Get the free Term Deposit Application - Gateway Credit Union

Show details

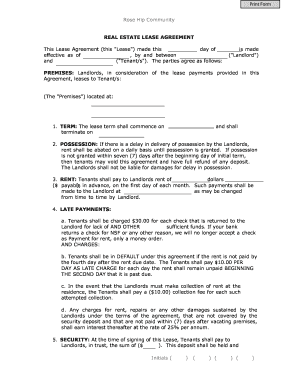

Term Deposit Application This form is for use by existing Gateway Members ONLY. To apply for Gateway Membership and open a Term Deposit Account please complete the Gateway Membership/Account Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term deposit application

Edit your term deposit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term deposit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit term deposit application online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit term deposit application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out term deposit application

Who needs term deposit application?

01

Individuals who want to earn higher interest on their savings: Term deposits are a popular choice for individuals who want to earn higher interest rates on their savings. By filling out a term deposit application, they can secure their funds for a fixed period of time and enjoy a guaranteed return on their investment.

02

Businesses looking to grow their cash reserves: Many businesses choose to invest their excess cash in term deposits to earn a steady stream of interest income. Filling out a term deposit application allows them to allocate their funds effectively and maximize their returns while keeping their money easily accessible.

03

Individuals or businesses seeking a low-risk investment option: Term deposits are considered a low-risk investment option since they offer a guaranteed return. Investors who want to avoid the volatility of the stock market or other riskier investments often opt for term deposits and can fill out an application to start securing their savings.

How to fill out a term deposit application?

01

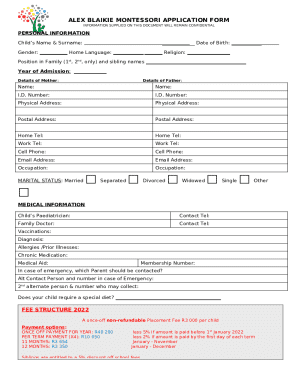

Gather the necessary documentation: Before filling out the term deposit application, you will typically need to provide identification documents such as your driver's license, passport, or social security number. Additionally, you might be asked to provide proof of address, proof of income, or any other required documentation specified by the financial institution.

02

Select the term and amount: Determine the desired term (length of time) and the amount of money you wish to invest in the term deposit. Different financial institutions offer various term lengths, so choose one that aligns with your financial goals.

03

Choose the interest payment frequency: Some term deposit options allow you to receive interest payments at regular intervals, such as monthly, quarterly, semi-annually, or annually. Select the frequency that suits your needs.

04

Decide on the maturity options: When the term deposit reaches maturity, you may have different options regarding what to do with the funds. You can choose to renew the term deposit, withdraw the principal and interest, or rollover the funds into a different investment. It is important to understand the available options and decide accordingly.

05

Read and understand the terms and conditions: Thoroughly review the terms and conditions associated with the term deposit application. Pay attention to details such as interest rates, penalties for early withdrawal, and any other clauses that may impact your investment. If you have any questions or concerns, seek clarification from the financial institution.

06

Complete the application form: Fill out the application form accurately and legibly. Provide all the necessary information requested, including personal details, contact information, investment amount, term length, and any other relevant information.

07

Submit the application: Once you have completed the application form, submit it to the financial institution either in person, through mail, or via their online banking portal. Keep a copy of the application for your records.

08

Fund the term deposit: Once your application is approved, you will typically need to transfer the funds you wish to invest in the term deposit to the financial institution. Follow the instructions provided by the institution to ensure a smooth transfer.

09

Confirmation and receipt: After the funds have been received, the financial institution will provide you with a confirmation of your term deposit, including the terms, interest rate, and maturity date. Keep this confirmation safe for future reference.

By following these steps, individuals and businesses can successfully fill out a term deposit application and secure their savings or investments in a low-risk, interest-earning account.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit term deposit application online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your term deposit application to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the term deposit application in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your term deposit application and you'll be done in minutes.

Can I create an electronic signature for signing my term deposit application in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your term deposit application right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is term deposit application?

A term deposit application is a form used to apply for a fixed-term deposit account with a bank or financial institution.

Who is required to file term deposit application?

Any individual or entity looking to open a term deposit account is required to file a term deposit application.

How to fill out term deposit application?

To fill out a term deposit application, you will need to provide personal information, select the term length and interest rate, and sign the agreement.

What is the purpose of term deposit application?

The purpose of a term deposit application is to open a fixed-term deposit account to earn interest on deposited funds.

What information must be reported on term deposit application?

Information such as personal details, contact information, deposit amount, term length, and interest rate preference must be reported on a term deposit application.

Fill out your term deposit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Deposit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.