Get the free Business Loans Direct Debit Request - ME Bank

Show details

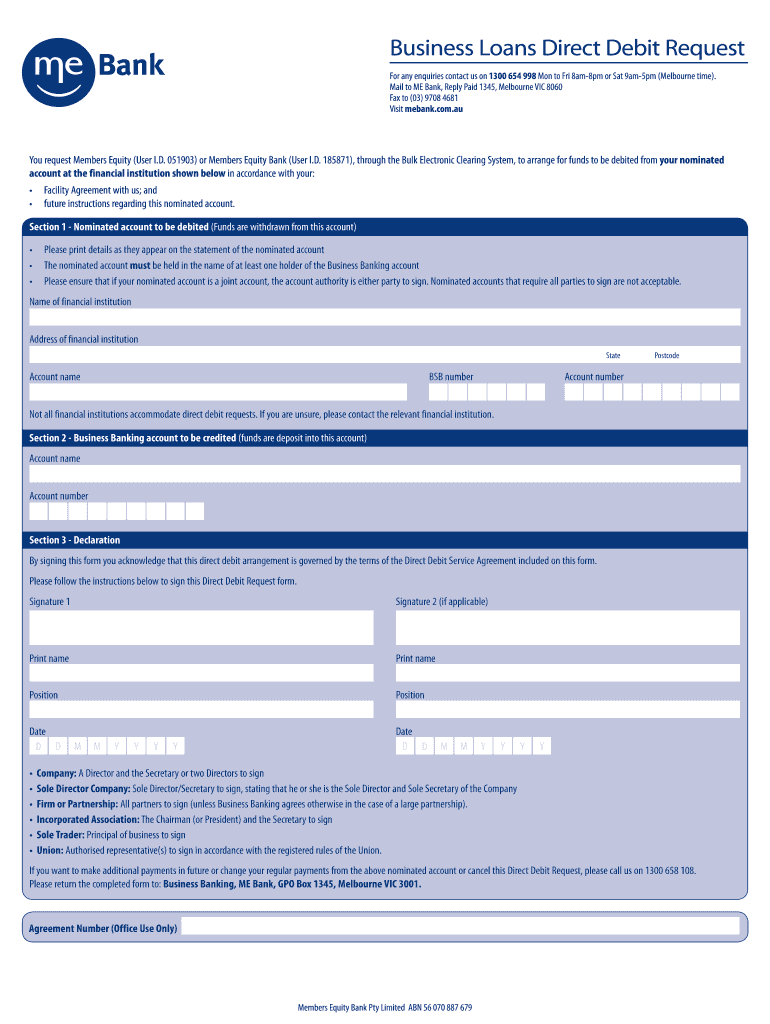

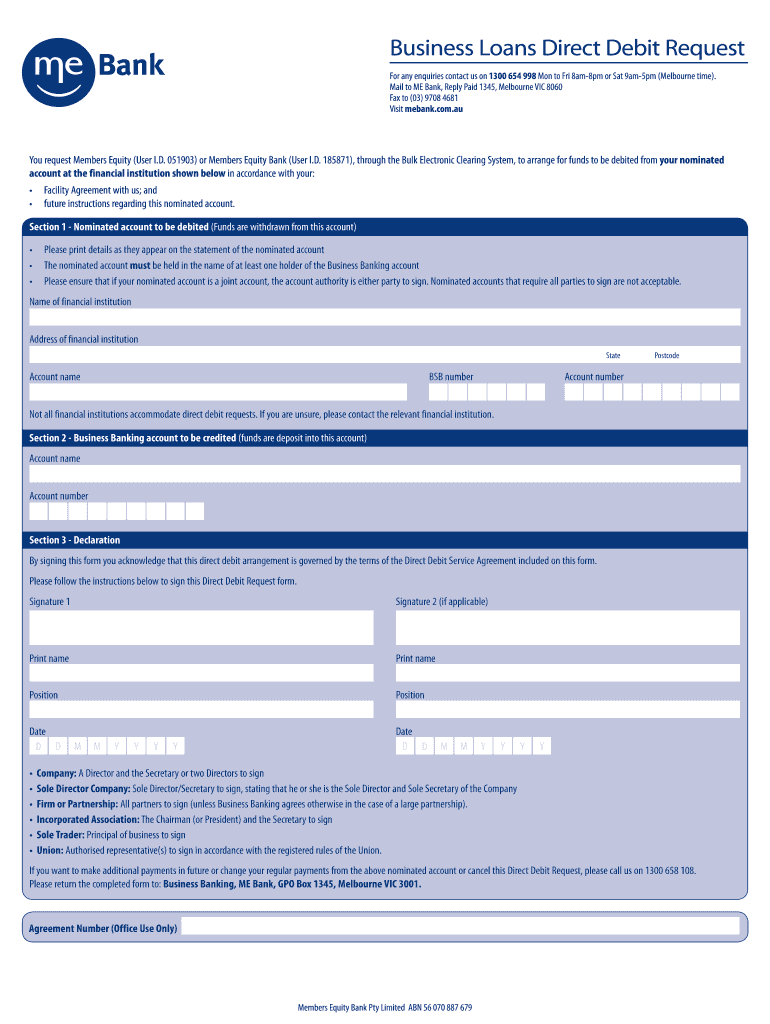

Business Loans Direct Debit Request For any inquiries contact us on 1300 654 998 Mon to Fri 8am8pm or Sat 9am5pm (Melbourne time). Mail to ME Bank, Reply Paid 1345, Melbourne VIC 8060 Fax to (03)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loans direct debit

Edit your business loans direct debit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loans direct debit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business loans direct debit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business loans direct debit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loans direct debit

How to fill out business loans direct debit:

01

Gather necessary information: Before filling out the direct debit form for your business loan, make sure you have all the required information handy. This might include your business's bank account details, the loan amount, and any specific instructions provided by the lending institution.

02

Review the form: Carefully read through the direct debit form to familiarize yourself with its sections and requirements. This will ensure that you understand each step and provide accurate information.

03

Enter your business details: Start by entering your business's name, address, and contact information as requested on the form. Double-check the accuracy of this information to avoid any issues with the loan repayment process.

04

Provide bank account details: Fill in your business's bank account information, including the account number, branch details, and any other relevant information as required. This will enable the lender to set up the direct debit arrangement correctly.

05

Specify loan details: Indicate the loan details on the form, such as the loan amount, repayment frequency, and the start date for the direct debit. Ensure that these details align with the terms and conditions of your business loan agreement.

06

Verify authorization: Sign and date the direct debit form to authorize the lender to initiate automated loan repayments from your business's bank account. By signing, you confirm that you have read and understood the terms of the direct debit arrangement.

Who needs business loans direct debit:

01

Small business owners: Entrepreneurs who need financing for their small businesses may require a business loan's direct debit facility. It simplifies the loan repayment process by automating the payments, ensuring timely and hassle-free repayments.

02

Startups: New businesses often require funding to establish themselves and cover initial costs. Direct debit for business loans allows startups to streamline their loan repayments, enabling them to focus on growing their business.

03

Established businesses: Even well-established businesses may require financing to support expansion, purchase equipment, or manage cash flow. Direct debit simplifies loan repayments, allowing these businesses to efficiently manage their financial obligations.

04

Entrepreneurs with multiple loans: Business owners who have taken out multiple loans may find it challenging to keep track of various repayment dates. By utilizing business loans direct debit, they can consolidate their repayments and have better control over their finances.

05

Businesses with variable income: Some businesses experience fluctuating income due to seasonal variations or other factors. Direct debit for business loans ensures that loan repayments are made consistently, irrespective of income fluctuations, reducing the risk of missed or late payments.

In summary, filling out a business loan's direct debit involves gathering necessary information, reviewing the form, providing accurate business and bank account details, specifying loan details, and authorizing the lender. This facility is beneficial for small business owners, startups, established businesses, entrepreneurs with multiple loans, and those with variable income.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business loans direct debit in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your business loans direct debit and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send business loans direct debit to be eSigned by others?

When you're ready to share your business loans direct debit, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute business loans direct debit online?

pdfFiller makes it easy to finish and sign business loans direct debit online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is business loans direct debit?

Business loans direct debit is a method of automatically withdrawing loan payments from a business's bank account on a scheduled date.

Who is required to file business loans direct debit?

Businesses that have taken out loans and have agreed to repay them through direct debit are required to file business loans direct debit.

How to fill out business loans direct debit?

To fill out business loans direct debit, businesses need to provide their bank account information, loan details, and authorization for automatic payments.

What is the purpose of business loans direct debit?

The purpose of business loans direct debit is to make loan repayment convenient and automated for businesses, ensuring timely payments.

What information must be reported on business loans direct debit?

The information reported on business loans direct debit includes the loan amount, repayment schedule, bank account details, and authorization for automatic payments.

Fill out your business loans direct debit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loans Direct Debit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.