Get the free Background on: Earthquake insurance and riskIII

Show details

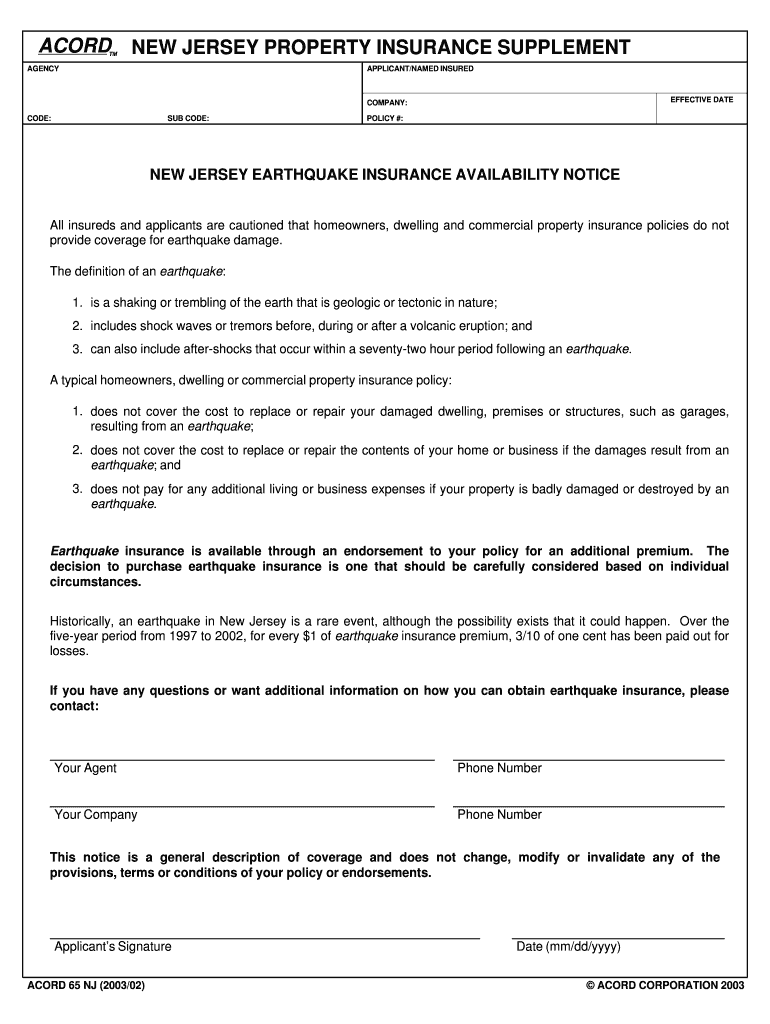

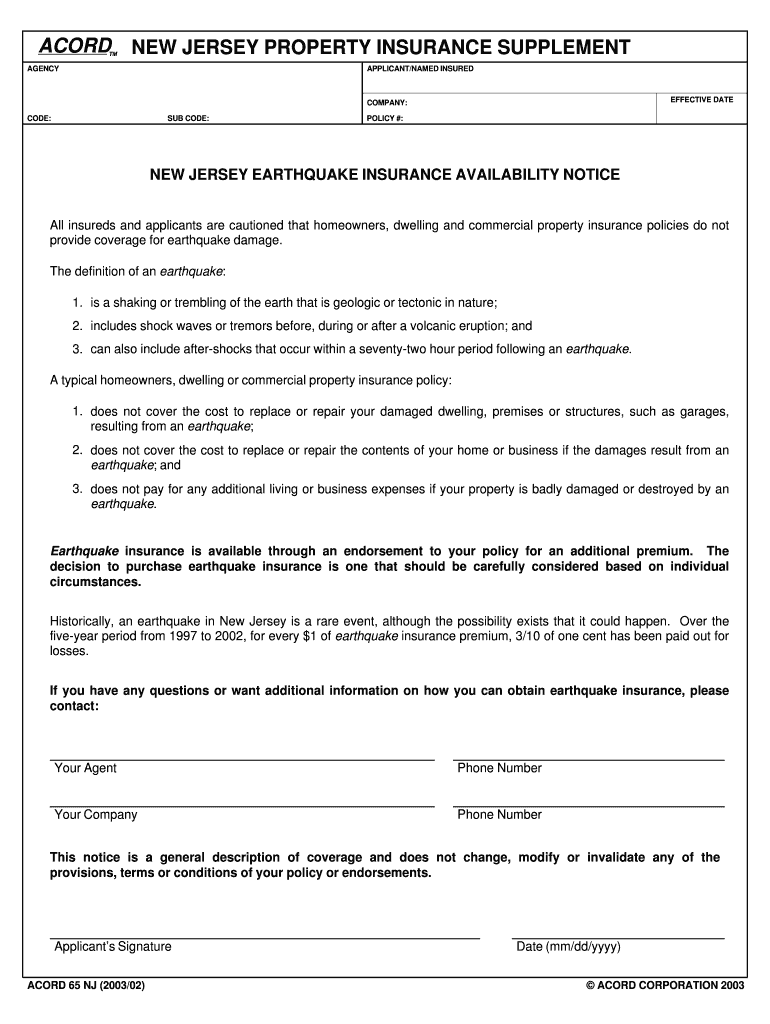

ACORDTMNEW JERSEY PROPERTY INSURANCE SUPPLEMENTAGENCYAPPLICANT/NAMED INSUREDEFFECTIVE ACCOMPANY: CODE:SUB CODE:POLICY #:NEW JERSEY EARTHQUAKE INSURANCE AVAILABILITY NOTICE All insureds and applicants

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign background on earthquake insurance

Edit your background on earthquake insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your background on earthquake insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit background on earthquake insurance online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit background on earthquake insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out background on earthquake insurance

How to fill out background on earthquake insurance:

01

Research the basics: Start by gaining a basic understanding of what earthquake insurance is and how it works. Familiarize yourself with terms such as deductibles, coverage limits, and policy exclusions.

02

Assess your risks: Evaluate the seismic activity in your area. Some regions are more prone to earthquakes than others, so it's crucial to determine the level of risk you face. You can consult official reports, geological surveys, or speak to local experts to gather this information.

03

Understand your current coverage: Review your existing homeowners or renters insurance policy to determine if it includes earthquake coverage. If it doesn't, you'll need to consider purchasing a separate earthquake insurance policy to protect yourself adequately.

04

Gather necessary information: When applying for earthquake insurance, you will likely need to provide specific details about your property, such as its age, construction type, square footage, and value. Take time to collect this information as it will be required when completing the application.

05

Contact insurance providers: Research different insurance companies that offer earthquake insurance and obtain quotes from multiple providers. Compare coverage options, premiums, deductibles, and overall reputation before selecting the most suitable insurance provider for your needs.

06

Complete the application: Once you've chosen an insurance provider, fill out the application form accurately and comprehensively. Double-check all the information you provide to avoid any errors or omissions that could impact your coverage.

07

Review policy details: Carefully read through the policy document to understand the coverage, limitations, and exclusions of your earthquake insurance policy. If you have any questions or concerns, reach out to the insurance provider for clarification before finalizing the policy.

08

Make necessary adjustments: After reviewing the policy, you may need to update certain aspects, such as coverage limits or deductibles, to align with your specific requirements. Discuss any potential modifications with the insurance provider and make adjustments accordingly.

09

Paying premiums: Determine the payment schedule for your earthquake insurance premiums. Some policies may require annual lump-sum payments, while others may offer monthly or quarterly options. Set up a payment method that works best for your financial situation.

10

Keep records: Maintain copies of your earthquake insurance policy, payment receipts, and any correspondences with the insurance provider. These records can be essential during the claims process or if you have any inquiries in the future.

Who needs background on earthquake insurance?

01

Homeowners: Individuals who own a house or condominium are typically advised to consider earthquake insurance. Your home is a significant investment, and earthquake damage can be financially devastating without appropriate coverage.

02

Renters: Even if you don't own the property you live in, earthquake insurance is still relevant to renters. While the landlord may have insurance on the building's structure, it often doesn't cover your personal belongings or provide additional living expenses in the event of an earthquake.

03

Businesses: Business owners with physical locations should also consider earthquake insurance. Just like homeowners, commercial property owners face potential financial losses due to earthquake damage. Protecting your business assets and ensuring business continuity is crucial.

04

High-risk areas: Individuals residing in regions with a high seismic activity should particularly prioritize earthquake insurance. Areas near fault lines or known earthquake-prone regions typically pose higher risks, making insurance coverage even more important.

05

Peace of mind seekers: Some individuals may choose to carry earthquake insurance simply for peace of mind. Even if you don't reside in a high-risk area, having coverage can provide reassurance knowing you are protected against an unexpected earthquake event.

Overall, earthquake insurance is essential for those who want to safeguard their assets, protect their financial stability, and ensure they can recover and rebuild in the wake of an earthquake.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in background on earthquake insurance?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your background on earthquake insurance to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out the background on earthquake insurance form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign background on earthquake insurance and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out background on earthquake insurance on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your background on earthquake insurance by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is background on earthquake insurance?

Background on earthquake insurance typically refers to information related to the property being insured, the history of earthquakes in the region, and any previous insurance claims or coverage for earthquakes.

Who is required to file background on earthquake insurance?

Property owners or individuals seeking earthquake insurance coverage may be required to fill out background information on earthquake insurance.

How to fill out background on earthquake insurance?

To fill out background on earthquake insurance, individuals will typically need to provide information about the property being insured, any previous earthquake insurance coverage, and any relevant claims history.

What is the purpose of background on earthquake insurance?

The purpose of background on earthquake insurance is to assess the risk associated with providing coverage for earthquakes and to determine the appropriate coverage and premiums.

What information must be reported on background on earthquake insurance?

Information that may need to be reported on background on earthquake insurance includes property details, earthquake history in the region, previous insurance coverage, and claims history.

Fill out your background on earthquake insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Background On Earthquake Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.