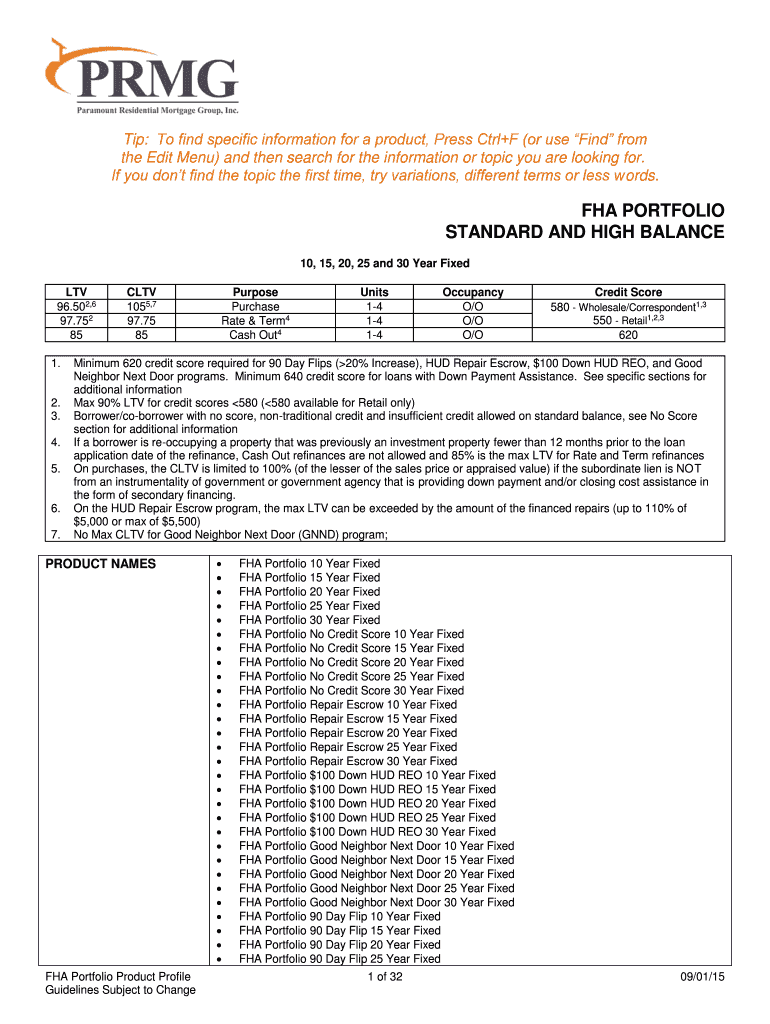

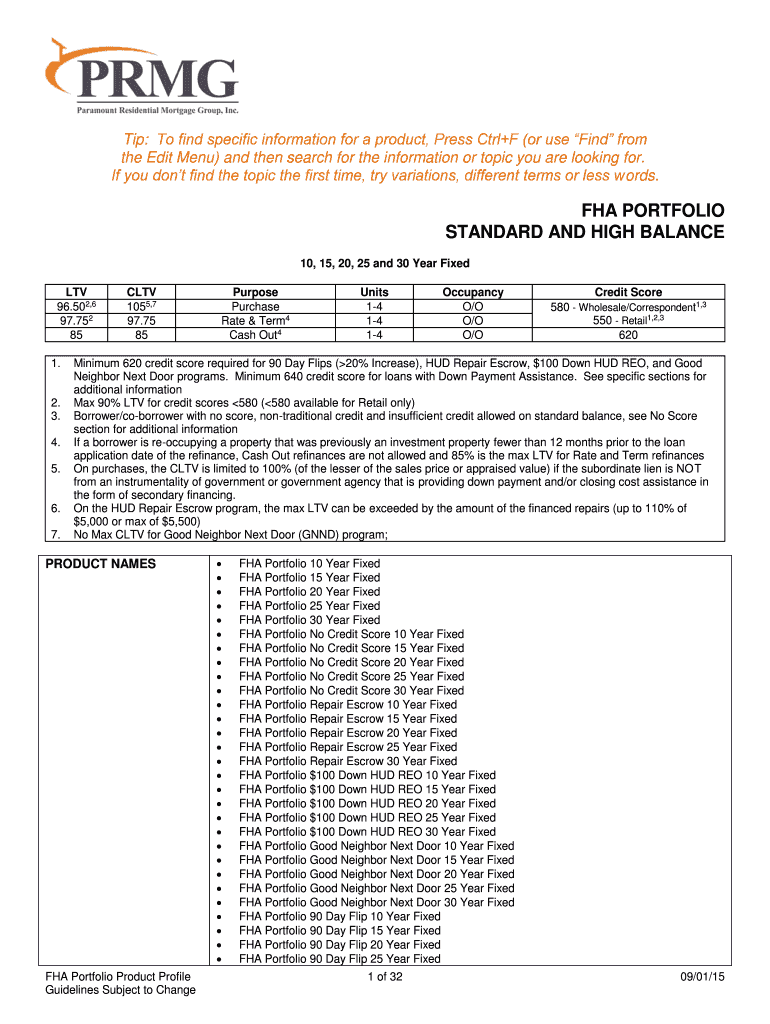

Get the free FHA PORTFOLIO STANDARD AND HIGH BALANCE - Dave Kevelighan

Show details

Tip: To find specific information for a product, Press Ctrl+F (or use Find from the Edit Menu) and then search for the information or topic you are looking for. If you don't find the topic the first

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha portfolio standard and

Edit your fha portfolio standard and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha portfolio standard and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha portfolio standard and online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fha portfolio standard and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha portfolio standard and

How to fill out FHA portfolio standard:

01

Understand the requirements: Familiarize yourself with the FHA portfolio standard guidelines to comprehend what is expected. This includes understanding the acceptable loan types, credit score requirements, and the maximum debt-to-income ratio.

02

Gather necessary documents: Collect all the required documents to fill out the FHA portfolio standard application accurately. This may include personal identification, income and asset documentation, employment history, and any other relevant financial information.

03

Complete the application: Fill out the FHA portfolio standard application accurately, providing all the required information. Double-check all the details to ensure accuracy and completeness.

04

Submit supporting documentation: Attach all the necessary supporting documents along with the application. These may include pay stubs, bank statements, tax returns, and any other documents specified in the FHA portfolio standard guidelines.

05

Consult an FHA-approved lender: If you have any doubts or questions while filling out the application, it is advisable to seek guidance from an FHA-approved lender. They can provide assistance and clarify any concerns you may have.

Who needs FHA portfolio standard:

01

Borrowers with low credit scores: The FHA portfolio standard is particularly helpful for individuals with low credit scores who may struggle to qualify for conventional loans. FHA loans cater to borrowers with less-than-perfect credit and offer more flexible approval criteria.

02

First-time homebuyers: FHA loans are popular among first-time homebuyers due to their lenient credit requirements and lower down payment options. This helps individuals who may not have a substantial savings account but wish to enter the housing market.

03

Homeowners looking for refinancing options: FHA portfolio standard can also be utilized by existing homeowners who want to refinance their current mortgages. By opting for FHA refinancing, borrowers may be able to secure better interest rates or extend the loan term to reduce monthly payments.

In summary, anyone who meets the specific criteria set by the FHA portfolio standard guidelines, including borrowers with low credit scores, first-time homebuyers, and homeowners looking to refinance, can benefit from FHA loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fha portfolio standard and from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including fha portfolio standard and. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the fha portfolio standard and form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign fha portfolio standard and and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit fha portfolio standard and on an Android device?

You can make any changes to PDF files, such as fha portfolio standard and, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is fha portfolio standard and?

The FHA portfolio standard is a requirement set by the Federal Housing Administration for lenders to maintain a certain level of quality in their loan portfolios.

Who is required to file fha portfolio standard and?

Lenders who participate in FHA loan programs are required to file the FHA portfolio standard.

How to fill out fha portfolio standard and?

Lenders must provide detailed information about their loan portfolios, including borrower demographics and loan performance data.

What is the purpose of fha portfolio standard and?

The purpose of the FHA portfolio standard is to ensure that lenders are maintaining a high level of quality in their loans and are serving the needs of FHA borrowers.

What information must be reported on fha portfolio standard and?

Lenders must report information such as borrower credit scores, loan-to-value ratios, and default rates.

Fill out your fha portfolio standard and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Portfolio Standard And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.