Get the free performance bank guarantee

Show details

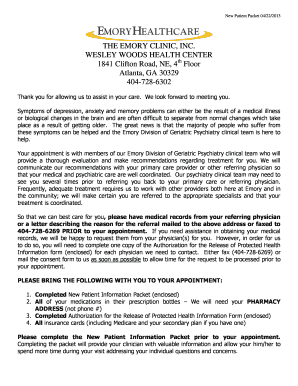

Appendix A3 Performance Bank Guarantee (BANK GUARANTEE FORMAT) Date Beneficiary: NATIONAL PAYMENTS CORPORATION OF INDIA 1001A, B wing 10th Floor, The Capital, BandraKurla Complex, Sandra (East), Mumbai

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign performance bank guarantee

Edit your performance bank guarantee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your performance bank guarantee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit performance bank guarantee online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit performance bank guarantee. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out performance bank guarantee

How to fill out performance bank guarantee:

01

Obtain the necessary forms: Contact the bank or financial institution that issued the performance bank guarantee and request the required forms for filling it out. These forms may also be available online.

02

Provide the required information: Fill out the forms with accurate and complete information. This typically includes details such as the name and address of the beneficiary, the amount of the guarantee, the purpose of the guarantee, and the duration of the guarantee.

03

Include supporting documentation: Attach any supporting documentation that may be required, such as contracts, agreements, or project specifications. These documents help validate the need for the performance bank guarantee and provide additional context.

04

Submit the forms: Once the forms are filled out and the supporting documentation is attached, submit the completed package to the bank or financial institution. This can usually be done in person or through electronic means as specified by the institution.

Who needs performance bank guarantee:

01

Contractors: Performance bank guarantees are often required by contractors as a commitment to complete a project according to the agreed terms and specifications. It provides assurance to the client that the contractor will fulfill their obligations.

02

Suppliers: Suppliers may require a performance bank guarantee to ensure that they are protected in case the buyer fails to make the payment or meet their contractual obligations. It acts as a safeguard in case of non-performance or breach of contract.

03

Government entities: Public sector projects often require performance bank guarantees to ensure that contractors or private entities fulfill their contractual obligations. It helps mitigate the risks associated with project delays or non-compliance.

In summary, filling out a performance bank guarantee involves obtaining the necessary forms, providing accurate information, including supporting documentation, and submitting the completed package to the issuing bank. Performance bank guarantees are commonly required by contractors, suppliers, and government entities to protect against non-performance or breach of contract.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between bank guarantee and performance bank guarantee?

The most common types of bank guarantees Advance payment guarantee: secures the buyer a refund of the advance payment if the merchandise is not delivered as per the contract. Performance guarantee: secures the seller's contractual obligations towards the buyer.

What is the period of performance bank guarantee?

Usually, the limitation period for Bank Guarantees in India is 12 months over an above Expiry date of bank Guarantee If a claim is not filed on a Bank Guarantee within this period, it expires. A Bank Guarantee expires under one of the following conditions: It is not invoked within the validity Period of guarantee.

What is the difference between a bank guarantee and a performance guarantee?

The most common types of bank guarantees Advance payment guarantee: secures the buyer a refund of the advance payment if the merchandise is not delivered as per the contract. Performance guarantee: secures the seller's contractual obligations towards the buyer.

Which is a performance guarantee?

A performance guarantee is an enforceable commitment by a corporate entity to supply the necessary resources to a prospective contractor and to assume all contractual obligations of the prospective contractor.

What are the three 3 types of guarantees?

Retrospective guarantee – It is a guarantee issued when the debt is already outstanding. Prospective guarantee – Given in regard to a future debt. Specific guarantee – Also known as a simple guarantee, it's a type that is used when dealing with a single transaction, and therefore a single debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute performance bank guarantee online?

Easy online performance bank guarantee completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in performance bank guarantee?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your performance bank guarantee to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit performance bank guarantee on an iOS device?

Create, edit, and share performance bank guarantee from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is performance bank guarantee?

A performance bank guarantee is a type of financial guarantee provided by a bank to ensure that a contractor or supplier fulfills their contractual obligations. It serves as security to the beneficiary in case the principal fails to complete the project or adhere to the terms of the contract.

Who is required to file performance bank guarantee?

Typically, contractors, suppliers, or service providers who are awarded contracts are required to file a performance bank guarantee. This requirement is often stipulated in the contract to ensure that the obligations will be met.

How to fill out performance bank guarantee?

To fill out a performance bank guarantee, the applicant must provide details such as the name of the guarantor (bank), the beneficiary (party receiving the guarantee), the principal's name (the party whose performance is being guaranteed), the contract details, the guarantee amount, and the validity period of the guarantee.

What is the purpose of performance bank guarantee?

The purpose of a performance bank guarantee is to provide assurance to the project owner or beneficiary that the contractor will perform their duties as per the contractual obligations. If the contractor defaults, the beneficiary can claim the amount specified in the guarantee.

What information must be reported on performance bank guarantee?

The information that must be reported on a performance bank guarantee includes the names of the parties involved, the contract reference, the guarantee amount, the expiration date, terms of the guarantee, and any conditions under which the guarantee can be invoked.

Fill out your performance bank guarantee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Performance Bank Guarantee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.