Get the free Tax Efficient Probate Avoidance

Show details

Atlantic Branch presents: Tax Efficient Probate Avoidance Thursday, February 25, 2010, Registration 2:00 pm Seminar 2:30 pm 4:30 pm Main Venue: Stewart McKelvy, 9001959 Upper Water Street, Halifax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax efficient probate avoidance

Edit your tax efficient probate avoidance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax efficient probate avoidance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax efficient probate avoidance online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax efficient probate avoidance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax efficient probate avoidance

How to fill out tax efficient probate avoidance?

01

Determine your assets: Make a comprehensive list of all your assets, including property, investments, and valuable possessions.

02

Consult with an estate planning professional: Seek the advice of an estate planning attorney or financial advisor specialized in probate avoidance to understand the best strategy for your specific situation.

03

Consider using living trusts: Living trusts are often utilized to avoid probate as they allow assets to pass directly to beneficiaries without going through the probate process.

04

Review beneficiary designations: Ensure that beneficiary designations on your retirement accounts, life insurance policies, and other financial accounts are up to date and reflect your intended beneficiaries.

05

Update your will: If you have a will, review and update it regularly to align with your current wishes and assets. Your will can include provisions for probate avoidance strategies.

06

Explore gifting strategies: Gift assets to your beneficiaries during your lifetime to minimize the value of your estate subject to probate.

07

Review joint ownership: Consider joint ownership of assets with rights of survivorship, such as joint bank accounts or joint tenancy in real estate, as this can ensure the seamless transfer of assets outside of probate.

Who needs tax efficient probate avoidance?

01

Individuals with significant assets: If you have substantial wealth or valuable assets, it is essential to consider probate avoidance to minimize the potential taxes that may arise during the probate process.

02

Those with complex family situations: If you have a blended family, dependents with special needs, or complicated family dynamics, probate avoidance can help ensure that your assets are distributed according to your intentions without delays or disputes.

03

Individuals wishing to maintain privacy: Probate is a public process, meaning that the details of your assets and beneficiaries become a matter of public record. If you value privacy, utilizing probate avoidance strategies can help maintain confidentiality.

04

Individuals seeking to save time and expenses: Probate can be a lengthy and costly process, involving court fees, attorney fees, and executor fees. By avoiding probate, you can save time and reduce the financial burden on your estate.

Note: It is essential to consult with a qualified professional to understand the specific requirements and options available in your jurisdiction to ensure tax efficient probate avoidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax efficient probate avoidance online?

The editing procedure is simple with pdfFiller. Open your tax efficient probate avoidance in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out tax efficient probate avoidance using my mobile device?

Use the pdfFiller mobile app to complete and sign tax efficient probate avoidance on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I fill out tax efficient probate avoidance on an Android device?

Use the pdfFiller mobile app to complete your tax efficient probate avoidance on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is tax efficient probate avoidance?

Tax efficient probate avoidance is the process of arranging one's assets and estate in a way that minimizes the tax burden for beneficiaries after the individual's passing.

Who is required to file tax efficient probate avoidance?

Anyone who wants to ensure their assets are passed on to beneficiaries in a tax efficient manner may choose to file tax efficient probate avoidance.

How to fill out tax efficient probate avoidance?

Tax efficient probate avoidance can be filled out with the assistance of a financial advisor, estate planner, or tax professional.

What is the purpose of tax efficient probate avoidance?

The purpose of tax efficient probate avoidance is to reduce the tax liability on assets being passed to beneficiaries after the individual's passing.

What information must be reported on tax efficient probate avoidance?

Information such as assets, liabilities, beneficiaries, and tax elections must be reported on tax efficient probate avoidance forms.

Fill out your tax efficient probate avoidance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Efficient Probate Avoidance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

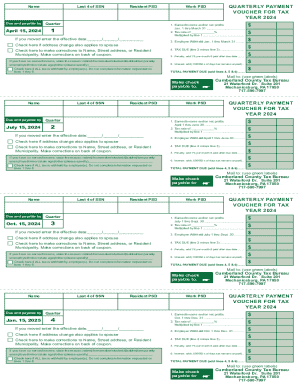

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.