PA RW-02 2006 free printable template

Show details

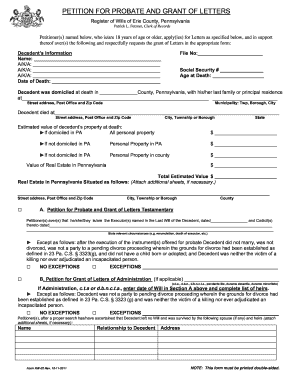

Decedent was domiciled at death in County Pennsylvania with his / her last principal residence at List street address town/city township county state zip code Decedent then years of age died on at Decedent at death owned property with estimated values as follows If domiciled in PA All personal property If not domiciled in PA Personal property in Pennsylvania Value of real estate in Pennsylvania situated as follows Wherefore Petitioner s respectfully request s the probate of the last Will and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA RW-02

Edit your PA RW-02 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA RW-02 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA RW-02 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA RW-02. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA RW-02 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA RW-02

How to fill out PA RW-02

01

Begin by downloading the PA RW-02 form from the official revenue website.

02

Fill in your personal information, such as your name, address, and Social Security number.

03

Provide details about your sources of income, including wages, interest, dividends, and any other earnings.

04

Calculate your total income and enter it in the designated section.

05

Deduct any applicable adjustments or exemptions to arrive at your taxable income.

06

Fill out the tax calculation section to determine the amount of tax owed or refundable.

07

Review the form for any errors or omissions before submission.

08

Submit the completed form to the appropriate state tax office by the required deadline.

Who needs PA RW-02?

01

Individuals who reside in Pennsylvania and need to report their income for state tax purposes.

02

Taxpayers who have taxable income that exceeds the state's thresholds and are required to file state tax returns.

Instructions and Help about PA RW-02

Fill

form

: Try Risk Free

People Also Ask about

Can you skip probate in PA?

In Pennsylvania, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

What is exempt from probate in PA?

Assets That Can Skip Probate The most common kinds of nonprobate property are: Property the deceased person owned in joint tenancy with another person—for example, a house or bank account owned by the deceased person and his spouse.

How do I settle an estate after death in Pennsylvania?

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of

What are the steps of probate in PA?

Probating a Will in Pennsylvania Step 1: Appoint an Executor. Step 2: Authenticate the Will. Step 3: Notification of Beneficiaries, Heirs, and Creditors. Step 4: Inventory the Assets. Step 5: Calculation of Estate and Inheritance Taxes. Step 6: Payment of Debts. Step 6: Resolve Will Disputes.

Can an estate be settled without probate in Pennsylvania?

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

How long do you have to file probate after death in PA?

There is no specific deadline for filing probate after someone dies in Pennsylvania. However, the law does require that within three months of the death, creditors, heirs, and beneficiaries are notified of the death. There is no specific deadline for filing probate after someone dies in Pennsylvania.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA RW-02 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like PA RW-02, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit PA RW-02 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share PA RW-02 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete PA RW-02 on an Android device?

Use the pdfFiller mobile app to complete your PA RW-02 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is PA RW-02?

PA RW-02 is a form required by the Pennsylvania Department of Revenue for certain taxpayers to report their annual revenue.

Who is required to file PA RW-02?

Businesses and individuals who meet specific revenue thresholds set by the Pennsylvania Department of Revenue are required to file PA RW-02.

How to fill out PA RW-02?

To fill out PA RW-02, taxpayers need to provide their total revenue figures, any applicable deductions, and complete all required sections according to the instructions provided by the Pennsylvania Department of Revenue.

What is the purpose of PA RW-02?

The purpose of PA RW-02 is to collect information about revenue for taxation and compliance purposes within the state of Pennsylvania.

What information must be reported on PA RW-02?

On PA RW-02, taxpayers must report their total revenue, applicable deductions, and any other information requested by the Pennsylvania Department of Revenue.

Fill out your PA RW-02 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA RW-02 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.