Get the free Lump sum contributions - Form 13 - Vision Super

Show details

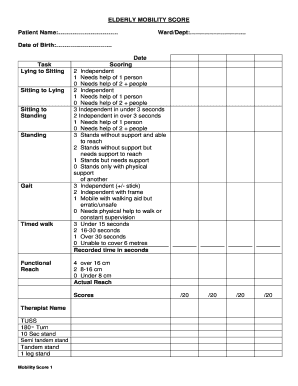

FORM 13 Lump sum member contribution form Page 1 of 1 1. Personal details Member number: Title: Mr Mrs Miss Ms Other Surname: Given name/s: Date of birth: Address: Suburb: State Postcode Contact email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lump sum contributions

Edit your lump sum contributions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lump sum contributions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lump sum contributions online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit lump sum contributions. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lump sum contributions

How to fill out lump sum contributions:

01

Gather necessary information: Before filling out lump sum contributions, gather all the required information including your personal details, employer information, and any relevant financial statements.

02

Understand the contribution limits: Familiarize yourself with the contribution limits set by the government or your pension plan. Make sure you do not exceed the maximum allowable contribution amount.

03

Determine your eligibility: Verify if you are eligible to make lump sum contributions. Some pension plans or retirement accounts may have specific criteria or restrictions.

04

Choose the appropriate form: Obtain the correct form for making lump sum contributions. This form can typically be obtained from your employer or the institution managing your retirement account.

05

Fill out personal details: Begin by providing your personal information such as your name, address, Social Security number, and date of birth. Accuracy is essential to ensure your contributions are properly attributed.

06

Provide employment information: Fill in any required details relating to your employment, including the name and address of your employer, as well as your job title or position.

07

Specify contribution amount: Indicate the amount you want to contribute as a lump sum. Double-check this figure to ensure it aligns with your financial goals and does not exceed the allowed limits.

08

Sign and date the form: Read the instructions carefully and sign the form once you have completed all the necessary sections. Include the date on which you are submitting the form.

09

Send the form: Depending on the requirements outlined in the form's instructions, submit it electronically or mail it to the designated recipient, such as your employer or retirement account administrator.

Who needs lump sum contributions?

01

Employees with extra savings: Lump sum contributions may be suitable for employees who have surplus savings and prefer to make a one-time contribution to their pension plan or retirement account.

02

Individuals nearing retirement: Those approaching retirement may choose to make lump sum contributions as a way to boost their retirement savings in a shorter timeframe.

03

Individuals with fluctuating incomes: Self-employed individuals or those with irregular incomes may find it beneficial to make lump sum contributions during higher-income years, effectively maximizing their retirement savings in years of ample cash flow.

04

Individuals looking to maximize tax advantages: Lump sum contributions can provide potential tax benefits, making them attractive for individuals seeking to optimize their tax planning strategies.

05

Individuals looking to catch up on retirement savings: For individuals who have fallen behind on their retirement savings goals, making a lump sum contribution can be a way to catch up and bridge the gap.

Note: It is always recommended to consult with a financial advisor or retirement planning professional to determine the suitability of lump sum contributions based on your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lump sum contributions?

Lump sum contributions refer to a single payment or a one-time amount of money that is made in full instead of in increments over time.

Who is required to file lump sum contributions?

Individuals who make lump sum contributions, such as retirement plan participants or individuals making large charitable donations, may be required to report these contributions.

How to fill out lump sum contributions?

Lump sum contributions can be reported on relevant tax forms or contribution statements provided by the recipient organization. It is important to accurately report the amount and purpose of the contribution.

What is the purpose of lump sum contributions?

The purpose of lump sum contributions is to provide a convenient way for individuals to make large financial contributions in one go, rather than spreading it out over time.

What information must be reported on lump sum contributions?

Information such as the amount of the contribution, the recipient organization or individual, and the purpose of the contribution must be reported on lump sum contributions.

How do I modify my lump sum contributions in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your lump sum contributions and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit lump sum contributions online?

With pdfFiller, it's easy to make changes. Open your lump sum contributions in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete lump sum contributions on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your lump sum contributions. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your lump sum contributions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lump Sum Contributions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.