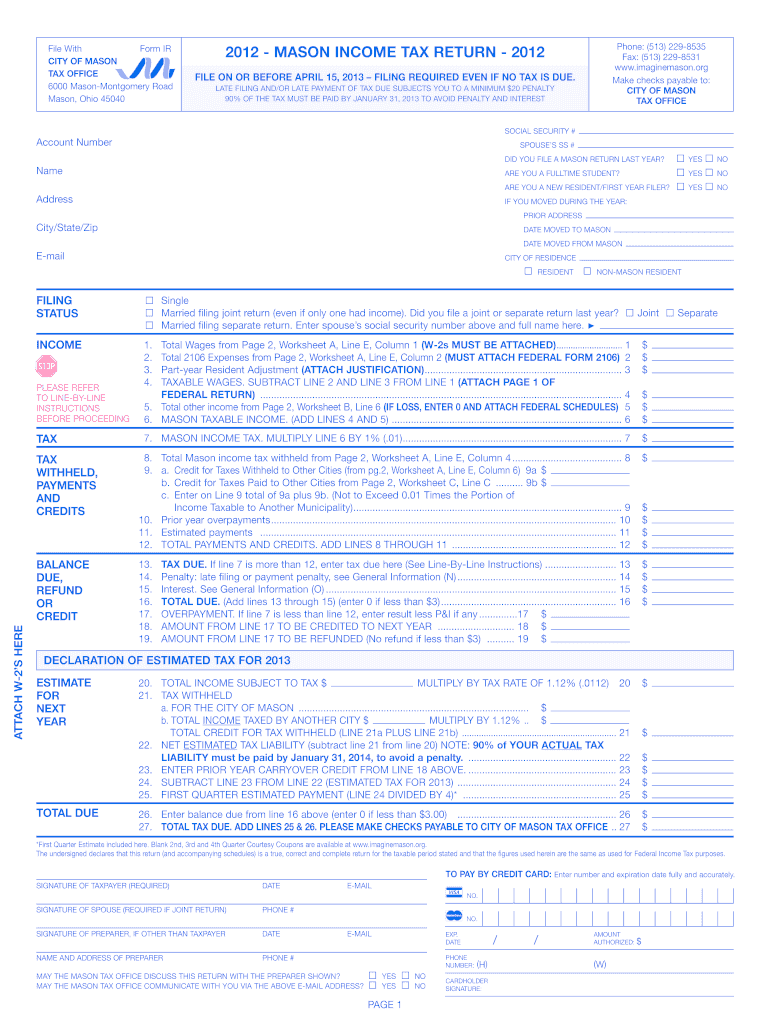

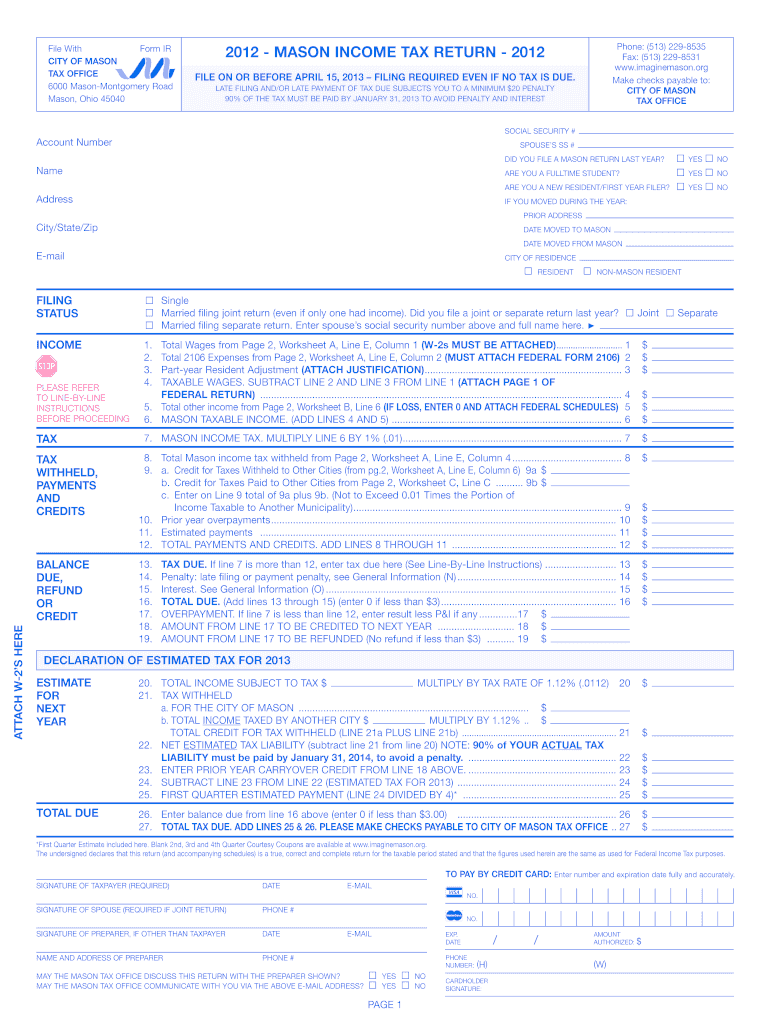

OH Form IR - Mason 2012 free printable template

Get, Create, Make and Sign OH Form IR - Mason

How to edit OH Form IR - Mason online

Uncompromising security for your PDF editing and eSignature needs

OH Form IR - Mason Form Versions

How to fill out OH Form IR - Mason

How to fill out OH Form IR - Mason

Who needs OH Form IR - Mason?

Instructions and Help about OH Form IR - Mason

Laws calm legal forms guide a w — seven form is the United States Internal Revenue Service tax form used to apply for an individual taxpayer identification number an ITIN is required for individuals who must submit an income tax return but do not have and are unable to obtain a United States social security number the W — seven form can be obtained through the IRS a--'s website or by obtaining the documents through a local tax office before submitting a W — seven form you must ensure that you are not eligible for a social security number if you are eligible you must apply for a Social Security number before using the W — seven form first select the reason for requesting an ITIN if you are applying for one for any reason other than claiming a tax treaty benefit you must also submit a standard tax return with your W — 7 for line one state your full name and any previous name given at birth put your full address on line two to provide the IRS with the mailing address if you have a P o box you must follow IRS instructions if you have a foreign address put this in line three do not use a P o box provide your date place of birth and gender in boxes four and five for line six answer any questions that apply to your circumstances include any countries of citizenship foreign tanks identifiers type of visa identification documents to be submitted with the W — seven form previous ITIN numbers and the name of the college you may be attending sign and date at the bottom of the form also including a phone number if a delegate has helped you with the form they must also state their name and relationship to you file the W — seven form with any necessary tax returns keep a copy for your records to watch more videos please make sure to visit laws comm

People Also Ask about

Is there city tax in Ohio?

Who has to pay city taxes in Ohio?

How much is Mason Ohio city tax?

Do I need to file an Ohio tax return with no income?

Where can I get Ohio tax forms?

Does Mason Ohio have a city tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the OH Form IR - Mason electronically in Chrome?

Can I create an electronic signature for signing my OH Form IR - Mason in Gmail?

How do I complete OH Form IR - Mason on an Android device?

What is OH Form IR - Mason?

Who is required to file OH Form IR - Mason?

How to fill out OH Form IR - Mason?

What is the purpose of OH Form IR - Mason?

What information must be reported on OH Form IR - Mason?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.