Get the free Banking at its Best

Show details

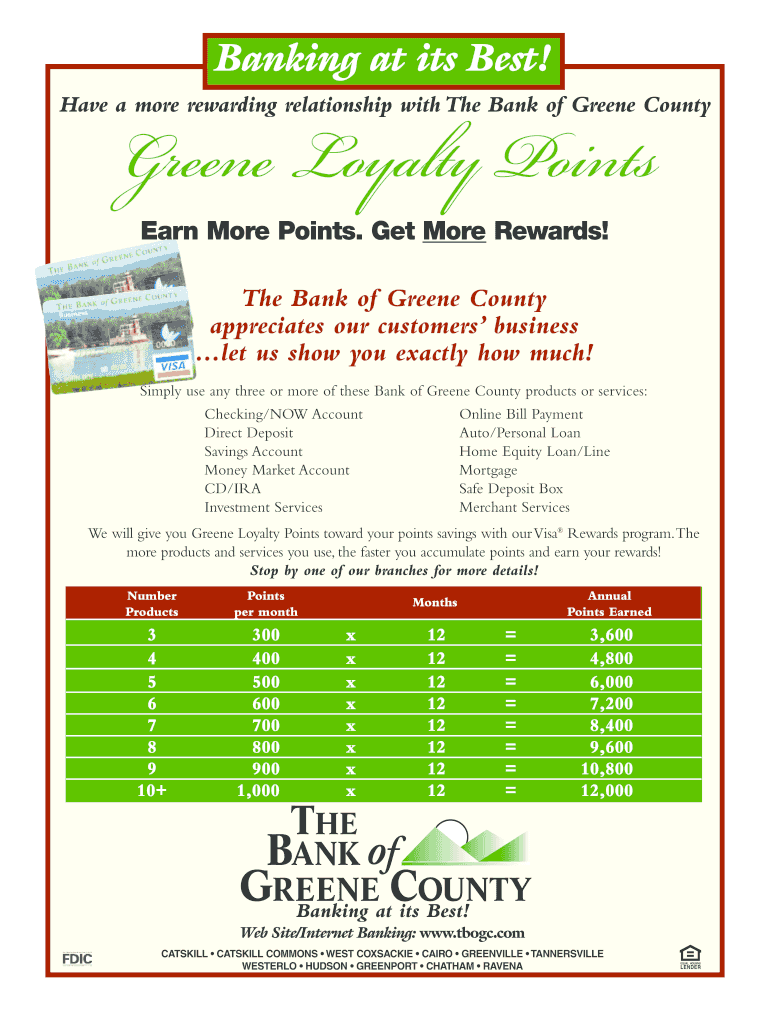

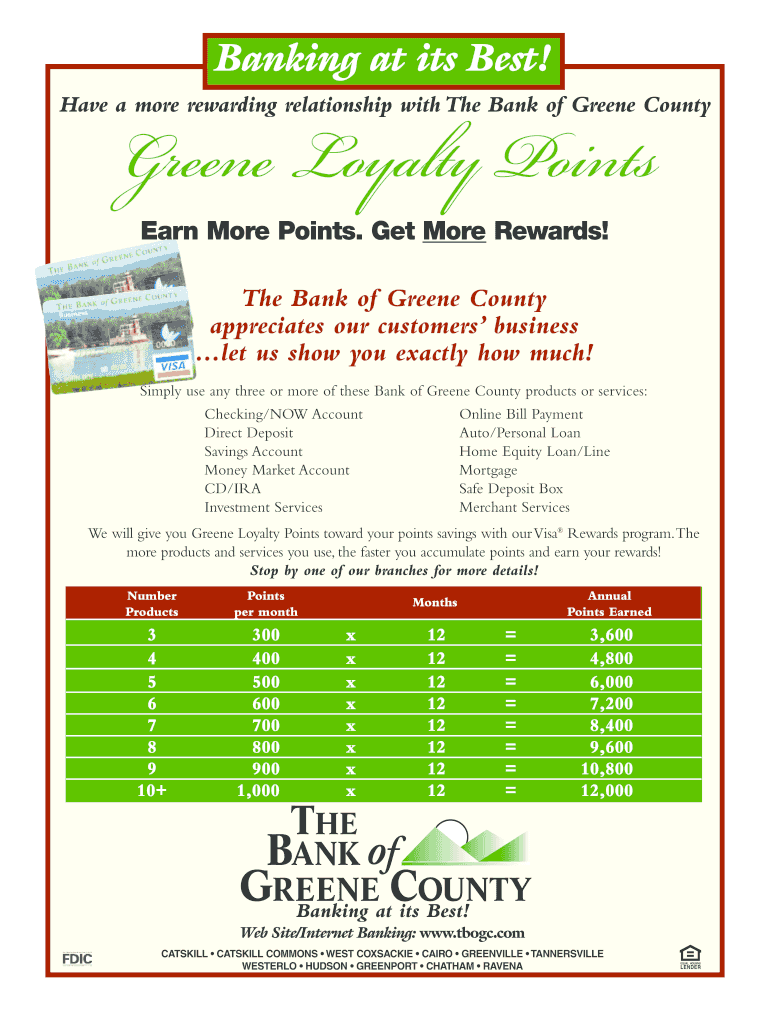

Banking at its Best! Have a more rewarding relationship with The Bank of Greene County Greene Loyalty Points Earn More Points. Get More Rewards! The Bank of Greene County appreciates our customers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign banking at its best

Edit your banking at its best form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your banking at its best form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit banking at its best online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit banking at its best. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out banking at its best

How to fill out banking at its best:

01

Research and choose the right bank: Start by researching different banks and their services. Look for a bank that offers the best features and benefits suited to your needs. Consider factors like fees, interest rates, customer service, and convenience.

02

Open an account: Once you've selected a bank, visit their branch or their website to open an account. Provide all the necessary identification documents and complete the required forms accurately. Ensure that you understand the terms and conditions of the account.

03

Understand the banking services: Familiarize yourself with the various banking services offered by your chosen bank. These may include checking accounts, savings accounts, loans, credit cards, and investment options. Take the time to understand how each service works and how it can benefit you.

04

Manage your finances: Use the bank's online banking platform or mobile app to monitor and manage your finances effectively. Keep track of your account balances, transactions, and set up alerts to stay updated on any changes or suspicious activity.

05

Utilize automated features: Take advantage of automated features provided by your bank, such as direct deposit and automatic bill payments. These features can help streamline your finances and avoid late payments or unnecessary fees.

06

Seek personalized advice: If you have specific financial goals or concerns, consider scheduling an appointment with a bank representative to seek personalized advice. They can provide guidance on budgeting, saving, investing, and other financial matters.

Who needs banking at its best:

01

Individuals and families: Banking at its best is essential for individuals and families who want to effectively manage their finances, save money, and access various financial services conveniently.

02

Small business owners: Small business owners can benefit from banking at its best by utilizing services like merchant accounts, business loans, and business credit cards. It can help them manage cash flow, track expenses, and grow their business efficiently.

03

Students and young adults: Students and young adults transitioning into the workforce can benefit from banking at its best to establish good financial habits, build credit, and access services like student loans or car loans.

04

Retirees and seniors: Retirees and seniors often have specific financial needs such as retirement accounts, estate planning, and long-term care solutions. Banking at its best can provide them with the necessary tools and services to manage their finances during their golden years.

Overall, banking at its best is valuable for anyone seeking financial security, convenience, and personalized support in managing their money effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send banking at its best for eSignature?

When you're ready to share your banking at its best, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my banking at its best in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your banking at its best and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out banking at its best on an Android device?

Use the pdfFiller app for Android to finish your banking at its best. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is banking at its best?

Banking at its best involves providing excellent customer service, transparent practices, and innovative financial solutions to meet the needs of clients.

Who is required to file banking at its best?

All financial institutions, including banks, credit unions, and investment firms, are required to adhere to the principles of banking at its best.

How to fill out banking at its best?

To fill out banking at its best, financial institutions must prioritize customer satisfaction, ethical practices, and regulatory compliance.

What is the purpose of banking at its best?

The purpose of banking at its best is to promote trust in the financial system, protect consumers, and ensure the stability of the economy.

What information must be reported on banking at its best?

Information regarding customer interactions, financial transactions, compliance with regulations, and ethical practices must be reported on banking at its best.

Fill out your banking at its best online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Banking At Its Best is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.