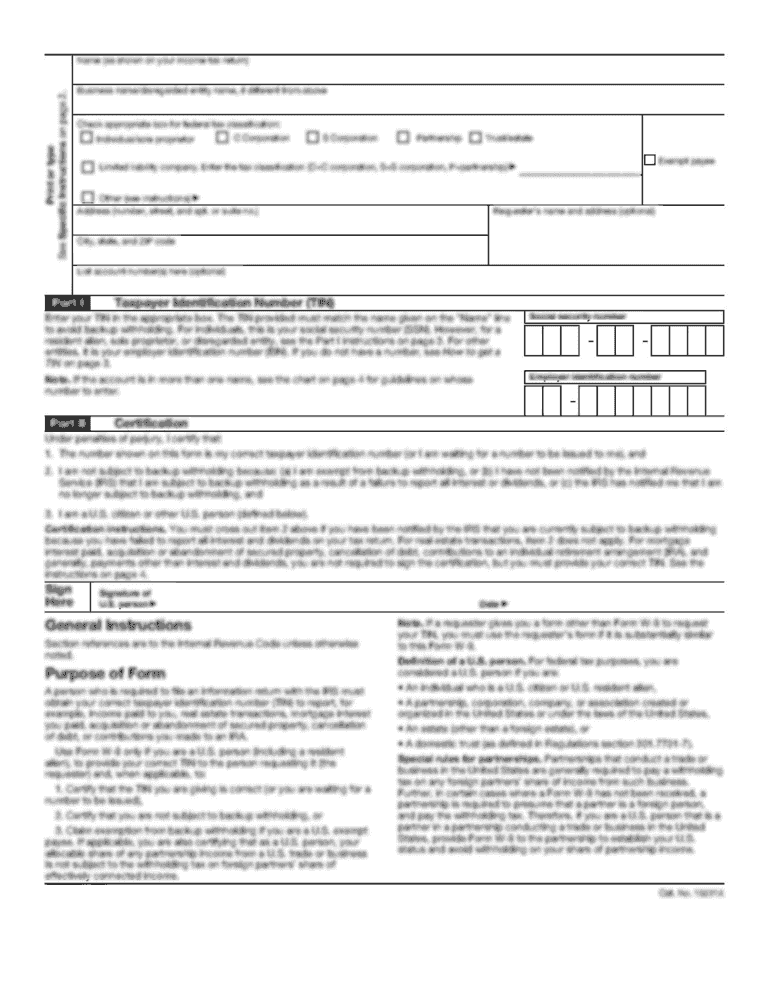

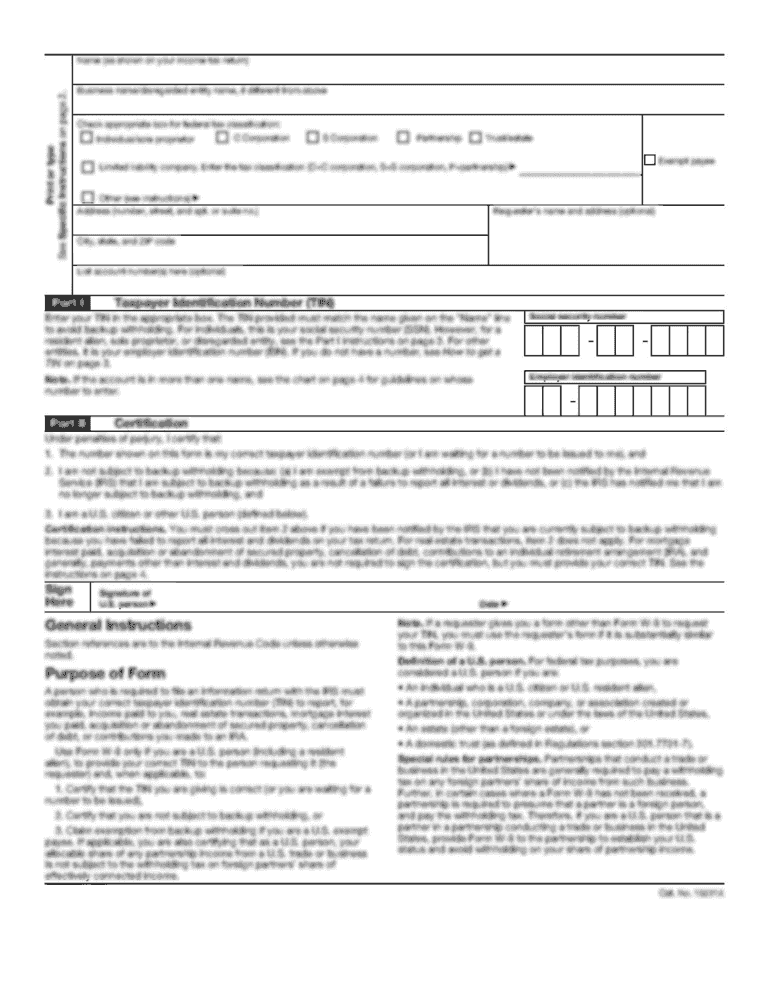

PA 83-A-15 2013 free printable template

Show details

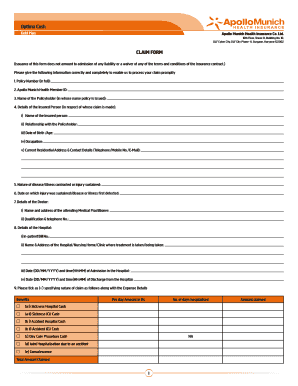

PETITION NUMBER (Office use only) CITY OF PHILADELPHIA DEPARTMENT OF REVENUE FUND SOURCE INDEX REFUND PETITION For all refunds except Individual Employee Wage Tax SEE INSTRUCTIONS ON REVERSE. CLEARLY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA 83-A-15

Edit your PA 83-A-15 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA 83-A-15 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA 83-A-15 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA 83-A-15. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA 83-A-15 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA 83-A-15

How to fill out PA 83-A-15

01

Obtain the PA 83-A-15 form from the appropriate governmental website or office.

02

Fill in your personal information at the top of the form, including name, address, and contact details.

03

Provide the required financial information in the designated sections, ensuring accuracy.

04

Include any supporting documentation as outlined in the form instructions.

05

Review the completed form for any errors or missing information.

06

Sign and date the form at the bottom as required.

07

Submit the form by mail or online according to the submission guidelines provided.

Who needs PA 83-A-15?

01

Individuals who are filing for specific financial assistance or tax credits may need PA 83-A-15.

02

Taxpayers who are required to report certain income types relevant to the form.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my Philadelphia Wage Tax back?

Wage Tax refund requests can be submitted through the Philadelphia Tax Center, including all income-based and Covid-EZ refunds for salaried or commissioned employees. If you requested a refund on your return, you do not need to fill out these forms.

How do I get a refund on my Philadelphia Wage Tax?

Wage Tax refund requests must be submitted through the Philadelphia Tax Center. This includes all income-based and Covid-EZ (non-residents only) refunds. You don't need a username and password to request a refund on the Philadelphia Tax Center.

Do I have to file Philadelphia city Wage Tax Return?

All employed Philadelphia residents owe the Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

How long does it take to get Philly Wage Tax refund?

All wage tax refund requests can be submitted online. You don't need a username and password to request a refund on the Philadelphia Tax Center site, but it may help to set up an account if you also need to pay other city taxes. Then you wait! It typically takes six to eight weeks for your refund to be sent.

What is the Philadelphia Wage Tax for 2020?

The City of Philadelphia announced that effective July 1, 2020, the Wage Tax rate for nonresidents is 3.5019%, an increase from the previous rate of 3.4481%. The rate for residents remains unchanged at 3.8712%. (News release, City of Philadelphia, June 30, 2020.)

Do I have to file a Philadelphia Wage Tax return?

All employed Philadelphia residents owe the Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

What is the Wage Tax refund petition for 2020 in Philadelphia?

Description: Non-resident, salaried employees can use this form to apply for a refund on 2020 Wage Tax for days they were required to work from home by their employer because of the coronavirus pandemic. Description: Salaried or hourly employees can use this form to apply for a refund on 2020 Wage Tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my PA 83-A-15 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your PA 83-A-15 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the PA 83-A-15 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign PA 83-A-15 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit PA 83-A-15 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share PA 83-A-15 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is PA 83-A-15?

PA 83-A-15 is a specific tax form used in Pennsylvania for reporting certain income or financial information to the state.

Who is required to file PA 83-A-15?

Individuals or entities that meet specific income requirements and have income sourced from Pennsylvania are required to file PA 83-A-15.

How to fill out PA 83-A-15?

To fill out PA 83-A-15, taxpayers must provide their personal information, income details, and any deductions or credits applicable, following the instructions provided with the form.

What is the purpose of PA 83-A-15?

The purpose of PA 83-A-15 is to ensure proper reporting of income to the Pennsylvania Department of Revenue for tax assessment and compliance.

What information must be reported on PA 83-A-15?

The information that must be reported on PA 83-A-15 includes the taxpayer's name, address, Social Security number or EIN, total income, and any deductions or taxable credits.

Fill out your PA 83-A-15 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA 83-A-15 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.