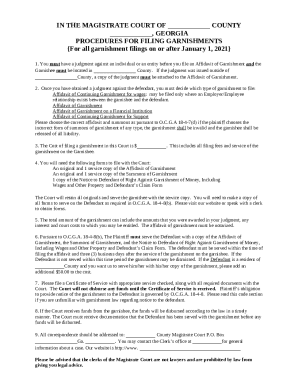

Get the free Financial and Estate Planning Objectives

Show details

Estate Planning Fact Finder Contents Page Family Information 1 Financial and Estate Planning Objectives 1 Present Estate Plan 2 PostDeath Monthly Income Objectives 2 Retirement Plans 2 Annual Income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial and estate planning

Edit your financial and estate planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial and estate planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial and estate planning online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial and estate planning. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial and estate planning

How to fill out financial and estate planning:

01

Determine your financial goals and objectives: Start by identifying what you want to achieve with your finances and estate planning. This could include saving for retirement, funding your children's education, or leaving a legacy for your loved ones.

02

Take stock of your assets and liabilities: Make a comprehensive inventory of your financial assets such as savings accounts, investments, real estate, and personal property. Also, note down any debts or liabilities you have, such as mortgages, loans, or credit card debt.

03

Assess your current financial situation: Evaluate your income, expenses, and cash flow to understand your current financial position. This will help you determine how much you can allocate towards your financial and estate planning goals.

04

Protect yourself and your loved ones with insurance: Consider purchasing life insurance, disability insurance, and long-term care insurance to safeguard yourself and your family against unforeseen events. Adequate insurance coverage can provide financial security and ease the burden on your loved ones in case of emergencies.

05

Create a will: A will is a legal document that outlines your wishes regarding the distribution of your assets after your death. Consult with an attorney to draft a will that reflects your intentions and ensures your assets are distributed according to your wishes.

06

Designate beneficiaries: Review the beneficiaries listed on your accounts, such as retirement plans, bank accounts, and life insurance policies. Ensure that the designated beneficiaries align with your intended distribution of assets, as these assets are typically not governed by a will.

07

Establish powers of attorney: Designate someone you trust to make financial and medical decisions on your behalf in case you become incapacitated. Granting powers of attorney ensures that your financial and healthcare affairs are managed according to your preferences and best interests.

08

Consider setting up trusts: Trusts can be useful in protecting and managing your assets, minimizing taxes, and providing for specific needs of your beneficiaries. Consult with an estate planning attorney to determine if setting up a trust is appropriate for your situation.

Who needs financial and estate planning?

01

Individuals and families: Financial and estate planning is essential for individuals and families who want to ensure their assets are managed and distributed according to their wishes. It helps secure their financial well-being and provides peace of mind.

02

Business owners: Business owners have unique financial considerations, including succession planning and protecting their business assets. Financial and estate planning can help address these specific needs and ensure a smooth transition of ownership.

03

High-net-worth individuals: High-net-worth individuals often have complex financial situations involving multiple assets, investments, and legal considerations. Financial and estate planning can help optimize their wealth management strategies and mitigate tax obligations.

04

Individuals with dependents: If you have dependents, such as minor children or individuals with special needs, financial and estate planning becomes crucial. It allows you to provide for their financial support and care even after you're no longer able to do so.

05

Retirees: Retirement planning is an integral part of financial and estate planning. It involves ensuring a stable income during retirement, managing healthcare costs, and devising strategies to leave a legacy for future generations.

Remember, consulting with a qualified financial advisor or estate planning attorney is recommended to tailor your financial and estate plan to your unique circumstances and needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial and estate planning in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your financial and estate planning and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I get financial and estate planning?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the financial and estate planning in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out financial and estate planning using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign financial and estate planning. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is financial and estate planning?

Financial and estate planning involves creating a strategy to manage your finances, assets, and investments both during your lifetime and after your death.

Who is required to file financial and estate planning?

Individuals who have assets and investments that they wish to manage and distribute according to their wishes are required to file financial and estate planning.

How to fill out financial and estate planning?

Financial and estate planning can be filled out with the assistance of financial planners, attorneys, or through online tools and templates.

What is the purpose of financial and estate planning?

The purpose of financial and estate planning is to ensure that your assets are managed and distributed according to your wishes, minimize taxes, and provide for your loved ones after your death.

What information must be reported on financial and estate planning?

Financial and estate planning typically includes information about your assets, investments, debts, beneficiaries, and instructions for distributing your assets.

Fill out your financial and estate planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial And Estate Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.