Get the free GSA Smart Pay Program Application

Show details

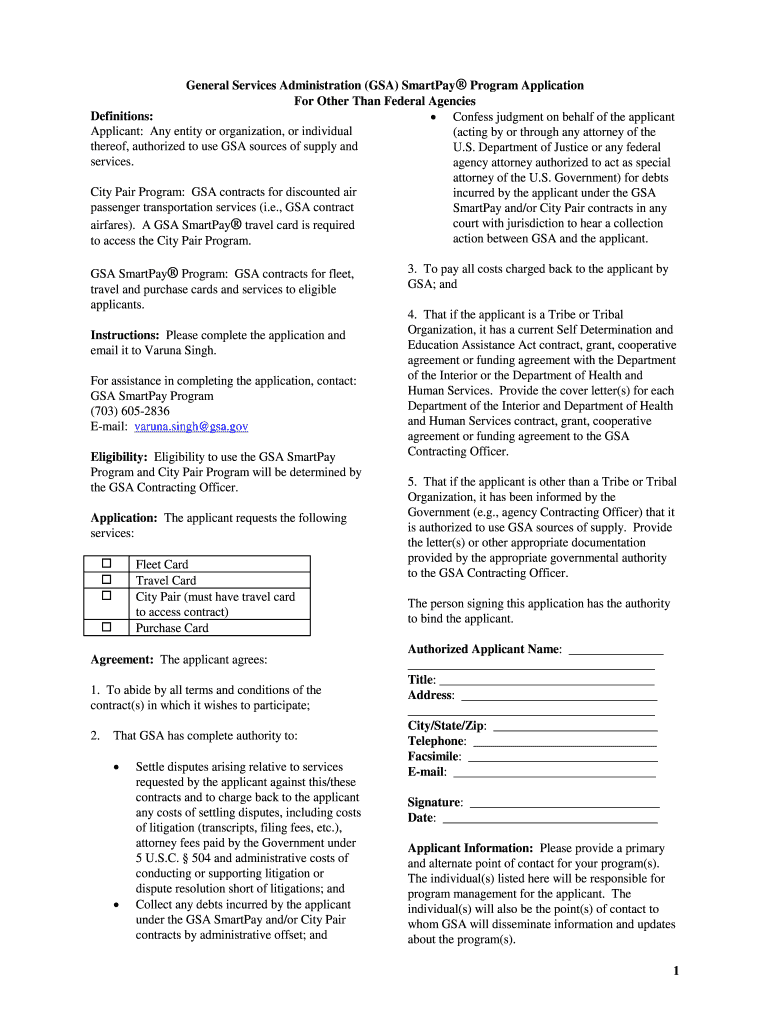

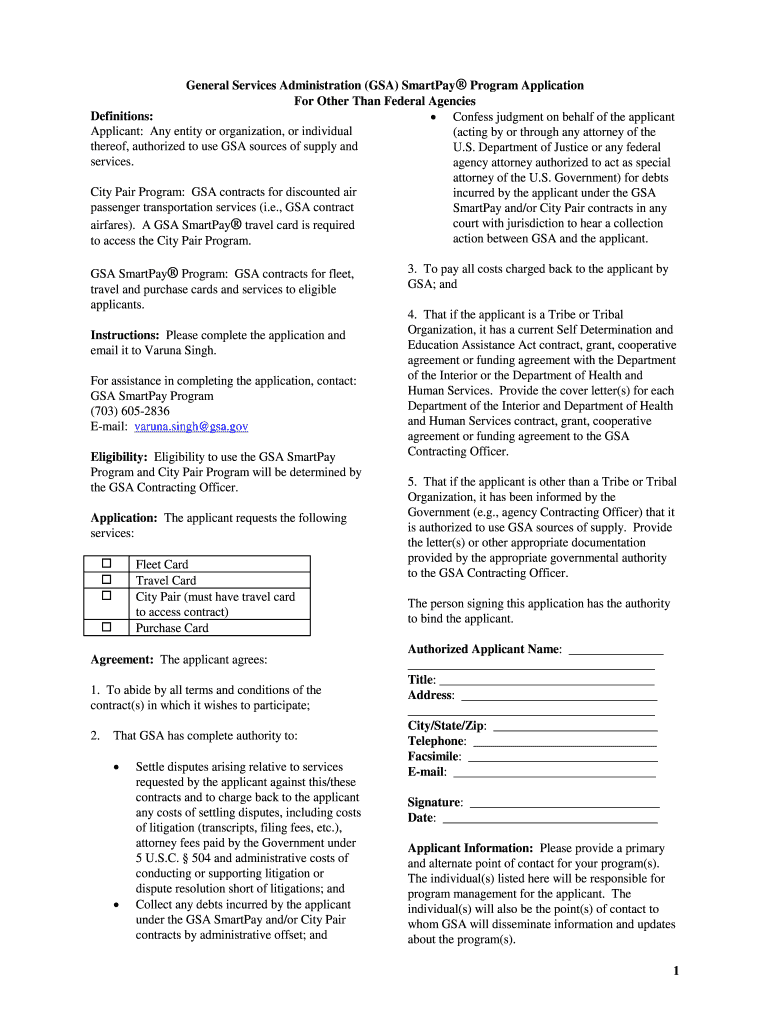

General Services Administration (GSA) Smartly Program Application For Other Than Federal Agencies Definitions: Confess judgment on behalf of the applicant: Any entity or organization, or individual

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gsa smart pay program

Edit your gsa smart pay program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gsa smart pay program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gsa smart pay program online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gsa smart pay program. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gsa smart pay program

Answer to "How to fill out GSA SmartPay program":

01

Start by researching the benefits and requirements of the GSA SmartPay program. Familiarize yourself with the program's purpose and how it can benefit your organization or agency.

02

Determine if your organization or agency is eligible to participate in the GSA SmartPay program. Check if you meet the specific criteria set by the General Services Administration (GSA) for enrollment.

03

Complete the necessary application forms provided by the GSA. These forms typically include information about your organization or agency, authorized account holders, and any additional details required for enrollment.

04

Submit the completed application forms to the appropriate GSA representative or program office. Ensure that all required documents and supporting materials, such as tax identification numbers or proof of eligibility, are included.

05

Wait for the GSA to review and process your application. This may take some time, so be patient during the evaluation period.

06

If approved, you will receive your GSA SmartPay card(s) and account information. Follow the instructions provided to activate your card(s) and set up any necessary online account access.

07

Familiarize yourself with the rules and regulations governing the use of GSA SmartPay cards. Ensure that all authorized account holders are aware of their responsibilities and limitations when using the program.

08

Start using your GSA SmartPay cards for authorized purchases. Keep track of all transactions and receipts to maintain accurate records and facilitate reconciliation.

09

Regularly review your account statements to identify any discrepancies or unauthorized charges. Report any issues promptly to the GSA or the issuer of your GSA SmartPay card.

10

Participate in any required training or education programs related to the GSA SmartPay program. Stay updated on any policy changes or updates that may impact your use of the program.

Answer to "Who needs GSA SmartPay program":

01

Federal Agencies: The GSA SmartPay program is primarily intended for use by federal agencies and government entities. It provides a streamlined and secure way to manage employee travel expenses, purchase goods and services, and pay for other authorized business-related costs.

02

Authorized Account Holders: Within federal agencies, individuals designated as authorized account holders may need the GSA SmartPay program. These individuals are responsible for making authorized purchases on behalf of their respective agencies using GSA SmartPay cards.

03

Government Contractors: In some cases, government contractors who have been awarded contracts by federal agencies may be required to use the GSA SmartPay program. This ensures that their purchases and expenses are properly tracked and align with government procurement guidelines.

04

State and Local Government Entities: While the GSA SmartPay program is primarily geared towards federal agencies, state and local government entities may also have the option to participate. This allows them to simplify and manage their payment processes in a similar manner to federal agencies.

05

Entities Eligible for Cooperative Purchasing: Certain non-federal entities, such as tribal governments, may be eligible to participate in the GSA SmartPay program through cooperative purchasing agreements. This enables them to leverage the benefits and convenience of the program for their specific needs.

It's important to note that eligibility and requirements may vary, so it's essential to consult with the GSA or appropriate authorities for accurate information regarding who needs the GSA SmartPay program in a particular context.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gsa smart pay program without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including gsa smart pay program. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out gsa smart pay program using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign gsa smart pay program and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit gsa smart pay program on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share gsa smart pay program on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is gsa smart pay program?

The GSA SmartPay program is a government credit card program that provides charge cards to federal government employees for official travel and purchases.

Who is required to file gsa smart pay program?

Federal government employees who need to make official travel and purchases are required to use the GSA SmartPay program.

How to fill out gsa smart pay program?

To fill out the GSA SmartPay program, federal government employees need to complete the necessary forms and provide information about their official travel and purchases.

What is the purpose of gsa smart pay program?

The purpose of the GSA SmartPay program is to streamline the payment process for official government expenses and provide a secure method for federal employees to make purchases.

What information must be reported on gsa smart pay program?

Federal employees using the GSA SmartPay program must report details of their official travel and purchases, including the amount spent, merchant name, and date of transaction.

Fill out your gsa smart pay program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gsa Smart Pay Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.