Get the free CPA Contact Authorization for Schools - NACCAS

Show details

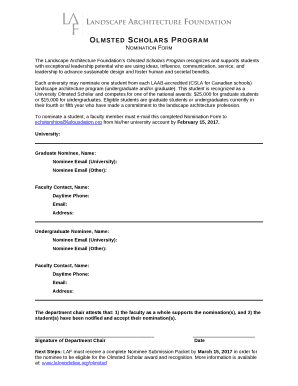

CPA AUTHORIZATION I, chief executive, school officer or school designated official, hereby authorize the Director of Finance (or his/her agent) of the National Accrediting Commission of Career Arts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cpa contact authorization for

Edit your cpa contact authorization for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpa contact authorization for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cpa contact authorization for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cpa contact authorization for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cpa contact authorization for

How to Fill Out CPA Contact Authorization Form:

01

Begin by downloading the CPA contact authorization form from the official website or obtaining a copy from your CPA.

02

Fill out your personal information accurately, including your full name, address, phone number, and email address. Make sure to provide the most up-to-date contact information.

03

Indicate the specific purpose of the contact authorization by selecting the appropriate checkboxes. For example, if you are authorizing your CPA to communicate with the IRS on your behalf, check the box next to "IRS Communication."

04

If you have multiple CPAs or tax professionals involved, specify the individuals or firms you are authorizing to contact. Provide their names, addresses, phone numbers, and email addresses in the designated sections.

05

Review the terms and conditions of the contact authorization form carefully. Ensure that you understand your rights and responsibilities regarding the authorized communication. If you have any questions, consult with your CPA before signing the form.

06

Sign and date the form in the designated spaces to validate your authorization. If there are additional signature lines for witness or notary, make sure to complete those sections if required.

07

Make a copy of the signed form for your records before sending the original back to your CPA. Consider sending it through certified mail or any method that provides proof of delivery.

Who Needs CPA Contact Authorization:

01

Individuals or businesses seeking professional assistance from a Certified Public Accountant (CPA) may need to complete a CPA contact authorization form.

02

If you want your CPA to communicate directly with government agencies like the Internal Revenue Service (IRS) on your behalf, a contact authorization is usually required.

03

Businesses or individuals with complex financial situations or facing audits may need to authorize their CPA to communicate with third parties such as banks, creditors, or legal representatives.

04

Taxpayers who need assistance in negotiating payment plans or resolving tax-related issues may find it beneficial to authorize their CPA to communicate with tax authorities.

05

Individuals or businesses involved in financial transactions, estate planning, or any situation where designated professional communication is necessary may require a CPA contact authorization.

Remember, the specific circumstances and requirements for a CPA contact authorization may vary. It is essential to consult with your CPA or tax advisor to determine whether you need to complete this form and how to do it correctly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cpa contact authorization for?

CPA contact authorization is used to authorize a Certified Public Accountant (CPA) to represent and communicate on behalf of an individual or business with the IRS.

Who is required to file cpa contact authorization for?

Any individual or business who wants their CPA to represent them before the IRS must file CPA contact authorization.

How to fill out cpa contact authorization for?

To fill out CPA contact authorization, the taxpayer must provide their personal information, CPA's information, and sign the form to authorize the representation.

What is the purpose of cpa contact authorization for?

The purpose of CPA contact authorization is to allow a CPA to act on behalf of a taxpayer for tax matters with the IRS.

What information must be reported on cpa contact authorization for?

The CPA contact authorization form must include the taxpayer's name, social security number, contact information, CPA's name, PTIN number, address, and signed authorization.

How can I manage my cpa contact authorization for directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your cpa contact authorization for as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make edits in cpa contact authorization for without leaving Chrome?

cpa contact authorization for can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the cpa contact authorization for in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your cpa contact authorization for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpa Contact Authorization For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.