Get the free Risk Management for Executors and

Show details

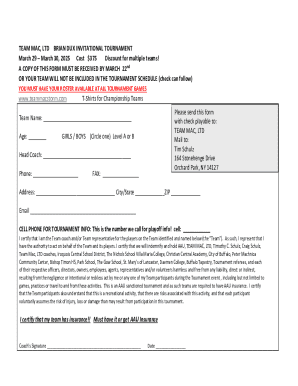

Seminar Vancouver Branch Presents: Risk Management for Executors and Trustees: Considerations for Planning Registration: 2:00 pm Seminar: 2:30 pm 5:00 pm Thursday, Oct 3, 2013 Speakers: Roger Lee,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk management for executors

Edit your risk management for executors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk management for executors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit risk management for executors online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit risk management for executors. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk management for executors

Point by point, here is how to fill out risk management for executors:

01

Start by identifying potential risks: As an executor, it is essential to identify and understand the potential risks that may arise during the execution of your duties. These risks can include legal liabilities, financial risks, disputes among beneficiaries, and unforeseen events that may impact the management of the estate.

02

Assess the likelihood and impact: After identifying the risks, assess their likelihood of occurring and determine the potential impact they might have on the estate and its beneficiaries. This step will help you prioritize your risk management efforts and allocate resources accordingly.

03

Develop a risk mitigation strategy: Once you have assessed the risks, you need to develop a comprehensive strategy to mitigate them. This could involve implementing preventive measures, creating contingency plans, and establishing protocols to minimize the impact of potential risks.

04

Monitor and review: Risk management is an ongoing process, so it's crucial to continuously monitor and review the effectiveness of your risk mitigation strategies. Regularly assess the changing circumstances that could affect the estate and make adjustments to your risk management plan accordingly.

05

Involve professionals when necessary: Depending on the complexity and size of the estate, it may be beneficial to seek advice from legal, financial, or other professionals to help you navigate through potential risks and ensure proper risk management.

As for who needs risk management for executors:

Executors of estate: The primary individuals who need risk management for executors are the executors themselves. They hold legal and fiduciary responsibilities and face potential risks associated with the management and distribution of an estate. By implementing effective risk management, executors can protect themselves and fulfill their duties more efficiently.

Beneficiaries: While beneficiaries are not directly responsible for risk management, they have a vested interest in ensuring that the estate is properly managed. Risk management helps minimize the likelihood of disputes among beneficiaries and ensures a fair and smooth distribution of assets.

Legal and financial advisors: Legal and financial advisors who assist with estate planning and administration can also benefit from risk management for executors. By understanding potential risks and assisting with risk mitigation strategies, these professionals can provide valuable guidance and support to the executors.

Ultimately, risk management for executors is essential for all parties involved in the estate administration process to ensure a successful and secure transfer of assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my risk management for executors in Gmail?

risk management for executors and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit risk management for executors straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing risk management for executors, you can start right away.

How do I fill out risk management for executors on an Android device?

On an Android device, use the pdfFiller mobile app to finish your risk management for executors. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is risk management for executors?

Risk management for executors involves identifying, assessing, and prioritizing risks that may affect the successful administration of an estate.

Who is required to file risk management for executors?

Executors or administrators of an estate are required to file risk management reports.

How to fill out risk management for executors?

Risk management for executors can be filled out by documenting potential risks, evaluating the likelihood and impact of each risk, and implementing measures to mitigate or manage these risks.

What is the purpose of risk management for executors?

The purpose of risk management for executors is to ensure that the estate is administered efficiently and effectively, while minimizing the impact of potential risks.

What information must be reported on risk management for executors?

Information such as potential risks to the estate, their likelihood of occurrence, their potential impact, and risk mitigation strategies must be reported on risk management for executors.

Fill out your risk management for executors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Management For Executors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.