Get the free Loss of Taxable Fuel Petition For Refund - adorstatealus - ador state al

Show details

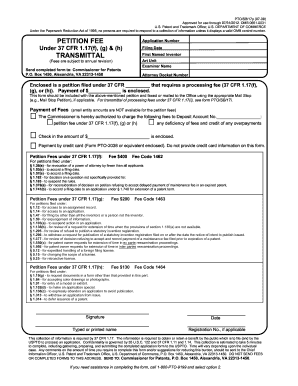

B&L: MFT PRL ALABAMA DEPARTMENT OF REVENUE 1/12 BUSINESS & LICENSE TAX DIVISION RESET MOTOR FUELS SECTION P.O. Box 327540 Montgomery, AL 361327540 (334) 2429608 Fax (334) 2421199 www.revenue.alabama.gov

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loss of taxable fuel

Edit your loss of taxable fuel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loss of taxable fuel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loss of taxable fuel online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loss of taxable fuel. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loss of taxable fuel

How to Fill out Loss of Taxable Fuel:

01

Gather all necessary information: Before filling out the loss of taxable fuel form, gather all the required information such as date of the loss, quantity of fuel lost, location of the loss, and reason for the loss.

02

Complete the top section: Start by filling out the top section of the form, which typically includes your name, address, contact information, and any tax identification numbers related to your fuel usage.

03

Provide the details of the loss: In the main body of the form, there will be sections where you need to provide specific details about the loss of taxable fuel. This may include the date and time of the loss, the type of fuel lost (e.g., gasoline, diesel, etc.), and the exact quantity that was lost.

04

Explain the circumstances: Along with the fuel loss details, there will be a section to explain the circumstances surrounding the loss. This may involve describing any accidents, spills, theft, or damage that resulted in the fuel loss. Be concise and provide all necessary details to support your claim.

05

Supportive documentation: In order to substantiate your claim, it's important to include any available supporting documentation. This might include photographs of the loss site, police or incident reports, repair invoices, or any other relevant evidence. Make sure to keep copies for your records.

06

Sign and date the form: Once you have provided all the required information, carefully review the form for accuracy and completeness. Sign and date the form at the bottom to certify the information provided is true and accurate to the best of your knowledge.

Who Needs Loss of Taxable Fuel?

01

Fuel vendors: Fuel vendors who experience a loss of taxable fuel due to theft, accidents, or spills may need to fill out a loss of taxable fuel form. This is important for them to report and document the lost fuel for taxation purposes.

02

Commercial transportation companies: Commercial transportation companies that use taxable fuel in their vehicles may require the loss of taxable fuel form. This allows them to report any fuel losses that may occur during transportation, ensuring proper documentation and potential tax adjustments.

03

Fuel storage facilities: Fuel storage facilities that experience losses, such as leaks or spills, may need to complete the loss of taxable fuel form. This helps them document and report the fuel losses for tax purposes, potentially making necessary adjustments.

Overall, anyone who has experienced a loss of taxable fuel should fill out the appropriate form to comply with tax regulations and to ensure accurate reporting of fuel inventory. Make sure to consult with the relevant tax authorities or seek professional advice to determine if you need to fill out a loss of taxable fuel form based on your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit loss of taxable fuel from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your loss of taxable fuel into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send loss of taxable fuel for eSignature?

To distribute your loss of taxable fuel, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I fill out loss of taxable fuel on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your loss of taxable fuel. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is loss of taxable fuel?

Loss of taxable fuel is the amount of fuel that has been lost or used for non-taxable purposes, such as for agriculture or off-highway use.

Who is required to file loss of taxable fuel?

Anyone who operates a diesel-powered highway vehicle and uses taxable fuel is required to file a loss of taxable fuel.

How to fill out loss of taxable fuel?

To fill out a loss of taxable fuel, you must report the total amount of fuel used, the amount lost or used for non-taxable purposes, and the reason for the loss.

What is the purpose of loss of taxable fuel?

The purpose of filing a loss of taxable fuel is to claim a tax refund or credit for the fuel that was lost or used for non-taxable purposes.

What information must be reported on loss of taxable fuel?

The information that must be reported on a loss of taxable fuel includes the total amount of fuel used, the amount lost or used for non-taxable purposes, and the reason for the loss.

Fill out your loss of taxable fuel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loss Of Taxable Fuel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.