Get the free SEPARATELY MANAGED A CCOUNT ACCOUNT OPENING FORM INDIVIDUAL

Show details

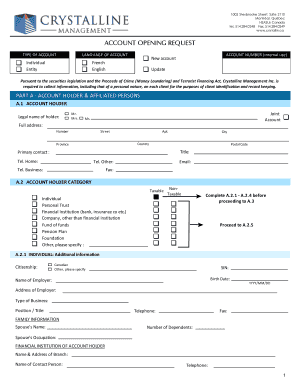

SEPARATELY MANAGED ACCOUNT OPENING FORM (INDIVIDUAL) 1. Personal Name (Title) Sex (Surname) (First Name) Date of Birth M Nationality DD F (Middle Name) MM BY Residential Address City State Country

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign separately managed a ccount

Edit your separately managed a ccount form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your separately managed a ccount form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit separately managed a ccount online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit separately managed a ccount. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out separately managed a ccount

How to fill out separately managed account:

01

Begin by gathering all the necessary information and documents needed to open a separately managed account. This could include identification documents, financial statements, and any other relevant paperwork.

02

Research and select a reputable financial institution or investment manager that offers separately managed accounts. It's important to choose someone with a proven track record and expertise in managing such accounts.

03

Arrange a meeting or consultation with the chosen financial institution or investment manager. During this meeting, discuss your investment goals, risk tolerance, and any other preferences or requirements you may have.

04

Based on your discussion and agreement with the financial institution or investment manager, they will create an investment plan tailored to your specific needs. This plan will outline the investment strategy, asset allocation, and any other relevant details.

05

Review and sign any necessary agreements or contracts provided by the financial institution or investment manager. Make sure you carefully read and understand all the terms and conditions before signing.

06

Once the paperwork is complete, you may be required to deposit funds into the separately managed account. The financial institution or investment manager will provide instructions on how to do this.

07

Monitor the performance of your separately managed account regularly. Stay in touch with your financial institution or investment manager to discuss any updates, changes, or concerns related to your account.

Who needs separately managed account:

01

High net worth individuals: Separately managed accounts are often popular among wealthy individuals who have a significant amount of investable assets. These accounts offer personalized investment management, tailored to their specific financial goals and needs.

02

Institutions: Many institutional investors, such as pension funds, endowments, or insurance companies, utilize separately managed accounts to manage their large portfolios. The customization and control offered by these accounts make them an attractive option for institutions.

03

Sophisticated investors: Some experienced investors who have a deep understanding of the financial markets may opt for separately managed accounts. These accounts provide the flexibility to implement complex investment strategies and take advantage of market opportunities.

Overall, separately managed accounts offer a high level of customization and personalized investment management, making them suitable for individuals with specific financial goals and institutions with unique investment requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit separately managed a ccount from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your separately managed a ccount into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send separately managed a ccount for eSignature?

When your separately managed a ccount is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the separately managed a ccount electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your separately managed a ccount in minutes.

What is separately managed account?

A separately managed account is a personalized investment account managed by a professional money manager or investment advisor.

Who is required to file separately managed account?

Investors who have a separately managed account are required to file it.

How to fill out separately managed account?

To fill out a separately managed account, investors need to provide details on the assets held in the account, performance data, and other required information.

What is the purpose of separately managed account?

The purpose of a separately managed account is to provide individual investors with a customized investment strategy based on their specific financial goals and risk tolerance.

What information must be reported on separately managed account?

Information such as asset holdings, transactions, performance metrics, and fees must be reported on separately managed accounts.

Fill out your separately managed a ccount online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Separately Managed A Ccount is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.