-resident working in Kansas City, Missouri to file and pay the earnings tax of one percent. Form RD-109 should not be filed if the earnings tax due is fully withheld by the taxpayer's employer.

Who is required to pay Kansas City tax?

For individuals, the tax is on the amount of money you earn while living or working in the city. Kansas City residents must pay the tax on their earnings, no matter where they work. But nonresidents only have to pay the tax on the money they earn within Kansas City.

What is the Kansas City profits tax RD 108?

Form RD-108/108B is a tax return used by a sole proprietor, corporation, partnership, K-1 recipient or other fiduciary to file and pay the earnings tax of 1% due on net profits.

What is the Kansas City local tax withholding?

All Kansas City, Missouri residents, regardless of where they are employed, and all non- residents who work within the city limits, are subject to a 1 percent tax on their gross earnings.

Do I have to pay Kansas City tax?

All Kansas City, Missouri residents are required to pay the earnings tax, even if they work outside of the city. Non-residents are required to pay the earnings tax on income earned within Kansas City, Missouri city limits.

What is Kansas City special tax?

The 9.975% sales tax rate in Kansas City consists of 4.225% Missouri state sales tax, 1.375% Jackson County sales tax, 3.25% Kansas City tax and 1.125% Special tax. You can print a 9.975% sales tax table here. For tax rates in other cities, see Missouri sales taxes by city and county.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MO RD-109 - Kansas City from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your MO RD-109 - Kansas City into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the MO RD-109 - Kansas City in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your MO RD-109 - Kansas City in minutes.

How do I fill out MO RD-109 - Kansas City on an Android device?

Use the pdfFiller mobile app to complete your MO RD-109 - Kansas City on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is MO RD-109 - Kansas City?

MO RD-109 is a tax form used in Kansas City, Missouri, to report and remit the local earnings tax for individuals and businesses.

Who is required to file MO RD-109 - Kansas City?

Individuals and businesses with earnings or income sourced from Kansas City are required to file MO RD-109.

How to fill out MO RD-109 - Kansas City?

To fill out MO RD-109, obtain the form from the Kansas City tax office website, enter your personal and financial information, calculate your earnings tax based on your income, and submit the completed form along with any required payment.

What is the purpose of MO RD-109 - Kansas City?

The purpose of MO RD-109 is to ensure that individuals and businesses fulfill their local earnings tax obligations to the city of Kansas City.

What information must be reported on MO RD-109 - Kansas City?

The MO RD-109 requires reporting of personal identification information, total earnings, deductions, and the calculated local earnings tax amount.

Fill out your MO RD-109 - Kansas City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO RD-109 - Kansas City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.