Get the free gctsd - gctsd k12 ar

Show details

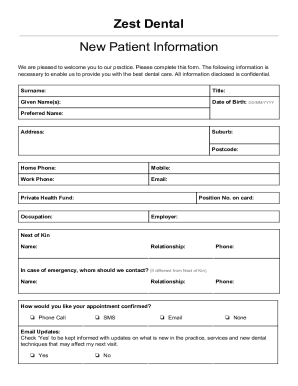

5413 W. Kings highway, Paragould, Arkansas 72450 (870) 2362762 Phone (870) 2367333 Fax APPLICATION FOR EMPLOYMENT CERTIFIED STAFF Name Present Address: Phone (Street City/State/Zip Present Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gctsd - gctsd k12

Edit your gctsd - gctsd k12 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gctsd - gctsd k12 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gctsd - gctsd k12 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gctsd - gctsd k12. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gctsd - gctsd k12

How to fill out GCTSD:

01

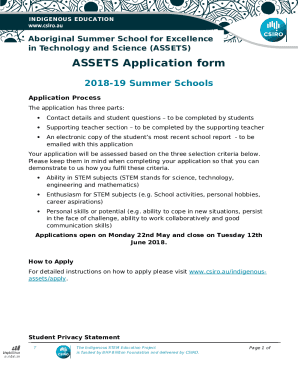

Start by obtaining a copy of the GCTSD form. This can typically be found online on the official website of the organization or agency requiring the form.

02

Carefully read the instructions provided with the form. This will give you a clear understanding of what information needs to be included and how to accurately complete the form.

03

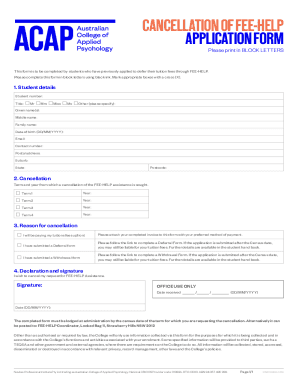

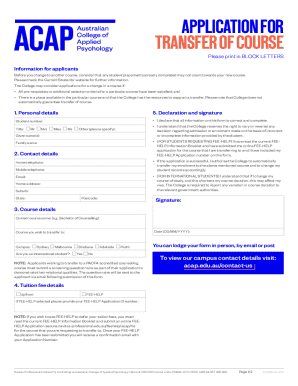

Begin by filling out personal information such as your full name, address, contact information, and any other details required.

04

Move on to the specific sections of the form, filling out the requested information in each. This may include details about your employment status, income, tax deductions, and other relevant data.

05

Be sure to double-check all the information you have entered for accuracy and completeness. Mistakes or missing information may result in delay or rejection of your application.

06

Once you have completed all the sections and reviewed your responses, sign and date the form as required.

07

Submit the filled-out GCTSD form according to the instructions provided. This may involve mailing it to a specific address, submitting it in person, or submitting it online if applicable.

Who needs GCTSD:

01

Individuals who are employed and have multiple sources of income may need to fill out the GCTSD form. This includes individuals who work multiple jobs, freelancers, or those who earn income from investments or rental properties.

02

Self-employed individuals, including sole proprietors, freelancers, and independent contractors, may also need to complete the GCTSD form to report their income and expenses.

03

Individuals who have certain deductions or credits, such as education expenses, child support payments, or healthcare expenses, may also be required to fill out the GCTSD form to claim these benefits.

Overall, the GCTSD form is necessary for individuals who have complex tax situations and need to accurately report their income, deductions, and credits to comply with tax regulations. It is important to carefully follow the instructions and fill out the form accurately to ensure compliance and avoid any potential penalties or audits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gctsd - gctsd k12 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including gctsd - gctsd k12, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit gctsd - gctsd k12 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing gctsd - gctsd k12 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out gctsd - gctsd k12 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign gctsd - gctsd k12 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is gctsd?

GCTSD stands for Global Country-by-Country Reporting which is a requirement established by the OECD for multinational enterprises to report their financial and tax information on a country-by-country basis.

Who is required to file gctsd?

Multinational enterprises with consolidated group revenue exceeding a certain threshold are required to file GCTSD.

How to fill out gctsd?

GCTSD can be filled out electronically through the designated tax authorities' portal or platform following the specific guidelines provided.

What is the purpose of gctsd?

The purpose of GCTSD is to enhance transparency in international tax matters by providing tax authorities with important information on the global allocation of the income, taxes paid, and economic activity of multinational enterprises.

What information must be reported on gctsd?

GCTSD requires reporting on the group's revenue, profit (loss) before income tax, income tax paid and accrued, stated capital, accumulated earnings, number of employees, and tangible assets other than cash and cash equivalents for each tax jurisdiction where the group operates.

Fill out your gctsd - gctsd k12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gctsd - Gctsd k12 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.