PA NBR-I 2012 free printable template

Show details

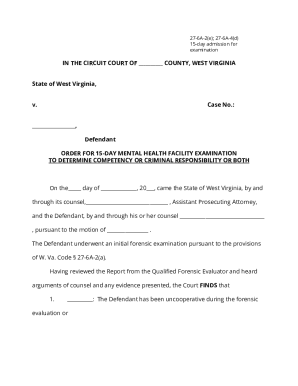

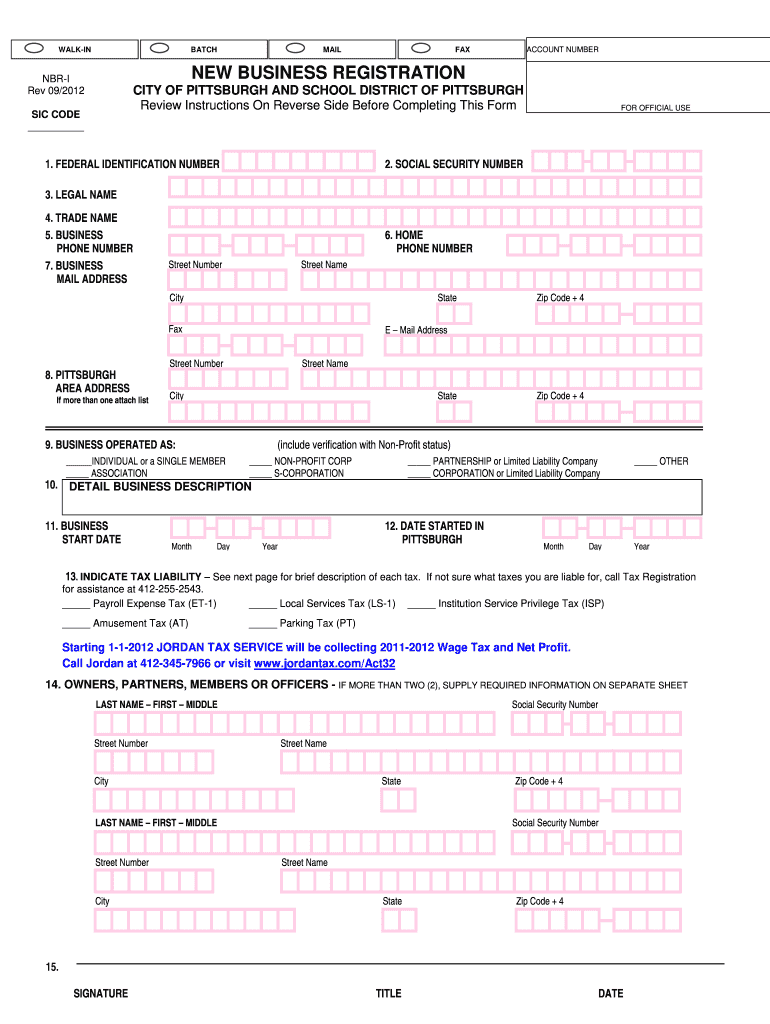

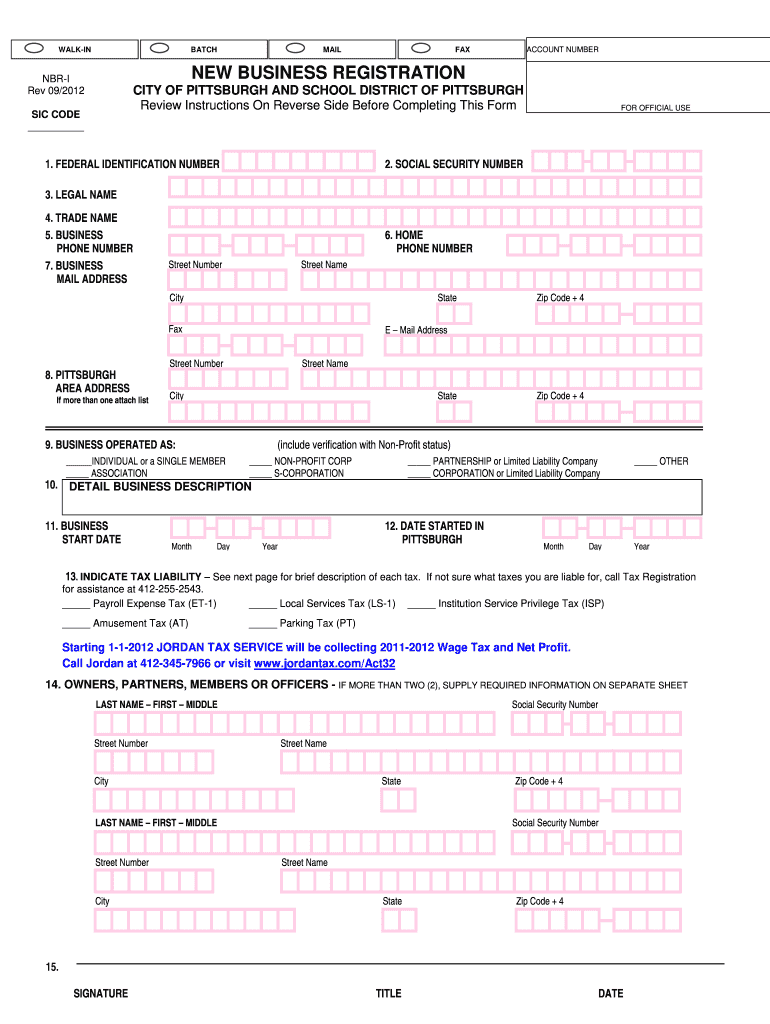

WALK-IN BATCH MAIL ACCOUNT NUMBER FAX NEW BUSINESS REGISTRATION NBR-I Rev 09/2012 CITY OF PITTSBURGH AND SCHOOL DISTRICT OF PITTSBURGH Review Instructions On Reverse Side Before Completing This Form SIC CODE 1.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA NBR-I

Edit your PA NBR-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA NBR-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA NBR-I online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA NBR-I. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA NBR-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA NBR-I

How to fill out PA NBR-I

01

Begin by gathering all necessary personal information, including your name, address, and Social Security number.

02

Review the specific instructions for PA NBR-I to understand any specific requirements.

03

Fill out the identification section completely and accurately.

04

Provide detailed information about your employment or business activities.

05

If applicable, include any additional documentation that supports your application.

06

Double-check all the information filled out for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the PA NBR-I form according to the provided submission guidelines.

Who needs PA NBR-I?

01

Individuals or businesses seeking to register for a Pennsylvania National Business Identification Number.

02

Anyone who plans to operate a business or engage in business-related activities in Pennsylvania.

03

People applying for permits, licenses, or tax registrations that require an identification number.

Fill

form

: Try Risk Free

People Also Ask about

How much is city tax in Pittsburgh?

What is the sales tax rate in Pittsburgh, Pennsylvania? The minimum combined 2023 sales tax rate for Pittsburgh, Pennsylvania is 7%. This is the total of state, county and city sales tax rates. The Pennsylvania sales tax rate is currently 6%.

What is the city tax withholding in Pittsburgh?

The tax is applied to people who earn income and/or profits and are CIty and School District residents. Residents pay 1% city tax and 2% school tax for a total of 3%. Non-Pennsylvania residents who work within the City pay 1%. Mt.

How much is a business license in PA?

How Much Does a Business License Cost in Pennsylvania? There is no cost when registering your business with the Department of Revenue. You won't be charged to obtain a sales tax license either.

Who is exempt from Pittsburgh local services tax?

The municipality is required by law to exempt from the LST employees whose earned income from all sources (employers and self-employment) in their municipality is less than $12,000.

How do I get a Pittsburgh city ID?

Pittsburgh City ID If you are a new business, register online with the City of Pittsburgh Finance Department to retrieve your ID. You should receive this within 5-10 business days.

Does Pittsburgh have property tax?

The county, local municipality, and local school all tax property at separate millage rates. Your choice in location will have a significant impact on these values. The City of Pittsburgh provides an online property tax calculator to help residents understand their property tax obligations.

What is the City of Pittsburgh Parks tax?

The parks tax is a 0.5-mill levy on property within the city. It costs $50 for each $100,000 of a property's assessed value.

Do I have to pay Pittsburgh city tax?

The tax is applied to people who earn income and/or profits and are CIty and School District residents. Residents pay 1% city tax and 2% school tax for a total of 3%. Non-Pennsylvania residents who work within the City pay 1%.

What is the city number for Pittsburgh?

Looking for general information concerning the City of Pittsburgh? You can contact the 311 Response Center for detailed information, non-emergency concerns and feedback. Dial 3-1-1, outside of Pittsburgh? Call 412-255-2621.

Does Pittsburgh have a City tax?

WHO IS TAXED? The tax is applied to people who earn income and/or profits and are CIty and School District residents. Residents pay 1% city tax and 2% school tax for a total of 3%. Non-Pennsylvania residents who work within the City pay 1%.

What is the parks tax in Pittsburgh PA?

The parks tax is a 0.5-mill levy on property within the city. It costs $50 for each $100,000 of a property's assessed value.

What is the city tax in Pittsburgh PA?

WHO IS TAXED? The tax is applied to people who earn income and/or profits and are CIty and School District residents. Residents pay 1% city tax and 2% school tax for a total of 3%. Non-Pennsylvania residents who work within the City pay 1%.

How do I become a landlord in Pittsburgh?

How Do I Become a Landlord? Have a Property to Rent. You can't be a landlord without something to rent. Know Landlord-Tenant Law for Residential Properties. Set a Price and Know Your Budget. Advertise the Property. Screen Tenants. Write and Sign a Lease. Inspect the Property. Check-in With the Tenant.

What is the state and local income tax in Pittsburgh PA?

Pennsylvania personal income tax is levied at the rate of 3.07 percent against taxable income of resident and nonresident individuals, estates, trusts, partnerships, S corporations, business trusts and limited liability companies not federally taxed as corporations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA NBR-I in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your PA NBR-I along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit PA NBR-I from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your PA NBR-I into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find PA NBR-I?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific PA NBR-I and other forms. Find the template you need and change it using powerful tools.

What is PA NBR-I?

PA NBR-I is a form used in Pennsylvania for the purpose of reporting the financial and operational status of certain regulated businesses.

Who is required to file PA NBR-I?

Entities engaged in activities regulated by the Pennsylvania Public Utility Commission or those that provide certain services are required to file PA NBR-I.

How to fill out PA NBR-I?

To fill out PA NBR-I, businesses must provide accurate financial details, operational information, and ensure that all required sections are completed before submission.

What is the purpose of PA NBR-I?

The purpose of PA NBR-I is to provide regulatory authorities with necessary information to oversee and ensure compliance within the industry.

What information must be reported on PA NBR-I?

PA NBR-I must report information such as financial statements, operational metrics, contact details, and any additional data required by the regulatory agency.

Fill out your PA NBR-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA NBR-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.