Get the free Business License Renewal Application and Business Tangible Tax Return - portsmouthva

Show details

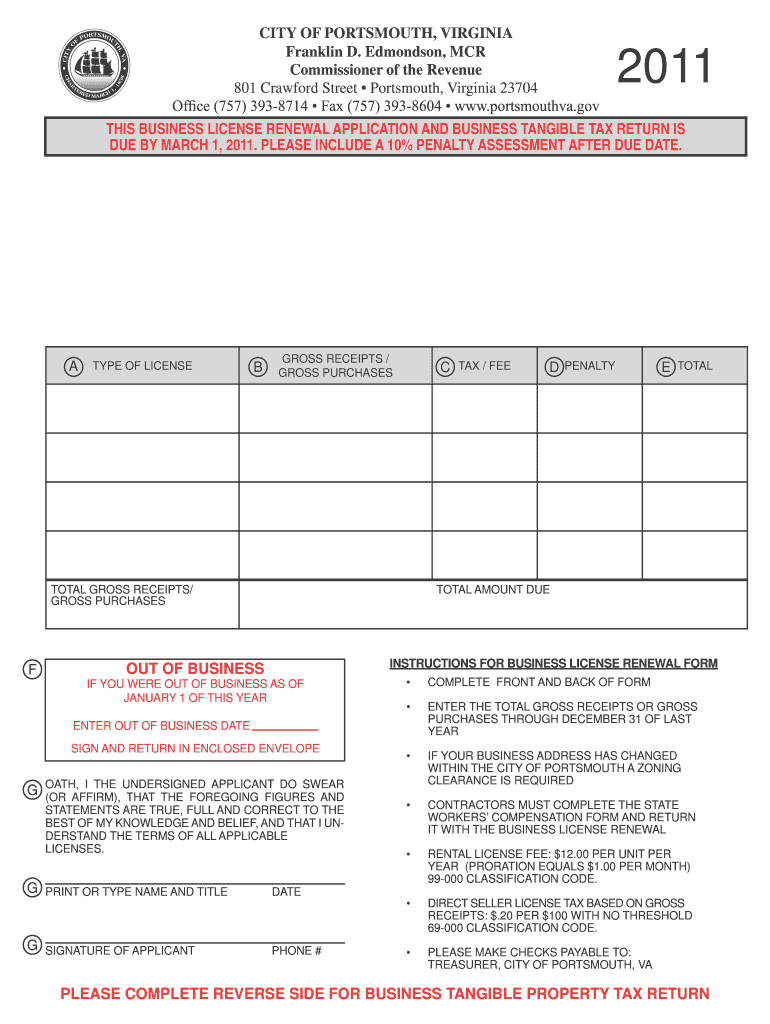

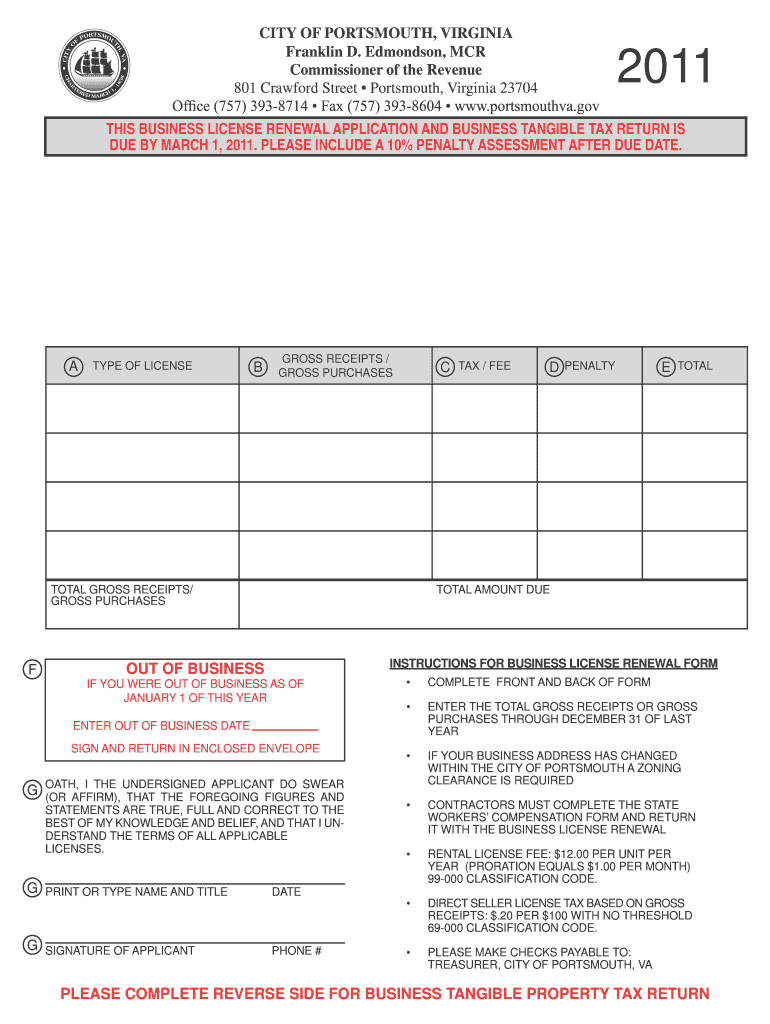

This document serves as a business license renewal application and business tangible tax return for entities operating within the City of Portsmouth, Virginia. It includes instructions for filing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business license renewal application

Edit your business license renewal application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business license renewal application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business license renewal application online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business license renewal application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business license renewal application

How to fill out Business License Renewal Application and Business Tangible Tax Return

01

Obtain the Business License Renewal Application form from your local government website or office.

02

Fill out the application form with your business name, address, and license number.

03

Provide details about the type of business activities you engage in.

04

Indicate any changes in business ownership or structure since the last renewal.

05

Calculate the total renewal fee based on your business type and size as specified in the guidelines.

06

Attach any required documentation (e.g., tax returns, proof of insurance).

07

Submit the completed application and payment by the specified deadline.

08

Obtain confirmation of your application submission and keep a copy for your records.

Who needs Business License Renewal Application and Business Tangible Tax Return?

01

All businesses operating within the jurisdiction that require a license to legally conduct their activities.

02

Businesses that have experienced changes in ownership, expansion, or a change in business activities since their last renewal.

03

Businesses subject to tangible taxes on physical assets that require the Tangible Tax Return to report and pay necessary taxes.

Fill

form

: Try Risk Free

People Also Ask about

Who needs a business license in Washington state?

Register with the Department of Revenue and get a business license if you meet any of the following conditions: Your business requires city, county, and state endorsements. You are doing business using a name other than your full name legal name. You plan to hire employees within the next 90 days.

What is the BPOL exemption in Virginia?

The Business Professional Occupational License (BPOL) Tax Exemption allows eligible new businesses with annual gross receipts of $250,000 or more to pay a $30 annual fee instead of paying BPOL tax for up to two years.

Who qualifies for property tax exemption in Virginia?

Virginia Program Overview. The Commonwealth of Virginia does not offer property tax relief programs. However, most Virginia cities, counties, and towns offer some form of personal property tax relief to homeowners age 65 and older, and to homeowners with disabilities.

What is the exemption amount in Virginia?

Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption.

Who is subject to Virginia BPOL tax?

When and How to Apply for a Business License. All business owners, including owners of home-based businesses, are subject to the BPOL tax. Business owners are required to register their business with the Department of Tax Administration (DTA) within 75 days of beginning business operations in Fairfax County.

How much is a business license in Richmond, VA?

What is the cost of a business license? Gross ReceiptsBusiness License Cost $5,000 or less $0.00 $5,001-$99,999 $30 License Fee $100,000+ Gross receipts x tax rate applicable to business type

Does Richmond, VA require a business license?

All businesses / persons conducting business of any kind in Richmond are required to have a City of Richmond Business License. Apply electronically via portal or download application to mail or fax. For information on required business licenses, view the Business License Issuing section.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business License Renewal Application and Business Tangible Tax Return?

The Business License Renewal Application is a form that businesses must submit to renew their operating license, ensuring they comply with local regulations. The Business Tangible Tax Return is a document filed by businesses to report tangible personal property owned by the business, which is subject to taxation.

Who is required to file Business License Renewal Application and Business Tangible Tax Return?

All businesses operating within the jurisdiction are typically required to file a Business License Renewal Application. Additionally, businesses that own tangible personal property, such as equipment or vehicles, are required to file a Business Tangible Tax Return.

How to fill out Business License Renewal Application and Business Tangible Tax Return?

To fill out the Business License Renewal Application, businesses need to provide basic information including their business name, address, ownership structure, and any updates since the last renewal. For the Business Tangible Tax Return, businesses must report details about their tangible personal property, including descriptions, values, and acquisition dates. Specific forms and instructions are usually provided by the local tax authority.

What is the purpose of Business License Renewal Application and Business Tangible Tax Return?

The purpose of the Business License Renewal Application is to ensure that a business is operating legally and in compliance with local laws. The Business Tangible Tax Return serves to assess and tax the tangible personal property owned by businesses, allowing local governments to collect revenues for public services.

What information must be reported on Business License Renewal Application and Business Tangible Tax Return?

The Business License Renewal Application generally requires the business name, address, contact information, ownership details, and any changes since the last submission. The Business Tangible Tax Return requires information about the types, values, and locations of tangible personal property, including equipment and inventory owned by the business.

Fill out your business license renewal application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business License Renewal Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.