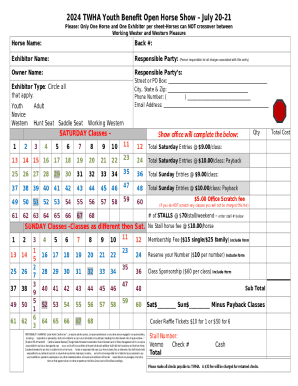

Get the free ACCOUNTING PRINCIPLES II

Show details

SALT COLLEGE OF APPLIED ARTS AND TECHNOLOGY SALT STE. MARIE, ONTARIO COURSE OUTLINE COURSE TITLE: ACCOUNTING PRINCIPLES II CODE NO. ACC 221 PROGRAM: ACCOUNTING AUTHOR: INSTRUCTOR: Grant. Dunlop saultcollege.ca

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting principles ii

Edit your accounting principles ii form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting principles ii form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounting principles ii online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit accounting principles ii. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting principles ii

How to fill out accounting principles ii:

01

Start by reviewing the course syllabus and familiarize yourself with the topics and objectives covered in accounting principles ii.

02

Attend all classes and actively participate in discussions to ensure a thorough understanding of the subject matter. Take detailed notes during lectures and ask questions to clarify any doubts.

03

Dedicate sufficient time outside of class to study and review the course material. Create a study schedule and stick to it, ensuring you allocate enough time for each topic.

04

Utilize various learning resources, such as textbooks, online tutorials, and practice exercises, to reinforce your understanding of accounting principles ii. Engage in self-study and practice problems regularly to improve your knowledge and skills.

05

Seek additional help if needed. If you find certain concepts or topics challenging, consider attending professor's office hours, joining study groups, or seeking tutoring assistance to clarify any confusion and enhance your understanding.

06

Complete all assigned readings and assignments on time. This will help you consolidate your understanding and apply the accounting principles learned in practical scenarios.

07

Stay organized with your notes, course materials, and assignments. Maintain a well-structured system to easily access and review the information when needed, especially during exams or when completing projects.

Who needs accounting principles ii:

01

Accounting Students: Accounting principles ii is typically a course that is required for students majoring in accounting. It builds upon the foundational knowledge gained in accounting principles i and delves deeper into more complex accounting concepts and practices.

02

Business Students: Students pursuing a degree in business, particularly those specializing in finance or management, can benefit from taking accounting principles ii. Understanding accounting principles is fundamental in analyzing financial statements, budgeting, and making informed business decisions.

03

Professionals in Finance or Accounting Roles: Individuals working in finance or accounting roles, such as bookkeepers, financial analysts, or tax professionals, may find value in taking accounting principles ii to further strengthen their knowledge and skills in the field.

04

Entrepreneurs and Small Business Owners: Even if you don't have a background in accounting, having a basic understanding of accounting principles can be crucial for managing the financial aspects of your business effectively. Accounting principles ii can provide a deeper insight into financial reporting, analysis, and decision-making, which can benefit entrepreneurs and small business owners.

05

Anyone with an Interest in Accounting: Accounting principles ii can also be beneficial for individuals who have a general interest in understanding how financial transactions are recorded, analyzed, and reported. It can provide a solid foundation for financial literacy and help individuals make informed personal financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send accounting principles ii to be eSigned by others?

Once you are ready to share your accounting principles ii, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my accounting principles ii in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your accounting principles ii directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit accounting principles ii on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing accounting principles ii, you need to install and log in to the app.

What is accounting principles ii?

Accounting principles ii is a set of guidelines and rules that govern the preparation and presentation of financial statements.

Who is required to file accounting principles ii?

Any organization or entity that needs to prepare financial statements in accordance with accounting principles ii is required to file.

How to fill out accounting principles ii?

Accounting principles ii can be filled out by following the guidelines provided in the accounting standards and ensuring that all required information is accurately reported.

What is the purpose of accounting principles ii?

The purpose of accounting principles ii is to ensure consistency, transparency, and comparability in financial reporting.

What information must be reported on accounting principles ii?

Information such as assets, liabilities, equity, income, expenses, and cash flows must be reported on accounting principles ii.

Fill out your accounting principles ii online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Principles Ii is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.