Get the free DISCLOSURE DOCUMENT FOR PORTFOLIO MANAGEMENT SERVICES - Trustline - trustline

Show details

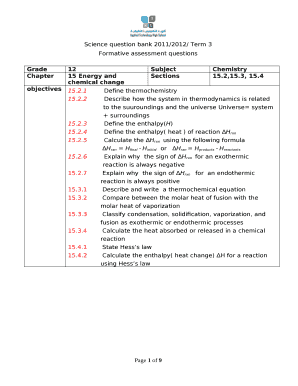

TRUSTING SECURITIES LIMITED (FORMERLY KNOWN AS K & A SECURITIES PVT. LTD.) SEMI REIGN No. INP000004268 DISCLOSURE DOCUMENT FOR PORTFOLIO MANAGEMENT SERVICES The Document has been filed with the Board

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign disclosure document for portfolio

Edit your disclosure document for portfolio form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disclosure document for portfolio form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit disclosure document for portfolio online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit disclosure document for portfolio. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out disclosure document for portfolio

How to Fill Out a Disclosure Document for Portfolio:

01

Gather necessary information: Before filling out the disclosure document for your portfolio, gather all the relevant information such as your personal details, financial holdings, investments, and any other required disclosures.

02

Understand the purpose: Familiarize yourself with the purpose of the disclosure document. It is designed to provide transparency and disclosure to clients regarding key information about your investment portfolio, including risks, performance history, fees, and conflicts of interest.

03

Follow the format: The disclosure document usually follows a standardized format. Start by providing a cover page with your personal and contact information. Then, include sections for risk disclosure, investment strategy, fees and expenses, performance history, and any other relevant sections required by the regulatory authorities.

04

Provide accurate and clear information: It is vital to ensure that the information provided in the disclosure document is accurate, current, and easily understandable for the clients. Be transparent about any risks associated with the investments, potential conflicts of interest, and any disciplinary actions or complaints against you.

05

Seek legal or professional advice if needed: If you are unsure about any particular section or have any legal concerns, it is advisable to seek the assistance of a legal professional or compliance expert. They can guide you through the process and help ensure that the document is compliant with all relevant regulations.

Who needs a disclosure document for a portfolio?

01

Investment Advisors: Registered investment advisors are usually required by regulatory authorities to provide a disclosure document to their clients. This ensures transparency and allows clients to make informed investment decisions.

02

Financial Institutions: Financial institutions, such as banks, brokerage firms, or asset management companies, are also required to provide disclosure documents to their clients. These documents help clients understand the nature of the products or services being offered and any associated risks.

03

Individual Investors: Even individual investors who manage their own portfolios may choose to create a disclosure document. This can be beneficial when seeking potential investors or when providing information to family members, heirs, or other parties who may have a vested interest in the portfolio.

Remember, it is crucial to check the specific regulations and requirements of your jurisdiction to determine exactly who needs a disclosure document and what information needs to be included.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is disclosure document for portfolio?

The disclosure document for portfolio is a report that outlines the investment holdings and activities of a portfolio manager or investment advisor.

Who is required to file disclosure document for portfolio?

Portfolio managers or investment advisors are required to file the disclosure document for portfolio.

How to fill out disclosure document for portfolio?

To fill out the disclosure document for portfolio, the portfolio manager or investment advisor must provide detailed information about the investments held in the portfolio, any conflicts of interest, and other pertinent information.

What is the purpose of disclosure document for portfolio?

The purpose of the disclosure document for portfolio is to provide transparency to investors and regulators about the investment activities and holdings of the portfolio manager or investment advisor.

What information must be reported on disclosure document for portfolio?

Information such as investment holdings, performance data, fee structure, conflicts of interest, and any regulatory disclosures must be reported on the disclosure document for portfolio.

How can I edit disclosure document for portfolio from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including disclosure document for portfolio, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the disclosure document for portfolio electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your disclosure document for portfolio in seconds.

Can I edit disclosure document for portfolio on an Android device?

With the pdfFiller Android app, you can edit, sign, and share disclosure document for portfolio on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your disclosure document for portfolio online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disclosure Document For Portfolio is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.