Get the free Annuity Maximization

Show details

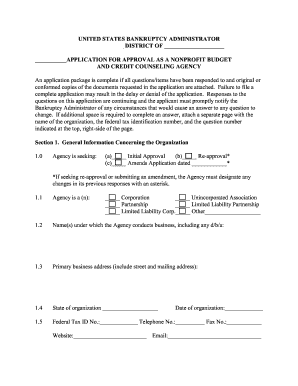

Guiding you through life. FACT FINDER WEALTH TRANSFER Advanced Markets Annuity Maximization Maximizing the Value of an Annuity By Using Life Insurance Client Information (Client A) Client Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annuity maximization

Edit your annuity maximization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity maximization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annuity maximization online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annuity maximization. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annuity maximization

How to fill out annuity maximization:

01

Evaluate your financial goals and needs: Before filling out the annuity maximization form, it is important to have a clear understanding of your financial goals and needs. Consider your current financial situation, retirement plans, and the level of income you would like to receive during your retirement years.

02

Research annuity options: Familiarize yourself with the different types of annuities available in the market. Annuities can be fixed, variable, or indexed, each with its own features and benefits. Research and compare annuities to determine which one aligns best with your financial goals.

03

Determine the annuity maximization strategy: Annuity maximization is a strategy that involves converting a non-qualified annuity to a life insurance policy to increase the death benefit for your beneficiaries. Consult with a financial advisor or insurance professional to understand if annuity maximization is the right strategy for you and how it can benefit your specific financial situation.

04

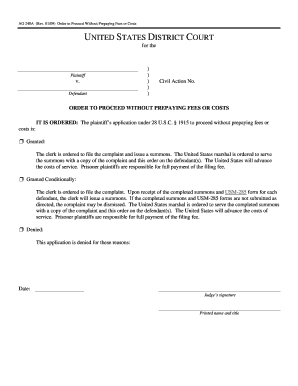

Complete the annuity maximization form: To fill out the annuity maximization form, gather all the required information, such as the details of your annuity contract, the life insurance policy you wish to purchase, and the beneficiary information. Follow the instructions on the form carefully and provide accurate information to ensure a smooth process.

05

Review and double-check the form: Once you have completed the annuity maximization form, review it thoroughly to ensure all the information is accurate and complete. Double-check the details of your annuity contract and the life insurance policy you wish to purchase to avoid any errors or discrepancies.

06

Submit the form: After reviewing and double-checking the form, submit it to the appropriate insurance company or financial institution. Follow any additional instructions provided, such as including any required supporting documents or payment for the life insurance policy.

Who needs annuity maximization?

01

Individuals with non-qualified annuities: Annuity maximization is particularly relevant for individuals who own non-qualified annuities. Non-qualified annuities are purchased using after-tax dollars and do not offer any tax advantages.

02

Those seeking to increase death benefits: If you have a non-qualified annuity and want to enhance the death benefit for your beneficiaries, annuity maximization can be a suitable strategy. By converting the annuity to a life insurance policy, you can potentially increase the amount your beneficiaries would receive upon your death.

03

Individuals concerned about income sustainability: Annuity maximization can be attractive to individuals who are concerned about the sustainability of their income during retirement. By maximizing the death benefit through life insurance, you can provide an additional source of financial support to your loved ones, ensuring they receive a certain amount even if you were to pass away.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my annuity maximization directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your annuity maximization along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit annuity maximization on an Android device?

You can edit, sign, and distribute annuity maximization on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete annuity maximization on an Android device?

Use the pdfFiller Android app to finish your annuity maximization and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is annuity maximization?

Annuity maximization is a strategy used to maximize the benefits of an annuity by taking advantage of certain tax and estate planning opportunities.

Who is required to file annuity maximization?

Individuals who hold annuities and wish to optimize their tax and estate planning may choose to file annuity maximization.

How to fill out annuity maximization?

Annuity maximization can be filled out by consulting with a financial advisor or tax professional who is familiar with the strategies involved.

What is the purpose of annuity maximization?

The purpose of annuity maximization is to maximize the benefits of an annuity for the annuitant and their beneficiaries.

What information must be reported on annuity maximization?

Annuity maximization typically requires information about the annuitant, the annuity contract, and any beneficiaries.

Fill out your annuity maximization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annuity Maximization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.