Get the free Tr u S t f o r Architectur eAS ement S Pr o P o S e d - architecturaltrust

Show details

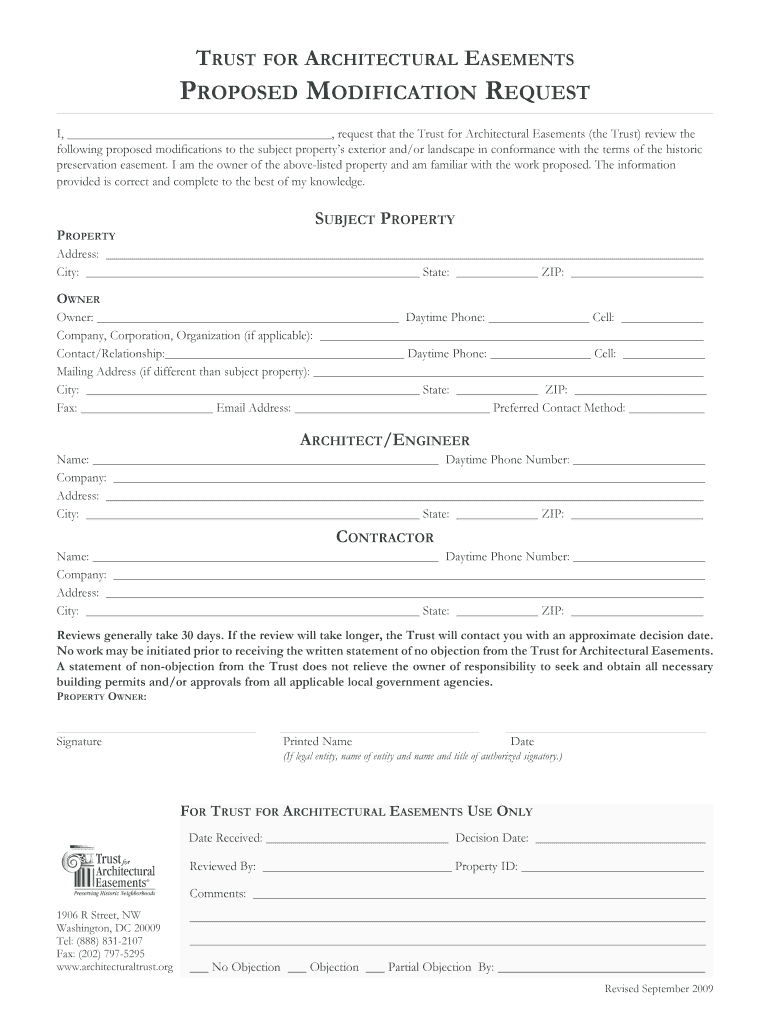

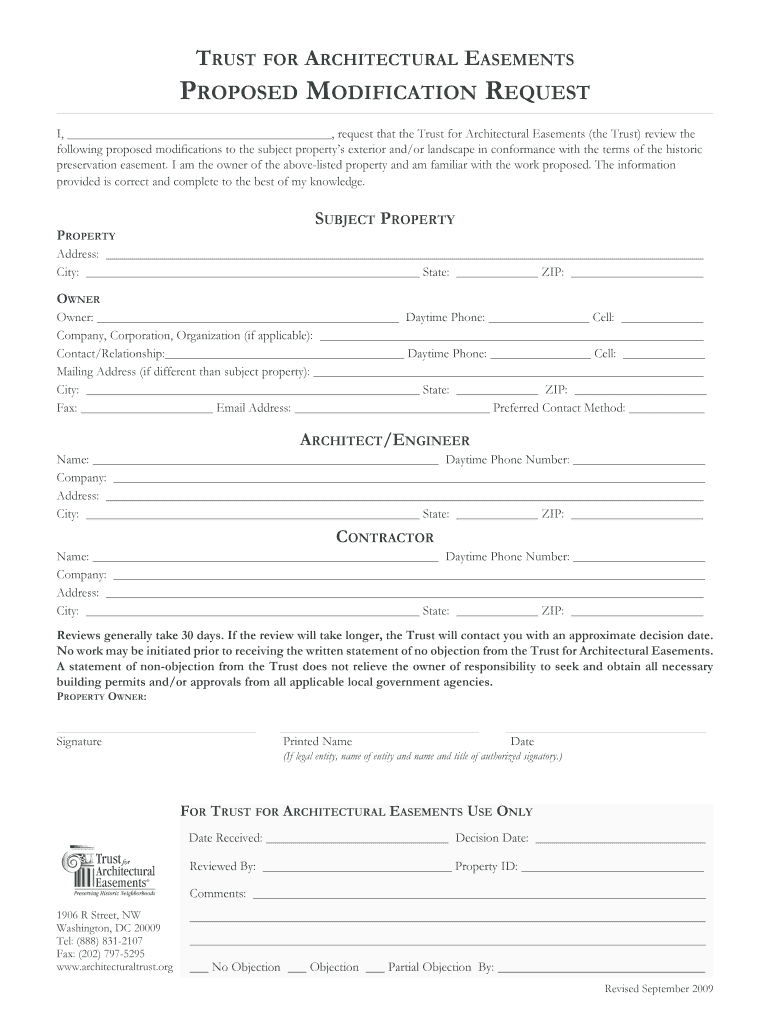

Trust for Architectural easements Proposed modification request I, request that the Trust for Architectural Easements (the Trust) review the following proposed modifications to the subject properties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tr u s t

Edit your tr u s t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tr u s t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tr u s t online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tr u s t. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tr u s t

How to fill out tr u s t:

01

Begin by gathering all necessary documentation, including the trust instrument, any amendments, and any applicable legal forms.

02

Carefully review the trust instrument and its provisions to ensure a thorough understanding of its purpose and requirements.

03

Identify the settlor, trustee(s), and beneficiaries named in the trust and gather their relevant information, such as names, addresses, and social security numbers.

04

Determine the assets that will be transferred or held within the trust and document their details, including descriptions, values, and locations.

05

Consider working with an attorney or professional advisor experienced in trust administration to ensure compliance with applicable laws and regulations.

06

Complete any required legal forms associated with establishing or funding the trust, ensuring accuracy and adherence to legal requirements.

07

Transfer the identified assets into the trust's name, following any specific instructions outlined in the trust instrument.

08

Review and update any associated beneficiary designations, such as life insurance policies or retirement accounts, to align with the trust's provisions.

09

Keep detailed records of all actions taken in relation to the trust, including correspondence, financial transactions, and any communication with beneficiaries or co-trustees.

10

Periodically review and update the trust as necessary, especially in the event of life changes, such as marriage, divorce, or the birth of children.

Who needs tr u s t:

01

Individuals who want to protect their assets and ensure proper asset distribution after their death or incapacitation may consider establishing a trust.

02

Parents or guardians can set up a trust to safeguard their children's inheritance until they reach a certain age or meet specified conditions.

03

High net worth individuals, business owners, or professionals in high-liability fields may use trusts for asset protection and to minimize estate tax liability.

04

Individuals who wish to maintain privacy and avoid the probate process may choose to create a trust, as it allows for a more confidential transfer of assets.

05

Charitable-minded individuals may establish charitable trusts to support causes or organizations they believe in.

06

Individuals with special needs or disabilities may benefit from a trust that ensures their ongoing care and financial support.

07

Business partners or co-owners can utilize trusts to facilitate smooth business succession planning and avoid complications in the event of a partner's death or retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tr u s t?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the tr u s t in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the tr u s t in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your tr u s t in minutes.

How do I edit tr u s t on an Android device?

With the pdfFiller Android app, you can edit, sign, and share tr u s t on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is tr u s t?

Trust is a legal entity that holds assets on behalf of beneficiaries.

Who is required to file tr u s t?

Trustees are required to file trust tax returns.

How to fill out tr u s t?

Trust tax returns are typically filled out using Form 1041.

What is the purpose of tr u s t?

The purpose of a trust is to manage and distribute assets according to the wishes of the grantor.

What information must be reported on tr u s t?

Trust tax returns must report income, deductions, and distributions.

Fill out your tr u s t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tr U S T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.