Get the free SMALL EMPLOYER HEALTH BENEFITS WAIVER OF COVERAGE - bfinlibcomb

Show details

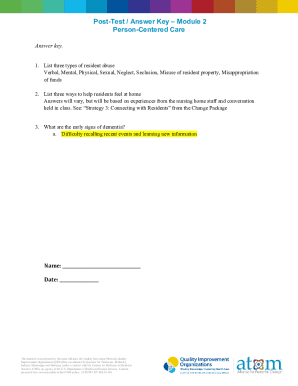

SMALL EMPLOYER HEALTH BENEFITS WAIVER OF COVERAGE Group Policy No.: Policyholder Name: Employee Name: Social Security #: Last Marital Status: Single First Married Widowed MI Divorced Date of Employment:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small employer health benefits

Edit your small employer health benefits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small employer health benefits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small employer health benefits online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit small employer health benefits. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small employer health benefits

How to fill out small employer health benefits:

01

Start by gathering all the necessary information and documentation required for the application process. This may include details about your employees, such as their names, addresses, social security numbers, and eligibility for coverage.

02

Review the available health benefit plans and determine which options are suitable for your employees. Consider factors such as cost, coverage, and any specific needs or preferences that your employees may have.

03

Consult with a reputable health insurance provider or broker who specializes in small employer health benefits. They can guide you through the process, help you understand the different plans available, and assist you in completing the necessary paperwork.

04

Complete the application forms accurately and thoroughly. Double-check all the information provided to ensure its accuracy. Any mistakes or omissions could result in delays or the rejection of your application.

05

Submit the completed application forms, along with any required supporting documents, to the designated health insurance provider or agency. Be sure to follow their specific guidelines and deadlines for submission.

06

Keep track of the application process and communicate regularly with the health insurance provider or broker to ensure everything is moving forward smoothly. Address any issues or concerns that may arise promptly.

07

Once your application is approved, review the coverage details with your employees. Explain the benefits, costs, and any additional information they need to know about their health insurance options.

08

Provide ongoing support to your employees regarding their health benefits, such as helping them navigate the claims process or addressing any inquiries or concerns that may arise.

09

Regularly assess the effectiveness of your small employer health benefits program and make adjustments as necessary to ensure it continues to meet the needs of your employees and your organization.

Who needs small employer health benefits:

01

Small businesses with employees who do not currently have access to health insurance through other means, such as a spouse's plan or a government program like Medicaid.

02

Employers who want to attract and retain quality employees by offering comprehensive health insurance coverage as part of their employee benefits package.

03

Businesses that want to take advantage of potential tax advantages or incentives provided to employers who offer health benefits to their employees.

04

Employers who recognize the importance of promoting the health and well-being of their employees and want to provide access to necessary medical care and services.

05

Business owners who understand that offering health benefits can contribute to a positive company culture and help create a productive and loyal workforce.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is small employer health benefits?

Small employer health benefits refer to the health insurance options provided by small businesses to their employees. These benefits usually include medical, dental, and vision coverage.

Who is required to file small employer health benefits?

Small employers with a certain number of employees are required to file small employer health benefits. The specific requirements may vary depending on the state or jurisdiction.

How to fill out small employer health benefits?

To fill out small employer health benefits, employers need to gather information about their employees, including their names, ages, dependents, and any health insurance choices they have made.

What is the purpose of small employer health benefits?

The purpose of small employer health benefits is to provide employees with access to affordable and comprehensive health insurance coverage. These benefits can help attract and retain talented employees.

What information must be reported on small employer health benefits?

Information that must be reported on small employer health benefits includes employee demographics, coverage options, premium costs, and any contributions made by the employer.

Where do I find small employer health benefits?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the small employer health benefits in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my small employer health benefits in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your small employer health benefits and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit small employer health benefits on an iOS device?

Use the pdfFiller mobile app to create, edit, and share small employer health benefits from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your small employer health benefits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Employer Health Benefits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.