Get the free Reason For Receipts - MyKairos - mykairos

Show details

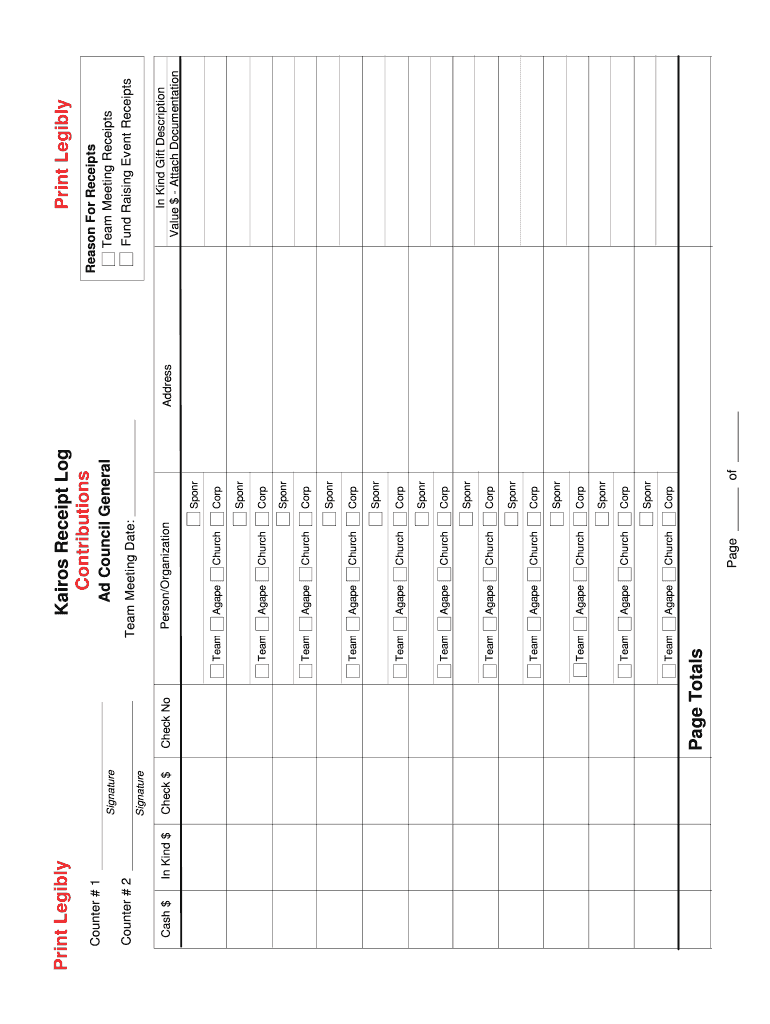

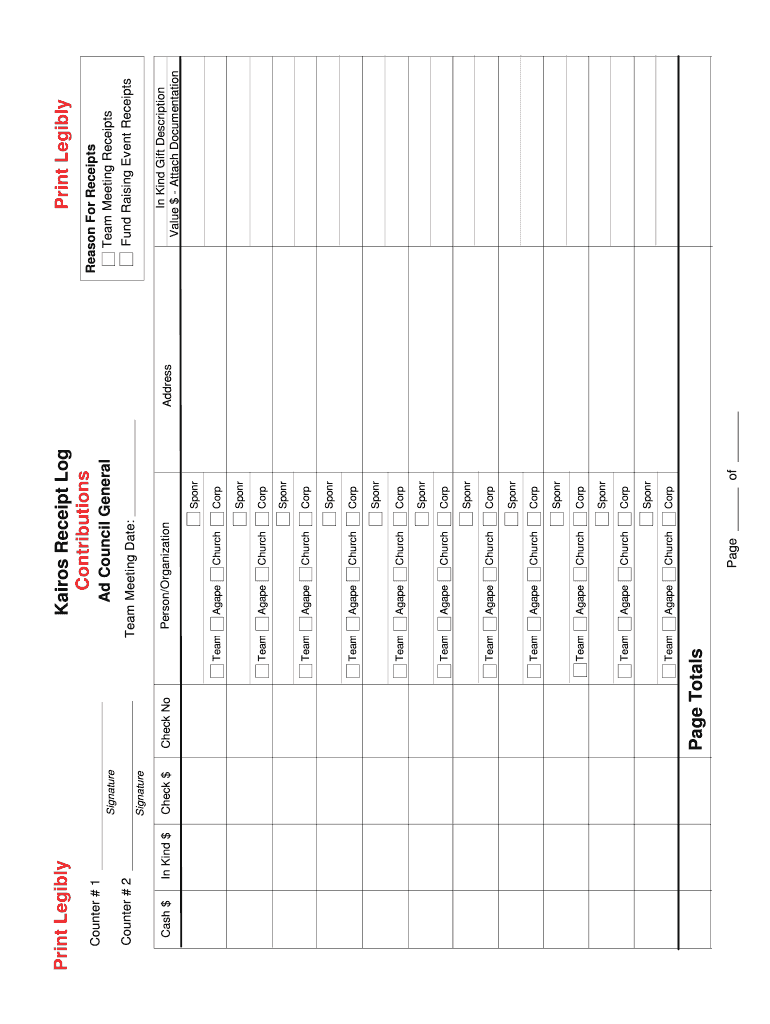

Reason For Receipts Church Team Corp Kearns Receipt Log Agape Print Legibly Team Meeting Receipts Print Legibly Ad Council General Counter # 1 Contributions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reason for receipts

Edit your reason for receipts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reason for receipts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reason for receipts online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit reason for receipts. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reason for receipts

How to fill out reason for receipts:

01

Start by identifying the purpose of the expense: Before filling out the reason for receipts, determine why you made the purchase or incurred the expense. Was it for business purposes, personal use, or something else?

02

Be specific and detailed: When filling out the reason for receipts, it's important to provide a clear and concise explanation. Avoid using generic terms such as "miscellaneous" or "other." Instead, provide specific details like the name of the client or project, the nature of the expense, or any relevant information that helps to justify the expenditure.

03

Use a consistent format: If your organization or financial system requires a specific format for filling out the reason for receipts, make sure to follow that format consistently. This can include using a certain number of characters or adhering to specific categories or labels.

04

Keep supporting documentation: In addition to filling out the reason for receipts, it is essential to keep any supporting documentation that can validate the expense. This may include invoices, receipts, contracts, or any other relevant paperwork. This documentation can be important for audits or financial reconciliation purposes.

Who needs reason for receipts?

01

Businesses and professionals: Businesses of all sizes, as well as self-employed professionals, often require reasons for receipts for accounting and tax purposes. Having a detailed and accurate reason for each expense can help track and categorize expenditures, reconcile financial statements, and ensure compliance with tax regulations.

02

Organizations and non-profits: Non-profit organizations, charities, and other entities that rely on funding or grants often need to provide reasons for receipts. This is important to demonstrate how the funds were utilized and ensure accountability and transparency to donors or grant providers.

03

Individuals for reimbursement: In some cases, individuals may need to provide reasons for receipts to be reimbursed for expenses incurred on behalf of an employer, organization, or client. This helps the reimbursement process by providing justification and ensuring that the correct expenses are reimbursed.

In conclusion, filling out the reason for receipts requires attention to detail, clear and concise explanations, and the ability to provide supporting documentation when necessary. It is essential for businesses, professionals, organizations, non-profits, and individuals who need to track, justify, or reimburse expenses accurately.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit reason for receipts online?

With pdfFiller, it's easy to make changes. Open your reason for receipts in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out reason for receipts using my mobile device?

Use the pdfFiller mobile app to fill out and sign reason for receipts on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit reason for receipts on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute reason for receipts from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is reason for receipts?

The reason for receipts is to keep track of financial transactions and provide proof of purchase or payment.

Who is required to file reason for receipts?

Any individual or business who wants to maintain a record of their financial transactions should file reason for receipts.

How to fill out reason for receipts?

Reason for receipts can be filled out manually or electronically, depending on the preference of the individual or business. It should include details such as date, amount, description of transaction, and payment method.

What is the purpose of reason for receipts?

The purpose of reason for receipts is to track expenses, monitor financial health, and provide documentation for tax purposes.

What information must be reported on reason for receipts?

Information that must be reported on reason for receipts includes date of transaction, amount, description of goods or services purchased, and payment method.

Fill out your reason for receipts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reason For Receipts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.