Get the free General Mortgage Knowledge Study GuidePDF

Show details

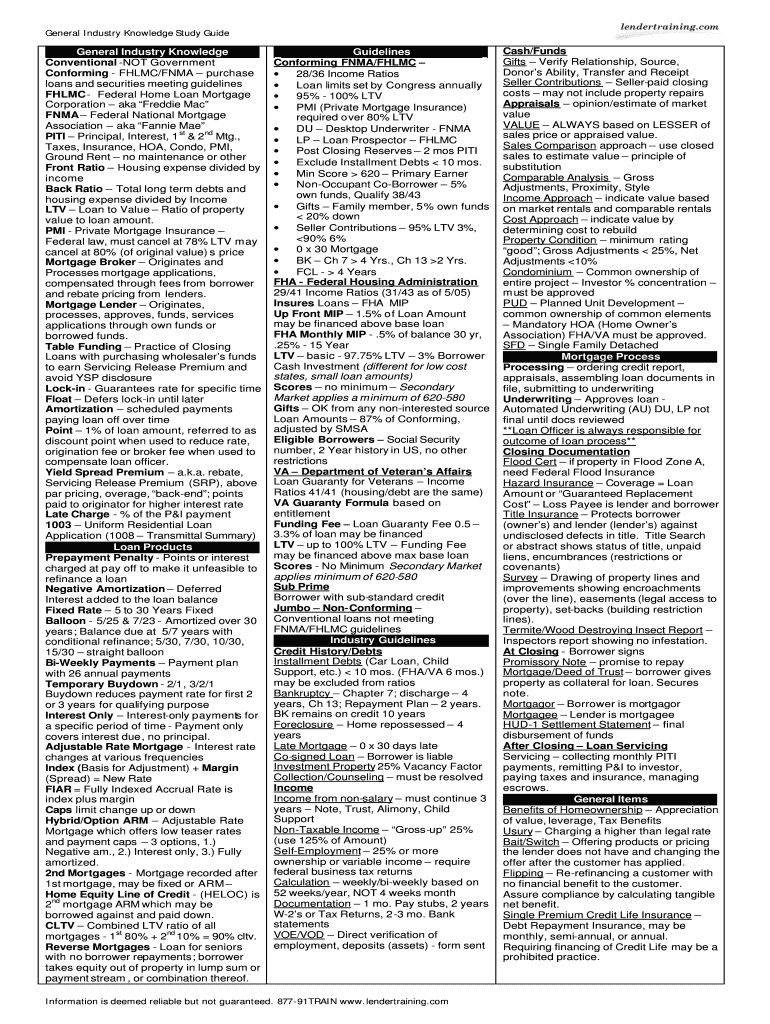

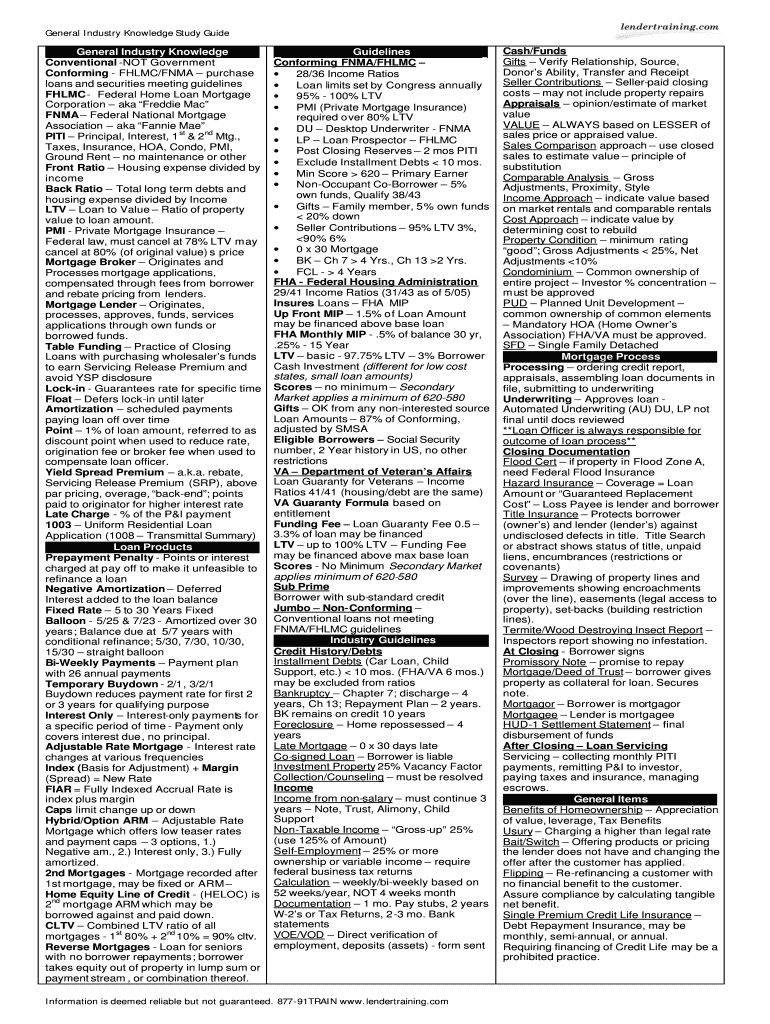

General Industry Knowledge Study Guide General Industry Knowledge Conventional NOT Government Conforming FILM/FNMA purchase loans and securities meeting guidelines FILM Federal Home Loan Mortgage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general mortgage knowledge study

Edit your general mortgage knowledge study form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general mortgage knowledge study form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general mortgage knowledge study online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit general mortgage knowledge study. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general mortgage knowledge study

How to fill out a general mortgage knowledge study:

01

Start by gathering relevant resources such as books, online articles, and study guides on mortgage topics.

02

Create a study plan to organize your learning process. Break down the topics into manageable sections and allocate specific time each day or week to study them.

03

Begin by understanding the basics of mortgages, including terms such as interest rates, loan types, and repayment options.

04

Dive deeper into mortgage-related concepts such as credit scores, loan-to-value ratios, and down payments.

05

Familiarize yourself with the mortgage application process, including the necessary documents, eligibility criteria, and steps involved.

06

Learn about the different types of mortgage lenders, such as banks, credit unions, and mortgage brokers, and understand their roles in the mortgage industry.

07

Explore the various government-backed mortgage programs available, such as FHA loans, VA loans, and USDA loans, and understand the eligibility requirements and benefits of each.

08

Study the role of mortgage insurance and understand when it's required and how it affects the overall cost of a mortgage.

09

Learn about mortgage refinancing options, including when and how to refinance a mortgage for potential cost savings or better loan terms.

10

Practice solving mortgage-related calculations, such as loan amortization, interest calculations, and affordability assessments.

11

Stay updated with current mortgage market trends, interest rates, and industry news by following reputable sources or attending relevant seminars and webinars.

12

Review and reinforce your knowledge by taking practice quizzes and mock exams to assess your understanding of the topics covered.

13

Seek guidance from industry professionals or certified mortgage advisors to clarify any doubts or questions you may have during your study.

14

Gradually build your knowledge and understanding of mortgages by consistently reviewing and revisiting the topics covered in your study plan.

Who needs general mortgage knowledge study?

01

Homebuyers: Individuals planning to purchase a property or obtain a mortgage can benefit from understanding the mortgage process, eligibility requirements, and how mortgages work.

02

Current homeowners: Homeowners looking to refinance their mortgage or explore other mortgage options can benefit from understanding mortgage terms, interest rates, and the refinancing process.

03

Real estate professionals: Professionals working in the real estate industry, such as real estate agents or brokers, can enhance their expertise and better assist their clients by having a solid understanding of general mortgage knowledge.

04

Mortgage professionals: Individuals working in the mortgage industry, such as loan officers, underwriters, or processors, need a comprehensive understanding of mortgage concepts to effectively serve their clients and perform their jobs efficiently.

05

Financial professionals: Financial advisors, accountants, and other financial professionals who work closely with clients' financial goals and investments can benefit from understanding mortgages as a part of their overall financial planning.

06

Students or researchers: Individuals studying finance, economics, or related fields can gain valuable insights by understanding general mortgage knowledge as it plays a significant role in the economy and financial markets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send general mortgage knowledge study for eSignature?

When you're ready to share your general mortgage knowledge study, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the general mortgage knowledge study in Gmail?

Create your eSignature using pdfFiller and then eSign your general mortgage knowledge study immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit general mortgage knowledge study on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute general mortgage knowledge study from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is general mortgage knowledge study?

General mortgage knowledge study is a comprehensive examination of the mortgage industry, regulations, policies, and practices.

Who is required to file general mortgage knowledge study?

Mortgage professionals, including loan officers, brokers, and lenders, are required to file general mortgage knowledge study.

How to fill out general mortgage knowledge study?

General mortgage knowledge study can be filled out online or through a paper form provided by the relevant regulatory body.

What is the purpose of general mortgage knowledge study?

The purpose of general mortgage knowledge study is to ensure that mortgage professionals have a thorough understanding of the industry and current regulations.

What information must be reported on general mortgage knowledge study?

General mortgage knowledge study typically requires information on the individual's education, training, work experience, and adherence to industry guidelines.

Fill out your general mortgage knowledge study online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Mortgage Knowledge Study is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.