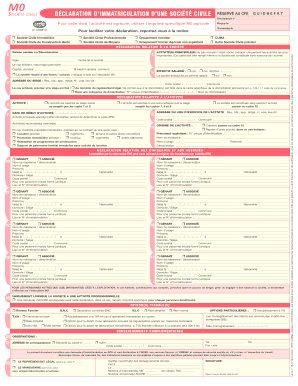

Get the free 2012 - Section 1031 Services Inc

Show details

Cost Segregation, Depreciation Recapture and 1031 and Refinancing in a 1031 Partnership Issues: Leasehold Improvement Exchanges Exchanging Multiple Properties 1031 vs. 1033 Issues Current Problems

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 - section 1031

Edit your 2012 - section 1031 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 - section 1031 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 - section 1031 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012 - section 1031. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 - section 1031

Answer point by point how to fill out 2012 - section 1031:

01

Ensure you have a complete understanding of the purpose and requirements of section 1031 of the 2012 tax code. Section 1031 allows for the tax-deferred exchange of certain properties, as long as specific criteria are met.

02

Determine if you are eligible to utilize section 1031. Generally, this section applies to individuals and businesses who own property held for productive use in a trade or business or for investment purposes. Personal residences and properties held primarily for sale do not qualify.

03

Identify the property you intend to exchange. It must be of a "like-kind" nature, which means properties used for similar purposes, such as land for land or commercial building for commercial building. Consult with a tax professional to ensure you meet the like-kind requirement.

04

Locate a qualified intermediary (QI) to assist you with the exchange process. A QI is an independent third party who facilitates the exchange and holds the proceeds from the sale of the relinquished property until the replacement property is acquired.

05

Sell your relinquished property. The sale should be structured as an exchange, and the proceeds should be transferred to the QI to avoid immediate tax liability. The sale must occur within the designated timeline specified in section 1031.

06

Identify suitable replacement property(ies) within the strict timeline outlined in section 1031. The replacement property must be of equal or greater value than the relinquished property to fully defer taxes. It's crucial to consult with a real estate professional or attorney to evaluate potential replacement properties.

07

Enter into a purchase agreement for the replacement property. Ensure that the agreement identifies the QI as the recipient of the funds held from the sale of the relinquished property.

08

Complete the necessary documentation to properly report the exchange on your tax return. This typically includes filing Form 8824, Like-Kind Exchanges, with your tax return for the year of the exchange.

Who needs 2012 - section 1031?

01

Real estate investors and business owners who own property held for productive use in a trade or business or for investment purposes may benefit from section 1031.

02

Individuals or entities looking to upgrade, diversify, or consolidate their real estate holdings may consider utilizing section 1031 to defer taxes and preserve capital.

03

Taxpayers who wish to defer capital gains taxes on the sale of property and reinvest the proceeds into another like-kind property can take advantage of the provisions outlined in section 1031.

Please note that while this answer provides a general overview, it's crucial to consult with a tax professional or attorney familiar with section 1031 and its application to your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2012 - section 1031 online?

Filling out and eSigning 2012 - section 1031 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the 2012 - section 1031 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your 2012 - section 1031.

How do I fill out the 2012 - section 1031 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 2012 - section 1031 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is section 1031 services?

Section 1031 services refer to the exchange of like-kind property that allows taxpayers to defer capital gain taxes.

Who is required to file section 1031 services?

Taxpayers who engage in like-kind exchanges of property are required to file section 1031 services.

How to fill out section 1031 services?

Section 1031 services can be filled out by including all necessary information related to the like-kind exchange of property.

What is the purpose of section 1031 services?

The purpose of section 1031 services is to allow taxpayers to defer capital gain taxes by exchanging like-kind property.

What information must be reported on section 1031 services?

Information such as the identification of properties exchanged, their values, and the timeline of the exchange must be reported on section 1031 services.

Fill out your 2012 - section 1031 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 - Section 1031 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.