Get the free FORM 10A - cityofsteubenville

Show details

This document is used to apply for a refund of municipal income tax withheld from an employee's wages, detailing necessary information about the taxpayer and required documentation for various claims.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10a - cityofsteubenville

Edit your form 10a - cityofsteubenville form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10a - cityofsteubenville form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 10a - cityofsteubenville online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 10a - cityofsteubenville. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10a - cityofsteubenville

How to fill out FORM 10A

01

Obtain FORM 10A from the relevant authority or download it from the official website.

02

Read the instructions thoroughly to understand the requirements.

03

Fill out your personal details in the designated sections, including your name, address, and contact information.

04

Provide any necessary identification numbers as required, such as social security or tax ID numbers.

05

Complete the specific sections related to your eligibility or purpose for submitting FORM 10A.

06

Review the form for accuracy and make sure all required fields are filled out.

07

Sign and date the form at the designated location.

08

Submit FORM 10A by mail or online, if applicable, following the submission guidelines.

Who needs FORM 10A?

01

Individuals seeking to claim deductions or exemptions under specific tax regulations.

02

Taxpayers who are required to submit documentation for compliance with tax authority regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a W-10 tax form?

You may use this form to get the correct name, address and taxpayer identification number (TIN) from each person or organization that provides care for your child or other dependent if: You plan to claim a credit for child and dependent care expenses on Form 1040 or 1040-SR, or.

What happens if you don't pay RITA taxes?

Penalties for Not Paying RITA Taxes RITA is known for aggressively pursuing unpaid local taxes, whether they are for services like waste collection or general municipal obligations. Missing even a single payment can result in late fees, wage garnishments, or other serious financial consequences.

What is the use of form 10?

The new form 10 IEA can be used to indicate the preference for the old tax regime by Individuals, HUF, AOP (other than co-operative societies), BOI & Artificial Judicial Persons (AJP) having income from business and profession.

Do local taxes get refunded?

If you received a refund of state or local income taxes from last year's tax return, you may receive a Form 1099-G reporting this refund as income. If you itemized deductions on your federal return in the same year that you received the state or local refund, the refund may be considered taxable income.

What is Ohio form 10A?

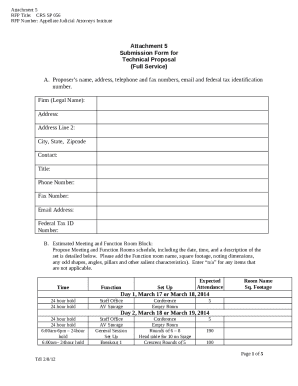

Form 10A. Application for Municipal Income Tax Refund.

How long can you go to jail for not paying RITA?

While RITA can take severe actions like wage garnishment, one thing you do NOT have to worry about is going to jail. RITA tax issues are civil matters, not criminal offenses. That means no one is going to issue a warrant for your arrest for failing to pay your local taxes.

What is form no. 10?

Any religious or charitable trust or institution in India can file Form 10 for: Claiming income tax exemption under Sections 10(23C), 11 and 12AA of the Income Tax Act. Accumulate or set apart income for future charitable or religious purposes within the guidelines set by the Income Tax Act.

What is a form 10A?

Form 10A is an application submitted to the Income Tax Department to re-register and provisionally register religious or charitable trusts or institutions under section 12A, 12AA, 10(23), 80G.

Will RITA garnish wages?

RITA can file a civil lawsuit to obtain a judgment, enabling collection efforts such as wage garnishment or bank account levies. A lien may also be filed against the taxpayer's property, complicating future sales or refinancing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 10A?

FORM 10A is an application form submitted to the relevant tax authorities in India for seeking approval of a charitable or religious trust or institution under section 12A of the Income Tax Act.

Who is required to file FORM 10A?

Organizations or institutions that seek to obtain registration as a charitable trust or institution under section 12A of the Income Tax Act are required to file FORM 10A.

How to fill out FORM 10A?

To fill out FORM 10A, organizations need to provide details such as name, address, PAN, details of the trust deed, and other required documents, ensuring that all information is accurate and complete.

What is the purpose of FORM 10A?

The purpose of FORM 10A is to apply for registration under section 12A of the Income Tax Act, which allows the organization to claim tax exemptions on income received.

What information must be reported on FORM 10A?

FORM 10A requires information such as the name of the organization, its objectives, the date of establishment, details of governing documents, and any other relevant information as specified in the form.

Fill out your form 10a - cityofsteubenville online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10a - Cityofsteubenville is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.