Get the free Transfer of asseTs form - James Advantage Funds

Show details

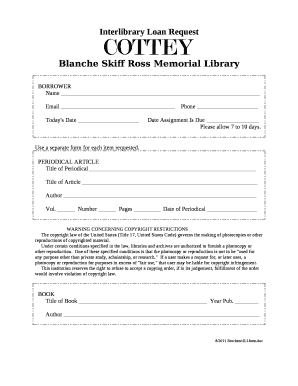

Transfer of assets Form SECTION 3: Transfer/Distribution Options (continued) SECTION 1: Account Information Investment Allocation Account Number Fund Name The Golden Rainbow Fund Date of Birth (MM/DD/BY)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer of assets form

Edit your transfer of assets form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer of assets form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transfer of assets form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit transfer of assets form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer of assets form

How to fill out transfer of assets form:

01

Start by gathering all relevant information regarding the assets being transferred. This includes details such as the asset type, current value, and any outstanding mortgages or liens.

02

Identify the purpose of the transfer. Is it for estate planning, gifting, divorce settlement, or another reason? Understanding the purpose will help determine the appropriate sections to fill out on the form.

03

Make sure to read the instructions or guidelines provided with the transfer of assets form. Different forms may have slight variations in terms of required information or additional documentation needed.

04

Begin filling out the form by providing your personal details, such as your full name, address, and contact information.

05

In the designated section, list the assets being transferred, including a description, estimated value, and any identifying numbers or details.

06

If there are multiple assets being transferred, consider numbering or labeling each asset to avoid confusion.

07

Indicate the intended recipient of the assets. This could be an individual, organization, trust, or any other legal entity. Provide their full name, contact information, and relationship to you, if applicable.

08

If there are any outstanding financial obligations related to the assets, such as loans or mortgages, include these details in the form. Specify the name of the lender, outstanding balance, and any necessary account numbers.

09

Depending on the purpose of the transfer, there may be additional sections to fill out. For example, if the assets are being transferred as part of an estate plan, you may need to provide information about beneficiaries or any specific instructions.

10

Carefully review the completed form for accuracy and completeness. Ensure all required sections are filled out, and double-check spelling and numerical accuracy.

Who needs a transfer of assets form?

A transfer of assets form may be needed by individuals or entities involved in various circumstances, including:

01

Estate planning: Individuals who wish to transfer assets to designated beneficiaries upon their death may require a transfer of assets form.

02

Divorce or separation: During divorce proceedings, a transfer of assets form may be necessary to distribute jointly-owned assets between the separating parties.

03

Real estate transactions: Buyers and sellers involved in property transfers may require a transfer of assets form to legally document the transfer of ownership.

04

Gifting: Individuals who want to gift their assets to someone else, such as family members or charitable organizations, may utilize a transfer of assets form.

05

Trust administration: Trustees managing a trust may use a transfer of assets form to transfer assets into or out of the trust.

It's important to consult with legal professionals or financial advisors to determine if a transfer of assets form is required and to ensure compliance with applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is transfer of assets form?

Transfer of assets form is a document used to report the transfer of ownership of assets from one party to another.

Who is required to file transfer of assets form?

Any individual or entity involved in the transfer of assets is required to file the transfer of assets form.

How to fill out transfer of assets form?

To fill out the transfer of assets form, one must provide accurate details of the transferred assets, including their description, value, and parties involved.

What is the purpose of transfer of assets form?

The purpose of transfer of assets form is to document and track the transfer of ownership of assets for legal and tax purposes.

What information must be reported on transfer of assets form?

Information such as description of assets, value, date of transfer, and parties involved must be reported on transfer of assets form.

How can I modify transfer of assets form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your transfer of assets form into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the transfer of assets form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your transfer of assets form.

How do I complete transfer of assets form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your transfer of assets form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your transfer of assets form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer Of Assets Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.