Get the free Kaiser Permanente: HSA-QUALIFIED DEDUCTIBLE HMO

Show details

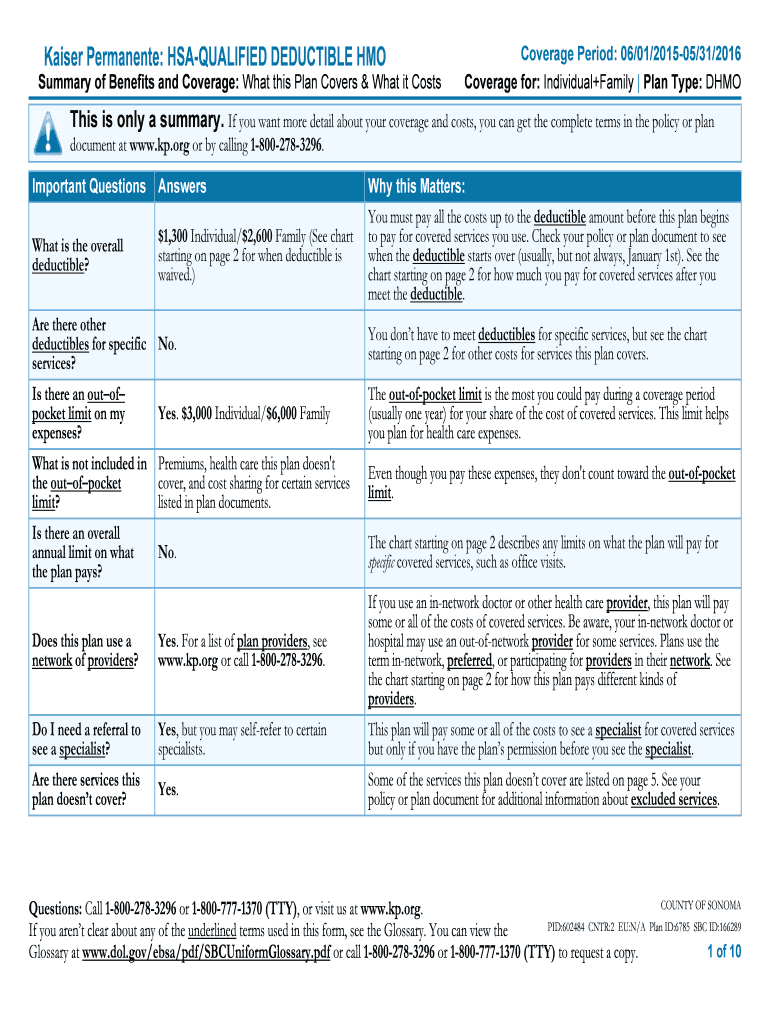

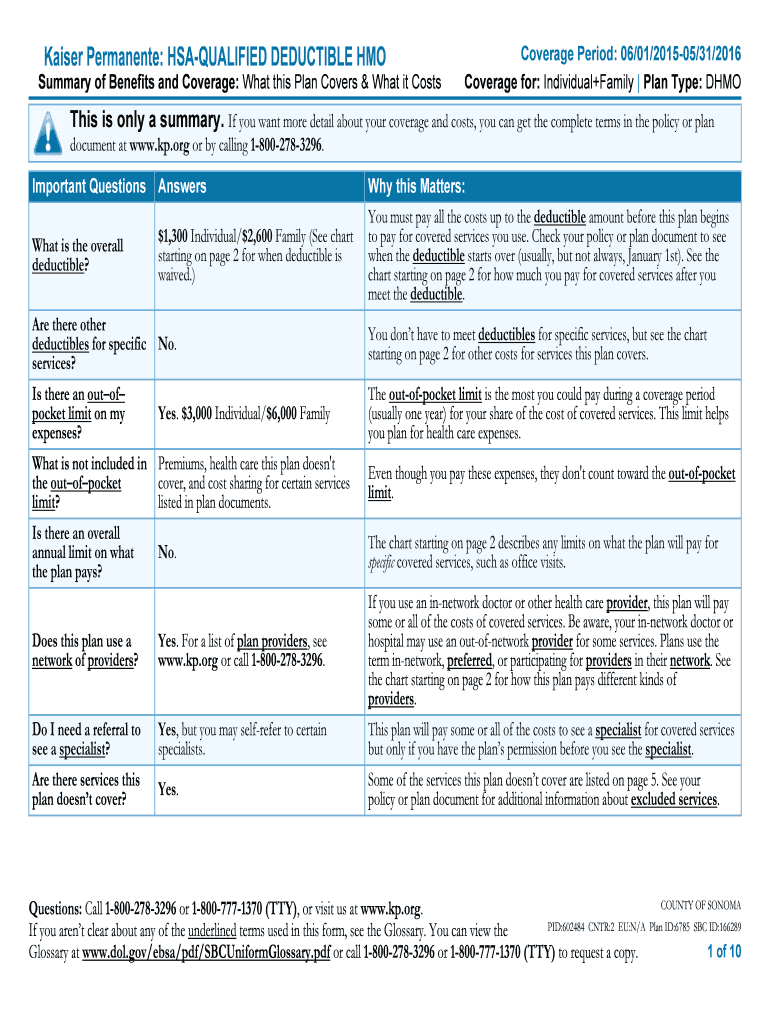

Kaiser Permanent: QUALIFIED DEDUCTIBLE Summary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage Period: 06/01/201505/31/2016Coverage for: Individual+Family Plan Type: Dhotis

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kaiser permanente hsa-qualified deductible

Edit your kaiser permanente hsa-qualified deductible form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kaiser permanente hsa-qualified deductible form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kaiser permanente hsa-qualified deductible online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kaiser permanente hsa-qualified deductible. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kaiser permanente hsa-qualified deductible

How to Fill Out Kaiser Permanente HSA-Qualified Deductible:

01

Obtain the necessary forms: Contact Kaiser Permanente to receive the required paperwork for filling out the HSA-qualified deductible. They may provide digital forms or mail them to you.

02

Review the instructions: Carefully read through the instructions provided with the forms. Make sure you understand the purpose of the deductible and any specific requirements for completing it.

03

Provide personal information: Fill in your personal details on the form. This may include your full name, contact information, social security number, and Kaiser Permanente membership number.

04

Indicate the coverage period: Specify the time period for which the deductible applies. This information can usually be found on your insurance plan documents or by contacting Kaiser Permanente directly.

05

Document your eligible expenses: Review your medical expenses that qualify for the HSA deductible. This typically includes eligible out-of-pocket medical costs, such as doctor visits, prescription medications, and certain medical procedures. Keep in mind that not all expenses may be eligible for the deductible, so refer to the instructions or consult with Kaiser Permanente if needed.

06

Calculate the deductible amount: Determine the total amount of eligible expenses that you have incurred during the coverage period. Subtract any reimbursements or payments from insurance or other sources to arrive at the deductible amount.

07

Complete any additional sections: Some forms may require you to answer additional questions or provide additional information. Make sure to carefully complete these sections as well to ensure accurate processing.

08

Review and submit: Carefully review all the information you have provided on the form. Make sure there are no errors or missing details. Once you are confident in the accuracy of your submission, sign and date the form. Follow the instructions for submission, whether it is through mail, online, or in-person.

09

Retain copies: Make copies of the completed forms and any supporting documentation for your records. This will serve as proof of your submission and can be helpful for future reference or inquiries.

10

Monitor your deductible progress: Keep track of your deductible progress throughout the coverage period. Understand the limit you need to reach before certain benefits kick in and ensure you continue to document your eligible expenses accordingly.

Who Needs Kaiser Permanente HSA-Qualified Deductible:

01

Individuals with a Kaiser Permanente Health Savings Account (HSA): The HSA-qualified deductible is primarily for individuals who have a Health Savings Account with Kaiser Permanente. This type of account allows you to save pre-tax money, which can be used to pay for eligible medical expenses.

02

Anyone seeking to manage healthcare costs: The HSA-qualified deductible provides an opportunity for individuals to manage their healthcare costs while enjoying tax benefits. By setting aside money in an HSA and meeting the deductible, individuals can access certain healthcare services at a lower cost or receive coverage for specific medical expenses.

03

Those looking for flexibility in healthcare financing: With a Kaiser Permanente HSA-qualified deductible, individuals have the flexibility to choose how they spend their healthcare funds. They can allocate the money based on their own needs, which can be particularly beneficial for those who anticipate high medical expenses or require regular healthcare services.

Note: It is important to consult with Kaiser Permanente or a qualified healthcare professional for specific guidance and advice regarding the HSA-qualified deductible and its relevance to your personal healthcare needs and financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit kaiser permanente hsa-qualified deductible from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your kaiser permanente hsa-qualified deductible into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute kaiser permanente hsa-qualified deductible online?

pdfFiller has made it simple to fill out and eSign kaiser permanente hsa-qualified deductible. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the kaiser permanente hsa-qualified deductible electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your kaiser permanente hsa-qualified deductible in seconds.

What is kaiser permanente hsa-qualified deductible?

The Kaiser Permanente HSA-qualified deductible is the amount of money that you must pay out of pocket for covered medical expenses before your health insurance plan starts to pay.

Who is required to file kaiser permanente hsa-qualified deductible?

Individuals who have a Health Savings Account (HSA) and a high deductible health plan (HDHP) through Kaiser Permanente are required to file the HSA-qualified deductible.

How to fill out kaiser permanente hsa-qualified deductible?

You can fill out the Kaiser Permanente HSA-qualified deductible by keeping track of your medical expenses and payments, and reporting them accurately on the necessary forms provided by Kaiser Permanente.

What is the purpose of kaiser permanente hsa-qualified deductible?

The purpose of the Kaiser Permanente HSA-qualified deductible is to encourage individuals to take more responsibility for their healthcare costs by having them pay a certain amount before insurance coverage kicks in.

What information must be reported on kaiser permanente hsa-qualified deductible?

You must report all medical expenses and payments made towards meeting the deductible on the Kaiser Permanente HSA-qualified deductible form.

Fill out your kaiser permanente hsa-qualified deductible online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kaiser Permanente Hsa-Qualified Deductible is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.