Get the free Corporate Finance Core Principles and Applications by - condor depaul

Show details

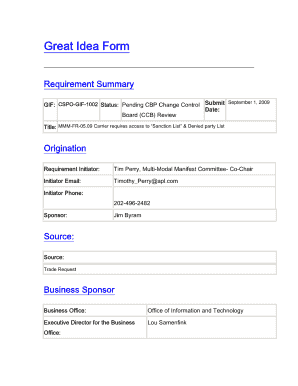

Finance 555302 Financial Management Spring 20062007 Tuesdays 5:45 p.m. 9:00 p.m. in DPC Room TBA Dr. Rebel A. Cole Office: 6138 DePaul Center (DPC) Phone (DPC) : (312) 3626887 Email: role DePaul.edu

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate finance core principles

Edit your corporate finance core principles form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate finance core principles form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate finance core principles online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporate finance core principles. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate finance core principles

How to fill out corporate finance core principles:

01

Understand the basics: Start by familiarizing yourself with the core principles of corporate finance, such as the time value of money, risk and return, and the concept of cash flow. This will provide a foundation for your understanding of more complex financial decisions.

02

Identify the goals: In corporate finance, the primary goal is to maximize shareholder value. This involves making financial decisions that contribute to increasing the value of the company's stock. Other goals may include minimizing risk, maximizing profitability, or maintaining liquidity.

03

Analyze financial statements: Analyzing financial statements is essential to gain insights into a company's financial health and performance. This includes reviewing the income statement, balance sheet, and cash flow statement to understand key financial metrics, such as revenue, expenses, assets, liabilities, and cash flow.

04

Evaluate investment opportunities: As part of corporate finance, you will need to assess investment opportunities, including projects, acquisitions, or investments in financial markets. This involves calculating the potential returns, risks, and relevant financial metrics like net present value (NPV), internal rate of return (IRR), and payback period.

05

Manage capital structure: Another aspect of corporate finance is determining the optimal capital structure for a company. This involves deciding the mix of equity and debt financing to use, considering factors such as cost of capital, risk tolerance, and impact on shareholder value.

06

Make financing decisions: Corporate finance also encompasses making financing decisions, such as issuing stocks or bonds, securing loans, or conducting equity offerings. This requires evaluating the available options, considering interest rates, costs, and the impact on the company's financial position.

07

Implement financial strategies: Once the core principles of corporate finance are understood, it is crucial to implement financial strategies effectively. This may involve budgeting, forecasting, financial planning, and risk management to achieve the desired financial outcomes.

Who needs corporate finance core principles:

01

Business professionals: Corporate finance core principles are essential for professionals working in finance, accounting, investment banking, or any role that involves financial decision-making within a company. They need a solid understanding of the core principles to make informed decisions and contribute to the company's financial success.

02

Entrepreneurs and business owners: Whether starting a new venture or managing an existing business, entrepreneurs and business owners need to apply corporate finance principles to make strategic decisions about investments, financing, and capital structure. This knowledge helps in assessing risks, evaluating profitability, and determining the financial health of the business.

03

Investors: Investors, both individual and institutional, require an understanding of corporate finance core principles to evaluate investment opportunities and make informed decisions. They analyze financial statements, assess the company's financial performance, and consider factors like risk and return before investing their capital.

04

Students and academics: Students pursuing degrees in finance, accounting, or business administration study corporate finance core principles as part of their curriculum. Academics also research and teach corporate finance principles, contributing to the advancement of knowledge in the field.

In summary, filling out corporate finance core principles involves understanding the basics, analyzing financial statements, evaluating investment opportunities, managing capital structure, making financing decisions, and implementing financial strategies. These principles are essential for business professionals, entrepreneurs, investors, students, and academics in their respective roles.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find corporate finance core principles?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific corporate finance core principles and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the corporate finance core principles electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your corporate finance core principles in seconds.

Can I edit corporate finance core principles on an iOS device?

You certainly can. You can quickly edit, distribute, and sign corporate finance core principles on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is corporate finance core principles?

Corporate finance core principles are the fundamental concepts and guidelines that govern how businesses manage their financial activities and make strategic decisions to maximize value for shareholders.

Who is required to file corporate finance core principles?

All companies and organizations that engage in financial activities are required to adhere to corporate finance core principles. This includes publicly traded corporations, private businesses, and non-profit organizations.

How to fill out corporate finance core principles?

To fill out corporate finance core principles, companies must analyze their financial statements, assess investment opportunities, evaluate capital structure, and make decisions that align with the organization's overall financial goals.

What is the purpose of corporate finance core principles?

The purpose of corporate finance core principles is to guide companies in making sound financial decisions that maximize shareholder value, minimize risk, and ensure long-term financial stability.

What information must be reported on corporate finance core principles?

Companies must report information related to their financial performance, capital structure, investment decisions, risk management strategies, and compliance with financial regulations on corporate finance core principles.

Fill out your corporate finance core principles online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Finance Core Principles is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.