Get the free Zero or Low Income Letter of Support PARENT 2015-2016

Show details

Zero or Low Income Letter of

Support for Parent

Dear Parent:

Please write a letter in the space below or submit a separate statement explaining how you

supported yourself and your family (if applicable)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign zero or low income

Edit your zero or low income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your zero or low income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

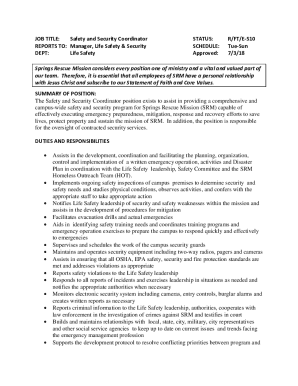

Editing zero or low income online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit zero or low income. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out zero or low income

How to fill out zero or low income:

01

Begin by gathering all necessary documents, such as your W-2 forms, 1099 forms, and any other income-related documents.

02

Make sure to accurately report all sources of income, including any side gigs or freelance work. It's important to be thorough and transparent in your reporting.

03

Deduct any expenses or deductions that you may be eligible for, such as business expenses or education-related deductions. This can help reduce your taxable income.

04

Consider seeking assistance from tax professionals or free tax preparation services if you're unsure about how to accurately fill out your return. They can provide guidance and ensure you're taking advantage of all available credits and deductions.

05

Review your completed tax return carefully before submitting it. Double-check for any errors or omissions that could lead to issues with the IRS.

06

If you have a low or no income, you might be eligible for certain tax credits, such as the Earned Income Tax Credit or the Child Tax Credit. Make sure to research and understand the eligibility criteria for these credits and include them in your return if applicable.

Who needs zero or low income?

01

Individuals with little or no income: This can include unemployed individuals who are actively seeking employment, students with limited income, or individuals with disabilities who are unable to work.

02

Small business owners: Some small business owners might experience low or zero income during specific periods, especially during startup phases or when facing significant financial challenges.

03

Retired individuals: Retirees who rely on fixed incomes, such as social security payments, pensions, or retirement funds, might fall into the low-income bracket.

04

Freelancers or gig workers: Self-employed individuals who work on a project basis or earn income through freelance work might experience fluctuating or low income depending on the availability of projects or clients.

05

Individuals facing financial hardships: Certain life situations, such as unexpected medical expenses, divorce, or job loss, can lead to a temporary or prolonged period of zero or low income.

Overall, anyone can face a period of low or no income, and understanding how to accurately fill out tax forms during these times can help individuals navigate their financial obligations effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my zero or low income in Gmail?

zero or low income and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send zero or low income to be eSigned by others?

zero or low income is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in zero or low income without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing zero or low income and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is zero or low income?

Zero or low income refers to individuals who earn very little or no income at all.

Who is required to file zero or low income?

Individuals who have zero or low income are required to file for zero or low income.

How to fill out zero or low income?

To fill out zero or low income, individuals must provide information about their income, assets, and any government assistance received.

What is the purpose of zero or low income?

The purpose of zero or low income filing is to report income status to the government and potentially qualify for certain benefits or assistance programs.

What information must be reported on zero or low income?

Information such as sources of income, assets, expenses, and any government assistance received must be reported on zero or low income.

Fill out your zero or low income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Zero Or Low Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.