IL LLC-45.5(S) 2010 free printable template

Show details

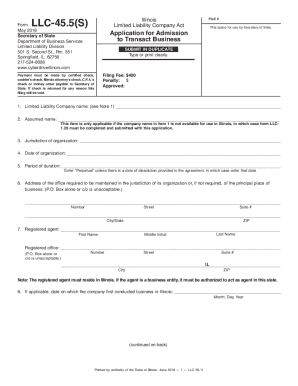

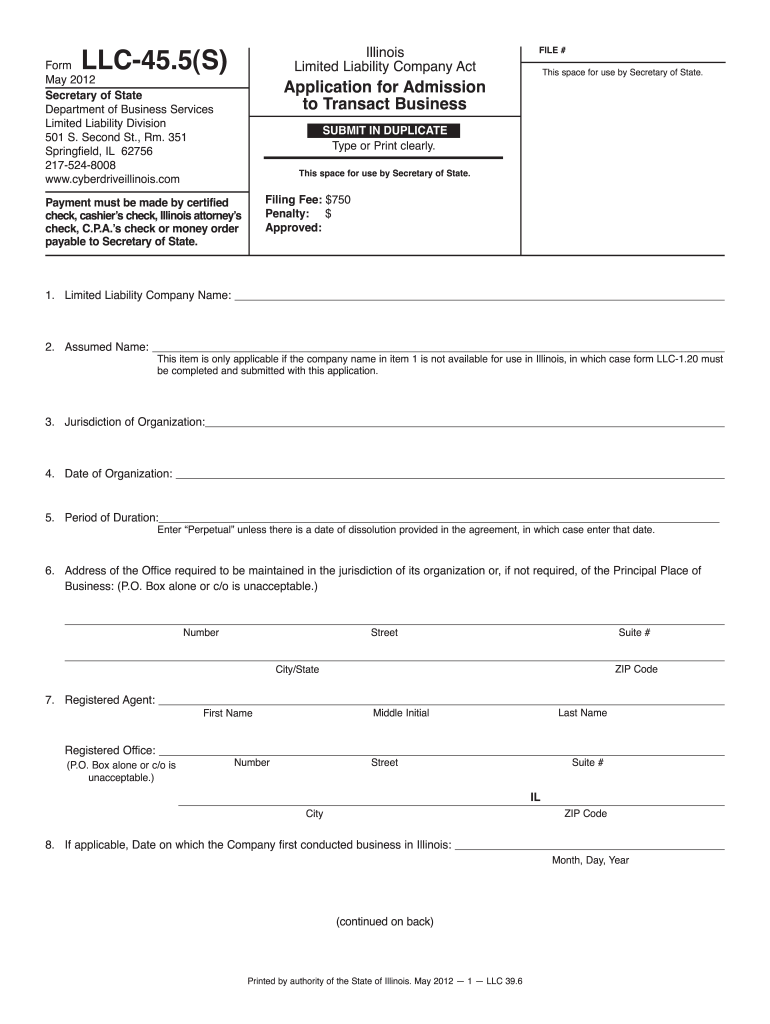

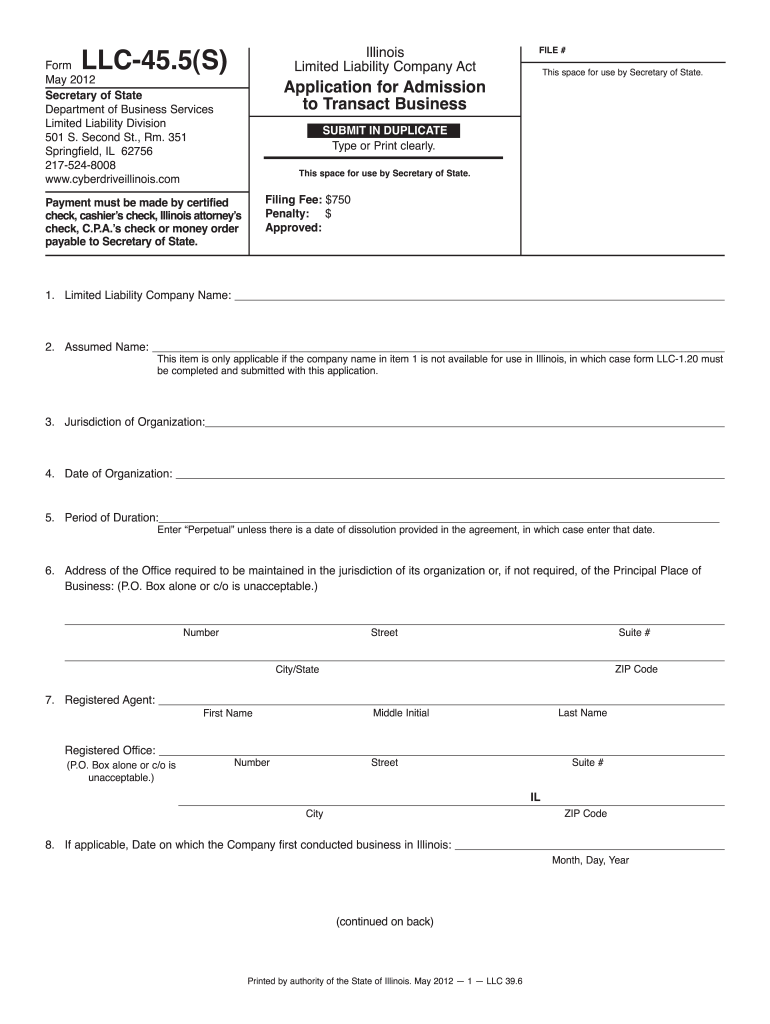

Print Illinois Limited Liability Company Act LLC-45. 5 S Form May 2012 Secretary of State Department of Business Services 501 S. Second St. Rm. 351 Springfield IL 62756 217-524-8008 www. cyberdriveillinois. com Reset Save FILE This space for use by Secretary of State. Application for Admission to Transact Business SUBMIT IN DUPLICATE Type or Print clearly. Filing Fee 750 Penalty Approved Payment must be made by certified check cashier s check Illinois attorney s check C. P. A. s check or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign illinois form llc 45

Edit your illinois form llc 45 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois form llc 45 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit illinois form llc 45 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit illinois form llc 45. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL LLC-45.5(S) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out illinois form llc 45

How to fill out IL LLC-45.5(S)

01

Obtain the IL LLC-45.5(S) form from the Illinois Secretary of State's website or your local office.

02

Complete the top section with your LLC's name, the date of dissolution, and the address of the principal office.

03

Indicate whether the LLC has any outstanding debts by checking the appropriate box.

04

If applicable, provide the names and addresses of any members who want to continue the LLC as a different entity.

05

Sign and date the form, ensuring that the signature is from an authorized member or manager of the LLC.

06

Submit the completed form along with any required fees to the Illinois Secretary of State.

Who needs IL LLC-45.5(S)?

01

Any LLC in Illinois that wishes to formally dissolve its business operations and terminate its registration with the state.

Fill

form

: Try Risk Free

People Also Ask about

How do I dissolve an LLC in Illinois?

To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.

How do I dissolve an entity in Illinois?

How do you dissolve an Illinois Corporation? To dissolve your corporation in Illinois, you submit in duplicate the completed BCA 12.20, Articles of Dissolution form by mail or in person to the Secretary of State along with the filing fee.

How much does it cost to form an LLC in Illinois?

Form NumberForm NameFeeLLC 45.20Application for Registration of Name$50LLC 45.20Renewal of a Registered Name$50LLC 45.20Cancellation of a Registered Name$5LLC 45.25Amended Application for Admission$5046 more rows

How long does it take for an LLC to be approved in Illinois?

Mail filings: In total, mail filing approvals for Illinois LLCs take 3-4 weeks. This accounts for the 7-14 business day processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Illinois LLCs take 5-10 business days.

What is a LLC 5?

The LLC-5 is a California State form used when a domestic limited liability company formed in another state (or country) wishes to become a foreign limited liability company in California.

How do I close my LLC business in Illinois?

When you decide to close your business, you must contact the Illinois Department of Revenue regarding your tax liabilities. Contact can be made: electronically through MyTax Illinois, by calling us at 217-785-3707, or.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete illinois form llc 45 online?

pdfFiller has made filling out and eSigning illinois form llc 45 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit illinois form llc 45 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your illinois form llc 45, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the illinois form llc 45 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your illinois form llc 45 in seconds.

What is IL LLC-45.5(S)?

IL LLC-45.5(S) is a specific form used by Limited Liability Companies (LLCs) in Illinois to report certain financial information to the state.

Who is required to file IL LLC-45.5(S)?

All Limited Liability Companies (LLCs) registered in Illinois that meet specific criteria must file IL LLC-45.5(S).

How to fill out IL LLC-45.5(S)?

To fill out IL LLC-45.5(S), you need to provide accurate financial information, including income, expenses, and any other required details relevant to the LLC's operations.

What is the purpose of IL LLC-45.5(S)?

The purpose of IL LLC-45.5(S) is to ensure compliance with state tax regulations by reporting the financial activities of an LLC for a specific tax period.

What information must be reported on IL LLC-45.5(S)?

The information that must be reported on IL LLC-45.5(S) includes details on income, expenses, tax calculations, and any associated deductions or credits for the LLC.

Fill out your illinois form llc 45 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Form Llc 45 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.