Get the free Manual Underwriting required Automated Underwriting not

Show details

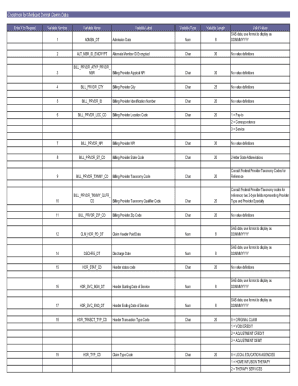

Qualifcollec FHA STREAMLINE 15, 20, 25 and 30 Year Fixed Rate LTV 1 97.75 CTV 100 Purpose Streamline Ref Units 1 Occupancy O/O Credit Score 660 1 Max LTV is equal to the Max CTV on Streamline Refinances

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manual underwriting required automated

Edit your manual underwriting required automated form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manual underwriting required automated form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit manual underwriting required automated online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit manual underwriting required automated. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manual underwriting required automated

To fill out manual underwriting required automated, follow these steps:

01

Gather all necessary documents: Collect all the required documentation such as income statements, bank statements, employment history, credit reports, and any other supporting documents that may be needed.

02

Review the guidelines: Familiarize yourself with the specific guidelines and requirements for the manual underwriting process. This may include specific income ratios, credit score thresholds, and debt-to-income (DTI) ratios.

03

Ensure accuracy and completeness: Double-check all the information provided on the application form to make sure it is accurate and complete. Providing incorrect or incomplete information can lead to delays or rejection of the application.

04

Organize the documentation: Arrange all the documents in a logical and organized manner. Make sure they are easy to navigate and that the required information is clearly visible.

05

Submit the application packet: Once you have gathered and organized all the necessary documents, submit the application packet to the appropriate department or institution. Follow the designated submission process, whether it is online, via mail, or in-person.

06

Follow up and provide additional information if requested: After submitting the application, be prepared to respond promptly if the underwriter requires additional documentation or requests further clarification.

Now, let's address who needs manual underwriting required automated:

Manual underwriting required automated is typically needed for individuals who may not meet the standard automated underwriting criteria set by lenders or financial institutions. This can include individuals with limited credit history, self-employed individuals, applicants with non-traditional income sources, or those with lower credit scores.

Manual underwriting may also be required in certain scenarios where the automated underwriting system cannot effectively assess the borrower's creditworthiness, such as for non-standard loans or unique financial situations.

Overall, manual underwriting provides an opportunity for individuals who do not meet the traditional automated criteria to demonstrate their creditworthiness through a more personalized assessment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send manual underwriting required automated to be eSigned by others?

To distribute your manual underwriting required automated, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit manual underwriting required automated on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing manual underwriting required automated right away.

How do I fill out manual underwriting required automated using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign manual underwriting required automated and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is manual underwriting required automated?

Manual underwriting required automated is the process of manually reviewing and assessing loan applications that do not meet the criteria for automatic approval.

Who is required to file manual underwriting required automated?

Lenders and financial institutions are required to file manual underwriting required automated for loan applications that need manual review.

How to fill out manual underwriting required automated?

To fill out manual underwriting required automated, lenders need to gather all necessary documents and information about the loan applicant and manually review the application.

What is the purpose of manual underwriting required automated?

The purpose of manual underwriting required automated is to ensure that loan applications are thoroughly reviewed and assessed for approval or denial.

What information must be reported on manual underwriting required automated?

Information such as applicant's income, credit history, employment status, and other relevant financial details must be reported on manual underwriting required automated.

Fill out your manual underwriting required automated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manual Underwriting Required Automated is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.