Get the free Group Long Term Care Insurance Application - cityofsalem

Show details

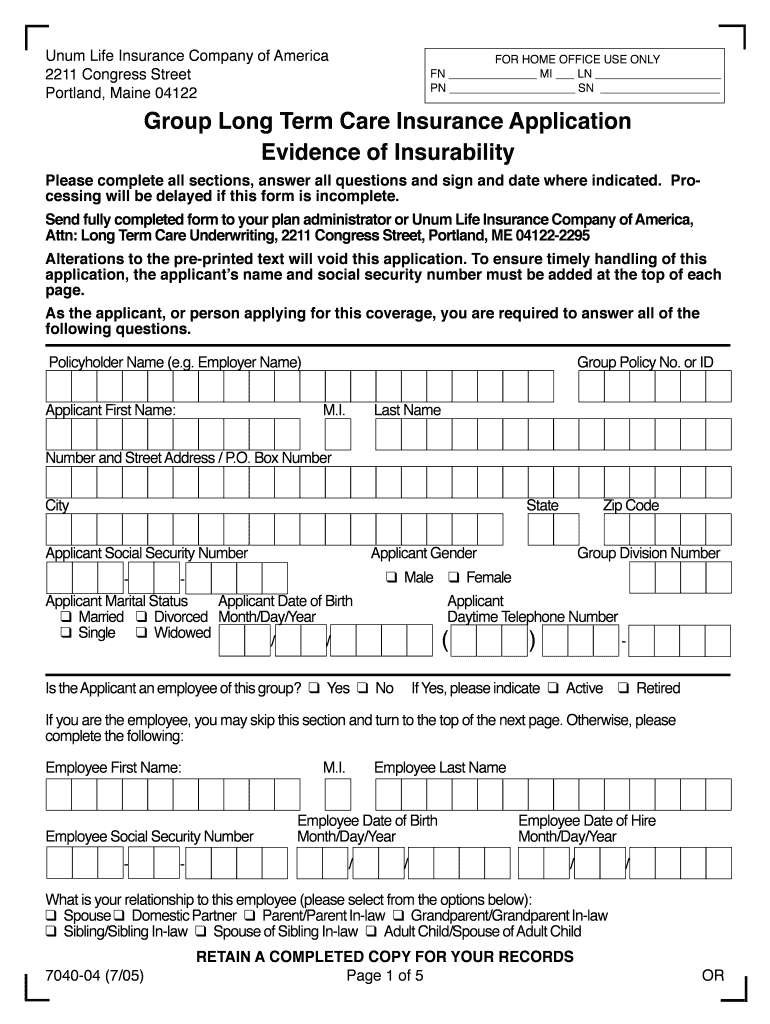

This document serves as an application for Group Long Term Care Insurance, requiring applicants to provide detailed information regarding their health and insurance history to assess insurability.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group long term care

Edit your group long term care form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group long term care form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group long term care online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group long term care. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group long term care

How to fill out Group Long Term Care Insurance Application

01

Obtain the Group Long Term Care Insurance Application form from your employer or insurance provider.

02

Fill in personal information, including your name, address, date of birth, and contact details.

03

Provide details about your employment status, including your job title and length of employment.

04

Indicate your type of coverage needed and any additional benefits you wish to include.

05

Answer any medical history questions truthfully, including current health conditions and medications.

06

Review and sign the application form, verifying all information is correct.

07

Submit the completed application to your HR department or the insurance provider according to their instructions.

Who needs Group Long Term Care Insurance Application?

01

Individuals who are part of a group plan offered by an employer or organization.

02

Those who want to prepare for potential long-term care needs in the future.

03

Employees who wish to secure coverage that may provide financial support for long-term care services.

04

People looking for a safety net for their family and loved ones regarding healthcare costs in later life.

Fill

form

: Try Risk Free

People Also Ask about

Can I self-insure for long-term care?

Self insurance is still a thing. In fact, it's probably the most popular way to provide benefits for long term care.

What is the best insurance company for long-term care?

Best long-term care insurance Best for seniors: Mutual of Omaha. Best for comparison shopping: GoldenCare. Best hybrid long-term care insurance: Nationwide. Best for customer service: MassMutual. Best for inflation protection: Brighthouse. Best for couples: New York Life.

What is the biggest drawback of long-term care insurance?

Call the Association at 818-597-3227 or complete the REQUEST A QUOTE FORM to be connected with an experienced professional who can explain the Mutual of Omaha Long-Term Care Insurance policy. In terms of the number of long-term care insurance policyholders, Genworth is the largest in the nation.

Who provides the best long-term care insurance?

Our Top Picks for the Best Long-Term Care Insurance Companies Mutual of Omaha: Best for Stand-Alone LTC Insurance. Nationwide: Best for Policy Customization. New York Life: Best for Financial Stability. Northwestern Mutual: Best for Couples. GoldenCare Insurance: Best for Comparing Multiple Providers.

What is the biggest drawback of long-term care insurance?

Cons of Long-Term Care Insurance Cost is a significant issue. To buy $165,000 worth of long-term care coverage in 2022, a 55-year-old man would pay an average of $2,220 per year. Rising premiums. It may not cover all expenses. Loss of premiums. Qualifying can be an obstacle.

What are the three main types of long-term care insurance policies?

What are the types of long-term care insurance? Standalone (traditional) long-term care insurance. Long-term care insurance rider. Linked-benefit long-term care insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Long Term Care Insurance Application?

Group Long Term Care Insurance Application is a form used to apply for long-term care insurance coverage for a group of individuals, typically provided by an employer or organization.

Who is required to file Group Long Term Care Insurance Application?

The group administrator or designated representative of the organization offering the insurance plan is typically required to file the Group Long Term Care Insurance Application.

How to fill out Group Long Term Care Insurance Application?

To fill out the Group Long Term Care Insurance Application, gather the necessary information about the group members, complete all sections of the application form accurately, and submit it to the insurance provider.

What is the purpose of Group Long Term Care Insurance Application?

The purpose of the Group Long Term Care Insurance Application is to enroll eligible participants in a group long-term care insurance plan, ensuring they have access to coverage for long-term care needs.

What information must be reported on Group Long Term Care Insurance Application?

The information that must be reported includes the applicant's personal details, health history, plan options, and any other required information as specified by the insurance provider.

Fill out your group long term care online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Long Term Care is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.