Get the free Qwealth Superannuation Master Trust

Show details

Transfer request authority Wealth Superannuation Master Trust March 2016 Oasis Fund Management Limited (Trustee) ABN: 38 106 045 050, ADSL: 274331, RSE License: L0001755 Client Services Oasis Superannuation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign qwealth superannuation master trust

Edit your qwealth superannuation master trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your qwealth superannuation master trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit qwealth superannuation master trust online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit qwealth superannuation master trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out qwealth superannuation master trust

How to fill out qwealth superannuation master trust:

01

Gather all necessary information: Before filling out the qwealth superannuation master trust, collect all the required documents such as identification proof, financial information, and any other relevant records.

02

Understand the form: Familiarize yourself with the form's structure and sections. Read through the instructions carefully to ensure you comprehend the information required for each section.

03

Provide personal information: Start by filling in your personal details, including your full name, date of birth, contact information, and address. Ensure that all the information provided is accurate and up to date.

04

Employment details: If you are currently employed, provide information about your job, including the employer's name, contact information, and your job title. If you are self-employed or retired, mention your status accordingly.

05

Nomination of beneficiaries: In this section, indicate who you would like to receive your superannuation benefits in the event of your death. Provide the full names of the beneficiaries, their relationship to you, and their contact details.

06

Investment preferences: Specify your investment preferences for your superannuation funds. It may include choosing between conservative, balanced, or growth investment options. Consult with a financial advisor if you are unsure which option suits your needs.

07

Insurance coverage: Indicate whether you want to opt for insurance coverage within the superannuation master trust. This may include life insurance, total and permanent disability insurance, or income protection insurance. Carefully review the options available and select the coverage that best aligns with your requirements.

08

Review and submit: Before submitting the form, ensure that you have accurately completed all the sections. Double-check for any errors or missing information. Once satisfied, sign and date the form, and submit it according to the instructions provided.

Who needs qwealth superannuation master trust?

01

Individuals seeking to secure their retirement funds: The qwealth superannuation master trust is ideal for individuals who want to plan and manage their retirement savings effectively. It provides a range of investment options and insurance coverage, ensuring financial security during retirement.

02

Employees looking to consolidate their superannuation: If you have changed jobs throughout your career and accumulated multiple superannuation accounts, the qwealth superannuation master trust can help you consolidate these funds into a single, easily manageable account.

03

Self-employed individuals: Freelancers, contractors, and small business owners can also benefit from the qwealth superannuation master trust. It offers a range of investment options tailored to suit the needs and risk tolerance of self-employed individuals.

04

Anyone interested in maximizing their superannuation benefits: By opting for qwealth superannuation master trust, individuals can take advantage of various investment strategies and options, potentially maximizing their superannuation returns over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is qwealth superannuation master trust?

Qwealth superannuation master trust is a trust established to provide superannuation benefits to its members.

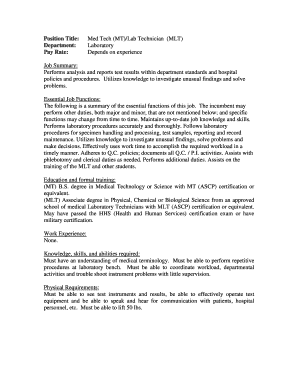

Who is required to file qwealth superannuation master trust?

Employers and trustees of the qwealth superannuation master trust are required to file the necessary documents.

How to fill out qwealth superannuation master trust?

Qwealth superannuation master trust forms can be filled out online or submitted in physical copies with the required information.

What is the purpose of qwealth superannuation master trust?

The purpose of qwealth superannuation master trust is to manage and invest funds for the retirement benefits of its members.

What information must be reported on qwealth superannuation master trust?

Required information includes contributions, investments, beneficiaries, and financial transactions of the trust.

How do I fill out the qwealth superannuation master trust form on my smartphone?

Use the pdfFiller mobile app to complete and sign qwealth superannuation master trust on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit qwealth superannuation master trust on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share qwealth superannuation master trust from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit qwealth superannuation master trust on an Android device?

With the pdfFiller Android app, you can edit, sign, and share qwealth superannuation master trust on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your qwealth superannuation master trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Qwealth Superannuation Master Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.