Treasury PD F 5444 2011-2025 free printable template

Show details

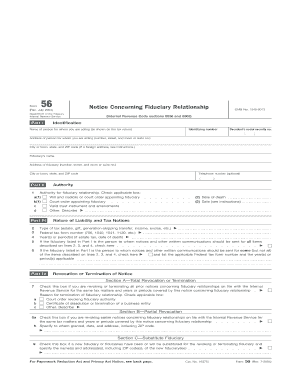

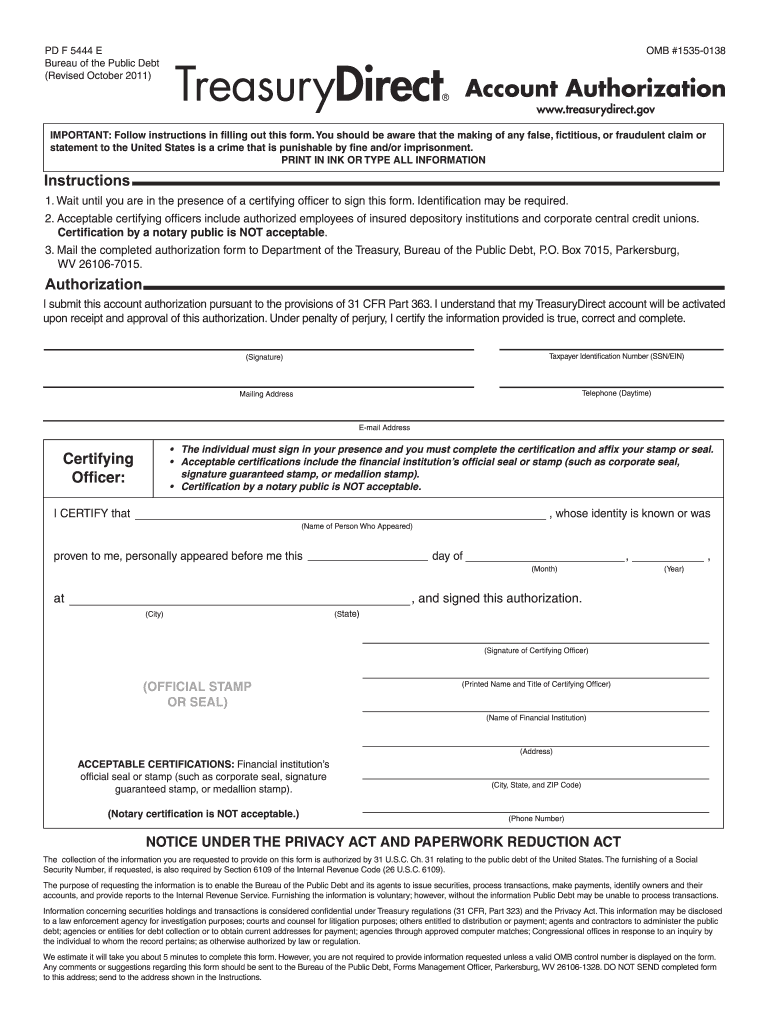

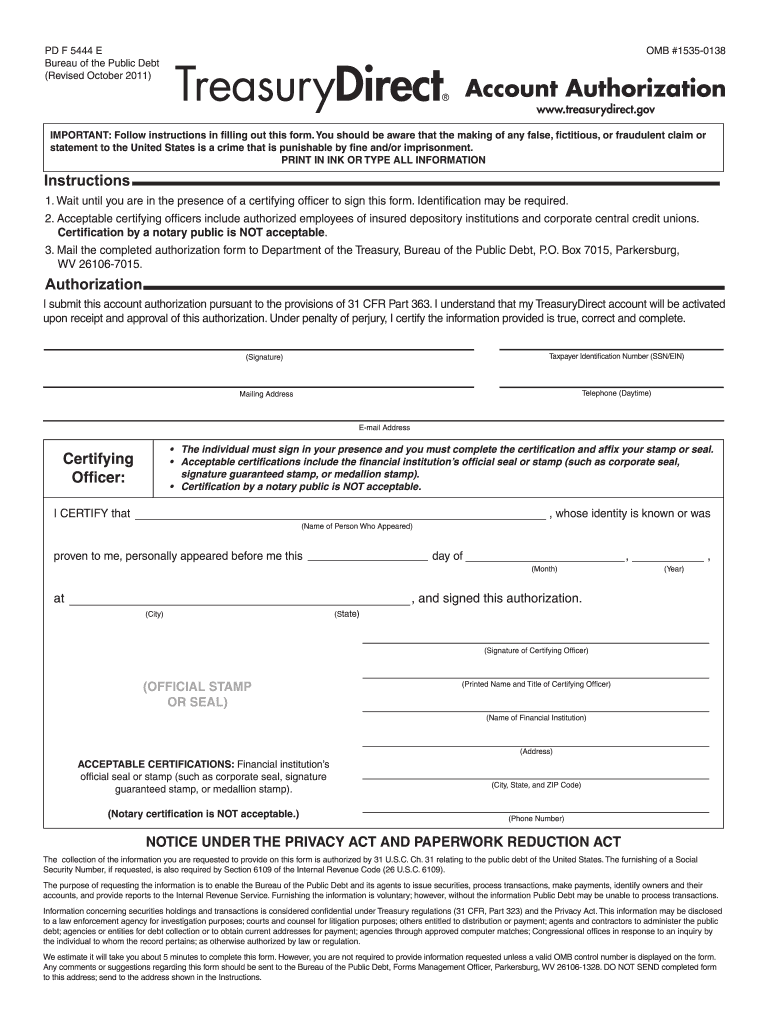

RESET PD F 5444 E Bureau of the Public Debt (Revised October 2011) TreasuryDirect OMB #15350138 Account Authorization www.treasurydirect.gov IMPORTANT: Follow instructions in filling out this form.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Treasury PD F 5444

Edit your Treasury PD F 5444 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Treasury PD F 5444 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Treasury PD F 5444 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Treasury PD F 5444. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Treasury PD F 5444

How to fill out Treasury PD F 5444

01

Obtain the Treasury PD F 5444 form from the official Department of the Treasury website or a designated office.

02

Read the instructions at the beginning of the form carefully to understand the requirements.

03

Fill out the personal information section, including your name, address, and contact details.

04

Provide information related to the types of securities involved in the transaction.

05

Indicate the reason for completing the form, ensuring you select the appropriate option.

06

Review all the information for accuracy and completeness before signing the form.

07

Submit the completed form to the appropriate authority as indicated in the instructions.

Who needs Treasury PD F 5444?

01

Individuals or entities involved in transactions related to U.S. Treasury securities.

02

Investors or financial institutions that need to report holdings or transactions of Treasury securities.

03

Taxpayers who are required to provide information under specific IRS requirements related to Treasury securities.

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid tax on inherited savings bonds?

How to Avoid Paying Taxes on Savings Bonds. The IRS lets you avoid paying taxes on interest earned by Series EE and Series I savings bonds when you redeem them if you use the money toward qualified higher education costs for yourself, your spouse, or any of your dependents.

What is form 1522 used for?

USE OF FORM – Use this form to request payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds.

What is a FS form 5336?

Document Type. Form FS Form 5336. Disposition of Securities Belonging to a Decedent's Estate Being Settled Without Administration. Form and Instruction. FS Form 5336 Application for Disposition of Treasury Securities Belon.

Who must file form 8815?

If you cashed series EE or I U.S. savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Use Form 8815 to figure the amount of any interest you may exclude.

What is form 5444?

Account Authorization (FS Form 5444)

Do I pay taxes on inherited U.S. Savings Bonds?

The short answer is yes, you generally will be responsible for taxes owed on savings bonds you inherit from someone else. The good news is that you may be able to defer taxes on inherited savings bonds or avoid it altogether in certain situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Treasury PD F 5444 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your Treasury PD F 5444, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out Treasury PD F 5444 using my mobile device?

Use the pdfFiller mobile app to fill out and sign Treasury PD F 5444 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit Treasury PD F 5444 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share Treasury PD F 5444 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is Treasury PD F 5444?

Treasury PD F 5444 is a form used by the U.S. Department of the Treasury to obtain information about certain financial transactions as part of the government's efforts to regulate and monitor money laundering and related financial crimes.

Who is required to file Treasury PD F 5444?

Persons or entities involved in specific transactions that meet the reporting criteria set by the U.S. Department of the Treasury, typically financial institutions, businesses, or individuals processing large sums of money, are required to file Treasury PD F 5444.

How to fill out Treasury PD F 5444?

To fill out Treasury PD F 5444, one must collect the required information related to the transaction, accurately complete each section of the form, including details such as the parties involved, transaction amounts, dates, and submitting it to the U.S. Department of the Treasury following their guidelines.

What is the purpose of Treasury PD F 5444?

The purpose of Treasury PD F 5444 is to assist in the detection and prevention of financial crimes, including money laundering and terrorist financing, by collecting information about significant financial transactions.

What information must be reported on Treasury PD F 5444?

The information that must be reported on Treasury PD F 5444 includes the names and addresses of the parties involved, the nature of the transaction, transaction amounts, dates, and any other pertinent details that help illustrate the context of the transaction.

Fill out your Treasury PD F 5444 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Treasury PD F 5444 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.