Get the free Movable Capital Assets - Office Furniture and Equipment - gpa gov nl

Show details

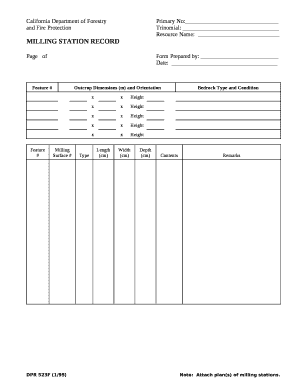

GOVERNMENT OF NEWFOUNDLAND AND LABRADOR MOVABLE CAPITAL ASSETS OFFICE FURNITURE AND EQUIPMENT SURPLUS TRANSFER DESTROYED COMPUTERS FOR SCHOOLS DEPARTMENT: REGION: DIVISION: BUILDING: NAME: COMMUNITY:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign movable capital assets

Edit your movable capital assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your movable capital assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit movable capital assets online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit movable capital assets. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out movable capital assets

How to fill out movable capital assets:

01

Start by gathering all relevant information about your movable capital assets. This includes their description, acquisition date, purchase price, and current value.

02

Categorize your movable capital assets based on their nature. For example, separate vehicles, machinery, and office equipment into different categories.

03

Determine the depreciation method you will be using for each asset. Common depreciation methods include straight-line, declining balance, and sum-of-the-years' digits. Consult with a tax professional or accountant if you are unsure about the most appropriate method for your assets.

04

Record the initial cost or value of each asset. This is the amount you paid for it when you acquired it. If you are unsure about the initial cost, consult your purchase records or contact the seller.

05

Calculate the depreciation expense for each asset. This is the amount by which the asset decreases in value each year. Refer to your chosen depreciation method to determine the correct calculation.

06

Update the current value of each movable capital asset. As time goes by, assets may appreciate or depreciate in value. Keep track of any changes to ensure accurate reporting.

Who needs movable capital assets:

01

Small business owners: Movable capital assets are essential for small business owners who rely on equipment, vehicles, or machinery to operate. These assets can range from delivery vans to specialized tools or manufacturing equipment.

02

Investors: Investors who purchase movable capital assets, such as real estate properties or vehicles, for the purpose of generating income may need to track and manage these assets for financial reporting and tax purposes.

03

Rental property owners: Individuals who own rental properties often require movable capital assets such as furniture, appliances, or electronic equipment to furnish and maintain their properties. Properly managing and tracking these assets is crucial for accounting and tax purposes.

04

Non-profit organizations: Non-profit organizations may make use of movable capital assets such as vehicles, office equipment, or technology devices to fulfill their mission. Properly tracking and managing these assets is important for financial accountability and reporting.

05

Individuals with personal investments: Some individuals may own movable capital assets for personal use, such as luxury vehicles, boats, or valuable art pieces. Managing these assets is essential for insurance purposes and potential future resale.

It's important to consider that the need for movable capital assets can vary depending on the specific circumstances and industries. Consulting with a financial advisor or tax professional can provide personalized advice and guidance in managing these assets effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is movable capital assets?

Movable capital assets refer to assets that can be physically moved or transferred, such as machinery, equipment, vehicles, and inventory.

Who is required to file movable capital assets?

Businesses or individuals who own movable capital assets are required to file them for tax purposes.

How to fill out movable capital assets?

Movable capital assets can be filled out on a designated form provided by the tax authority, where details of the assets such as description, purchase price, and depreciation will need to be reported.

What is the purpose of movable capital assets?

The purpose of reporting movable capital assets is to accurately assess the value of a business or individual's assets for tax purposes.

What information must be reported on movable capital assets?

Information such as description of the assets, purchase price, depreciation schedule, and current value must be reported on movable capital assets.

How can I edit movable capital assets on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing movable capital assets, you can start right away.

How do I fill out movable capital assets using my mobile device?

Use the pdfFiller mobile app to fill out and sign movable capital assets. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out movable capital assets on an Android device?

Use the pdfFiller mobile app to complete your movable capital assets on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your movable capital assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Movable Capital Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.