Get the free Skip-A-Payment Option

Show details

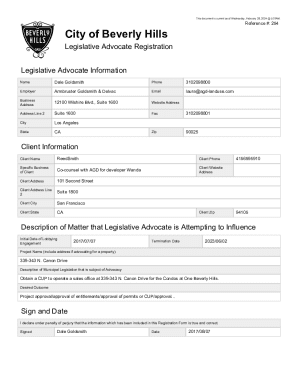

6001 Gibraltar Drive I P.O. Box 11269 I Pleasant on I CA 945881269 (800) 9720999 I Fax: (925) 7343438 I safeamerica.com SkipAPayment Option: Eligible Loans: Automobile Loan (s); Personal Loan (s);

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign skip-a-payment option

Edit your skip-a-payment option form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your skip-a-payment option form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit skip-a-payment option online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit skip-a-payment option. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out skip-a-payment option

To fill out the skip-a-payment option, you will need to follow these steps:

01

Contact your lender or financial institution: Reach out to your lender and inquire about the skip-a-payment option. They will provide you with the necessary information and forms to fill out.

02

Review the terms and conditions: Take the time to carefully review the terms and conditions of the skip-a-payment option. Understand the implications, such as any additional fees or interest that may accrue during the skipped payment period.

03

Complete the required forms: Fill out the provided forms accurately and completely. Ensure you include all necessary information, such as your personal details, loan or account number, and the specific payment you wish to skip.

04

Submit the forms on time: Make sure to submit the forms within the specified timeframe given by your lender. This is important to ensure that your skip-a-payment request is processed in a timely manner.

05

Confirm the approval: Once you have submitted the forms, you should receive confirmation from your lender regarding the approval of your skip-a-payment request. Keep this confirmation for your records.

5.1

The skip-a-payment option can be beneficial for various individuals who are facing financial difficulties or unexpected expenses. Here are some examples of people who may need to utilize the skip-a-payment option:

06

Individuals facing temporary financial hardships: If you are experiencing a temporary reduction in income or unexpected expenses, the skip-a-payment option can provide temporary relief by allowing you to skip a monthly payment and allocate those funds towards other pressing needs.

07

Students or recent graduates: Students or recent graduates who are just starting their careers and may be facing limited income or high levels of student loan debt may find the skip-a-payment option helpful to manage their finances while they establish themselves financially.

08

Individuals with irregular income: If you have irregular income due to freelancing, seasonal work, or other factors, the skip-a-payment option can provide flexibility in managing your cash flow during low-income periods.

09

People facing emergency expenses: Sometimes unexpected emergencies, such as medical bills or car repairs, can strain personal finances. The skip-a-payment option can be utilized to redirect funds towards these immediate needs while ensuring that loan or credit card payments are not neglected.

It's important to note that while the skip-a-payment option can provide temporary relief, it may also have long-term implications such as extending the loan term or accruing additional interest. Therefore, it's essential to carefully consider the benefits and potential drawbacks before deciding to utilize this option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit skip-a-payment option from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your skip-a-payment option into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for signing my skip-a-payment option in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your skip-a-payment option directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete skip-a-payment option on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your skip-a-payment option. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

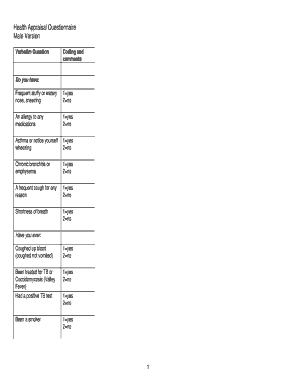

What is skip-a-payment option?

Skip-a-payment option allows borrowers to skip making a scheduled loan payment without incurring late fees or derogatory credit reporting.

Who is required to file skip-a-payment option?

Borrowers who are facing financial hardship and unable to make their loan payments may be eligible to file a skip-a-payment option.

How to fill out skip-a-payment option?

Borrowers can request a skip-a-payment option by contacting their lender or financial institution and completing the necessary paperwork.

What is the purpose of skip-a-payment option?

The purpose of skip-a-payment option is to provide temporary relief to borrowers who are experiencing financial difficulties and cannot make their loan payments.

What information must be reported on skip-a-payment option?

The skip-a-payment option form typically requires borrowers to provide their account information, reason for requesting the skip-a-payment, and agreement to the terms and conditions.

What is the penalty for late filing of skip-a-payment option?

The penalty for late filing of skip-a-payment option may result in additional fees, interest charges, and potential negative impact on the borrower's credit score.

Fill out your skip-a-payment option online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Skip-A-Payment Option is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.