Get the free Non-Profit Full Charge Bookkeeper Test - dioceseofpueblo

Show details

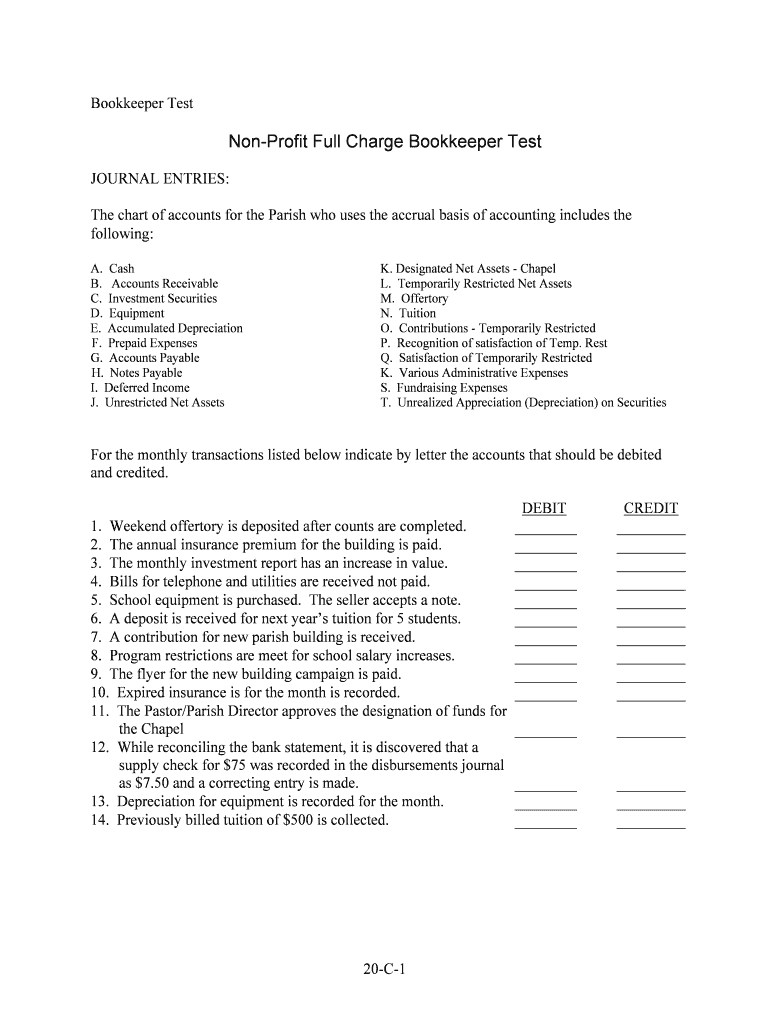

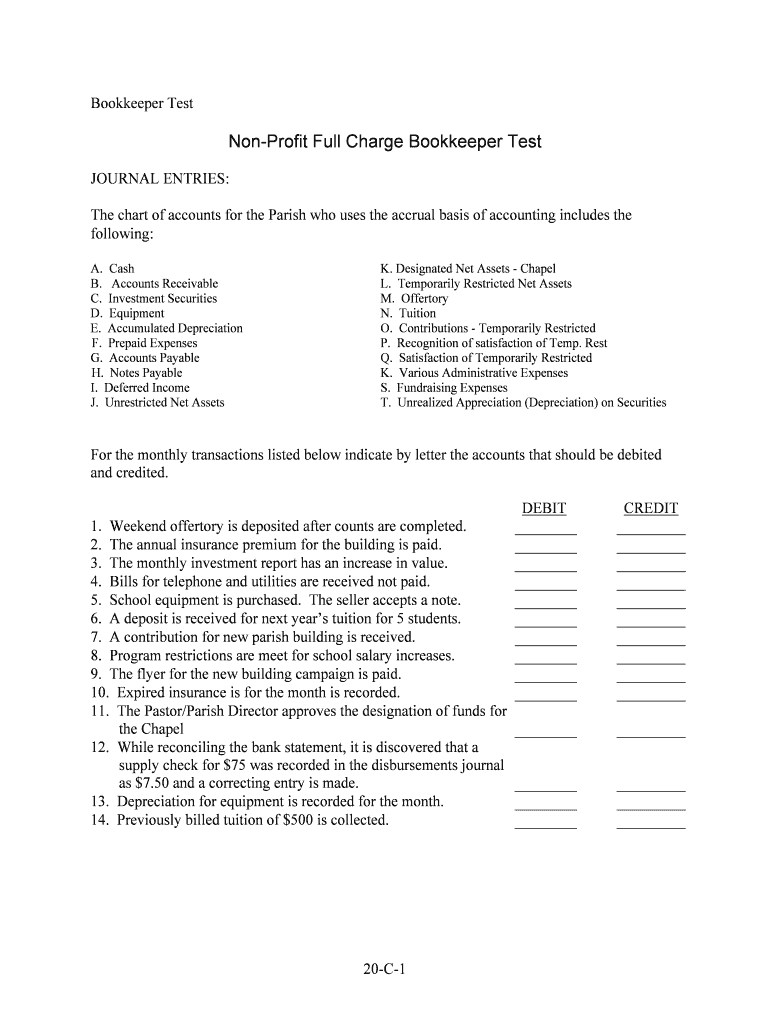

Bookkeeper Test Nonprofit Full Charge Bookkeeper Test JOURNAL ENTRIES: The chart of accounts for the Parish who uses the accrual basis of accounting includes the following: A. Cash B. Accounts Receivable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-profit full charge bookkeeper

Edit your non-profit full charge bookkeeper form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-profit full charge bookkeeper form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-profit full charge bookkeeper online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-profit full charge bookkeeper. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-profit full charge bookkeeper

How to fill out non-profit full charge bookkeeper:

01

Understand the Role: Begin by understanding the responsibilities and duties of a non-profit full charge bookkeeper. Familiarize yourself with the financial systems and processes specific to non-profit organizations.

02

Evaluate Skills and Experience: Assess your skills and experience in bookkeeping and accounting. Determine whether you have the necessary qualifications and knowledge to fulfill the role of a non-profit full charge bookkeeper.

03

Research Non-Profit Accounting Guidelines: Familiarize yourself with the unique accounting guidelines and regulations that apply to non-profit organizations. These guidelines may include specific reporting requirements and restrictions on how funds are used.

04

Familiarize Yourself with Non-Profit Software: Non-profit organizations often use specialized accounting software. Take the time to learn and become proficient with the specific software used by the non-profit you are working for.

05

Gather Financial Documentation: Collect all relevant financial documents such as receipts, invoices, bank statements, and payroll records. These documents will be essential for accurately recording and reporting financial transactions.

06

Record Financial Transactions: Use the non-profit accounting software to accurately record financial transactions. This may include inserting invoices, reconciling bank statements, and tracking donations or grants received.

07

Prepare Financial Statements: As a full charge bookkeeper, you will be responsible for generating financial statements such as balance sheets, income statements, and cash flow statements. Ensure accuracy and compliance with accounting guidelines.

08

Maintain Financial Records: Keep detailed and organized financial records for easy reference and auditing purposes. This includes maintaining a general ledger, vendor files, and employee payroll records.

Who needs a non-profit full charge bookkeeper:

01

Non-Profit Organizations: Any non-profit organization that handles financial transactions and requires accurate bookkeeping to maintain transparency, comply with regulations, and make informed financial decisions will need a non-profit full charge bookkeeper.

02

Charitable Foundations: Charitable foundations often have complex financial operations and rely on bookkeepers to manage their finances, track donations, and maintain donor records.

03

Religious Organizations: Churches and religious organizations are typically non-profit entities that require bookkeepers to manage their finances, track contributions, and prepare financial reports.

04

Community Centers and Associations: Many community centers, clubs, and associations are non-profit organizations that require bookkeepers to handle their financial transactions, maintain budgets, and prepare financial statements.

In summary, filling out a non-profit full charge bookkeeper involves understanding the role, evaluating skills and experience, researching non-profit accounting guidelines, familiarizing yourself with non-profit software, gathering financial documentation, recording transactions, preparing financial statements, and maintaining accurate financial records. Any non-profit organization, charitable foundation, religious organization, or community center may require a non-profit full charge bookkeeper to manage their finances efficiently.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify non-profit full charge bookkeeper without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like non-profit full charge bookkeeper, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit non-profit full charge bookkeeper in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your non-profit full charge bookkeeper, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the non-profit full charge bookkeeper in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your non-profit full charge bookkeeper and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is non-profit full charge bookkeeper?

A non-profit full charge bookkeeper is responsible for maintaining all financial records, reconciling accounts, and preparing financial reports for a non-profit organization.

Who is required to file non-profit full charge bookkeeper?

Non-profit organizations are required to file the full charge bookkeeper to ensure accurate financial reporting and compliance with regulations.

How to fill out non-profit full charge bookkeeper?

To fill out the non-profit full charge bookkeeper, the bookkeeper must accurately record all financial transactions, reconcile accounts, and prepare financial statements following accounting principles.

What is the purpose of non-profit full charge bookkeeper?

The purpose of the non-profit full charge bookkeeper is to maintain accurate financial records, track expenses and revenues, and provide financial information to support decision-making.

What information must be reported on non-profit full charge bookkeeper?

The non-profit full charge bookkeeper must report all financial transactions, expenses, revenues, assets, liabilities, and equity of the organization.

Fill out your non-profit full charge bookkeeper online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Profit Full Charge Bookkeeper is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.