Get the free Level Term Life Insurance Application - baafpinscomb

Show details

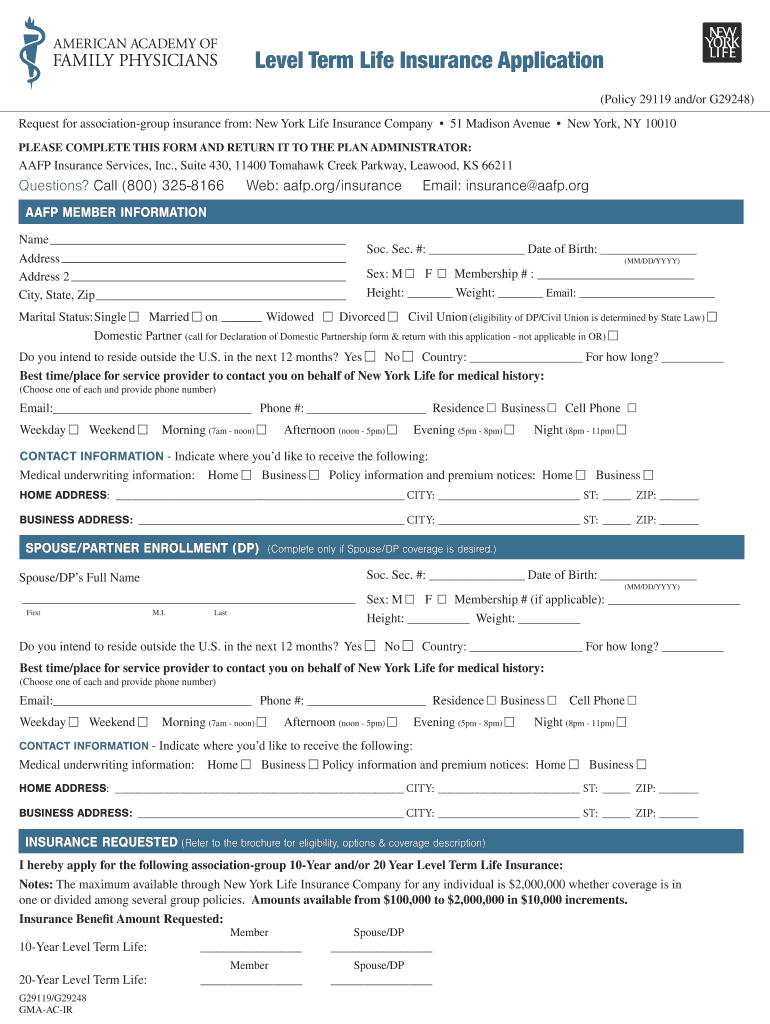

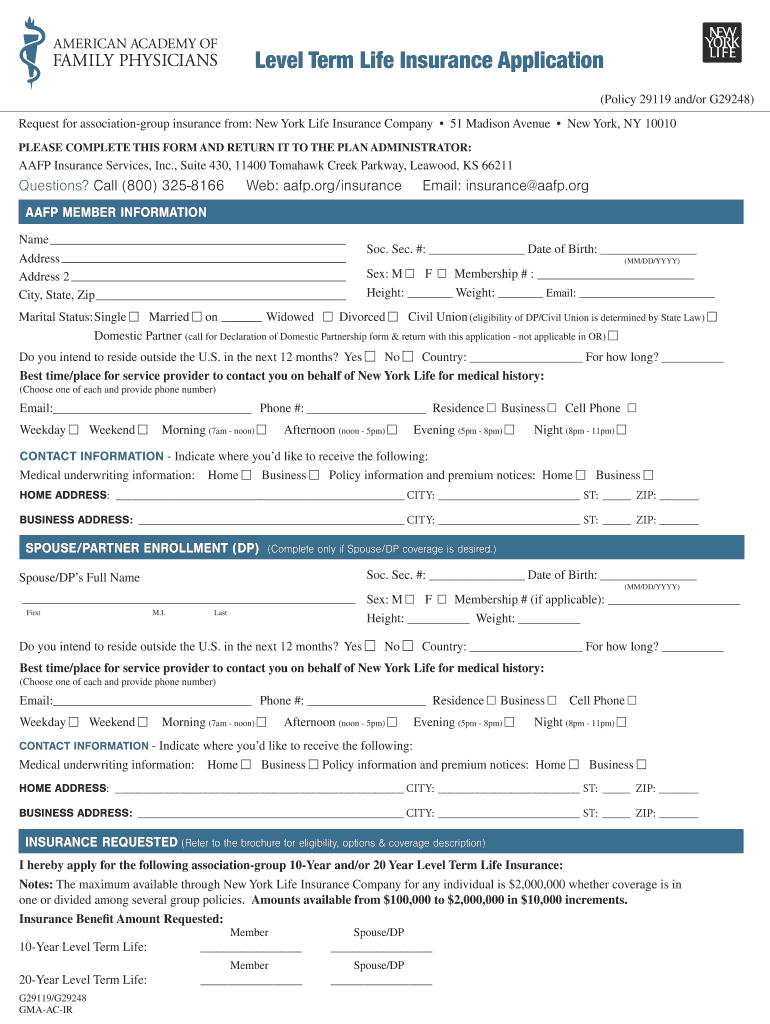

Level Term Life Insurance Application (Policy 29119 and/or G29248) Request for association group insurance from: New York Life Insurance Company 51 Madison Avenue New York, NY 10010 PLEASE COMPLETE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign level term life insurance

Edit your level term life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your level term life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit level term life insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit level term life insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out level term life insurance

How to fill out level term life insurance:

01

Start by gathering necessary information: Before filling out the application, gather personal information such as full name, date of birth, contact details, and social security number. You may also need information about your beneficiaries, such as their names and contact details.

02

Determine the coverage amount and term length: Level term life insurance allows you to choose how much coverage you need and the duration of the policy. Consider factors like your financial obligations, such as mortgage or debt, and the number of years you want coverage for.

03

Research and compare insurance providers: Look for reputable insurance companies that offer level term life insurance. Compare quotes, policy features, customer reviews, and financial strength ratings to ensure you choose a reliable provider.

04

Fill out the application form: Once you've selected an insurance company, you'll need to fill out the application form accurately and honestly. Provide all the required personal and medical information. Be prepared to disclose any pre-existing conditions or lifestyle habits that may impact your coverage.

05

Undergo a medical exam (if required): Some level term life insurance policies may require a medical exam to assess your health and determine the premium. Follow any instructions given by the insurance company and schedule the exam at a convenient time.

06

Review and sign the policy: After submitting the application, carefully review the policy documents provided by the insurance company. Pay attention to the coverage details, premium amount, exclusions, and any additional riders or options. If everything is satisfactory, sign the policy and make the initial premium payment.

07

Communicate with beneficiaries: Once you have level term life insurance in place, inform your chosen beneficiaries about the policy. Provide them with the necessary information about contacting the insurance company in case of your passing.

Who needs level term life insurance?

01

Individuals with financial dependents: If you have people who rely on your income, such as a spouse, children, or aging parents, level term life insurance can provide financial protection for them in the event of your death.

02

Homeowners with mortgages: If you have a mortgage or any other significant debts, level term life insurance can help ensure that your loved ones can continue to make payments and remain in the family home if something were to happen to you.

03

Sole breadwinners or primary income earners: If you are the primary earner in your household, level term life insurance can provide a safety net for your loved ones if you were no longer able to provide for them financially.

04

Business owners: Level term life insurance can be essential for business owners, especially those with partners or employees who rely on the business's success. It can help cover business debts, provide capital for succession planning, or compensate partners in case of a partner's death.

05

Individuals with estate planning needs: Level term life insurance can be utilized as an estate planning tool to assist with minimizing estate taxes, providing liquidity, and ensuring a smooth transfer of wealth to beneficiaries.

Remember, it's important to consult with a licensed insurance professional or financial advisor to determine if level term life insurance is suitable for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in level term life insurance?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your level term life insurance to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in level term life insurance without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your level term life insurance, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit level term life insurance on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign level term life insurance right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is level term life insurance?

Level term life insurance is a type of life insurance that provides coverage for a specified period of time, with a fixed premium and guaranteed death benefit.

Who is required to file level term life insurance?

Individuals who wish to obtain life insurance coverage for a specific term are required to file for level term life insurance.

How to fill out level term life insurance?

To fill out level term life insurance, individuals need to provide personal information, medical history, choose a coverage amount and term length, and pay the premium.

What is the purpose of level term life insurance?

The purpose of level term life insurance is to provide financial protection to beneficiaries in the event of the policyholder's death during the term of the policy.

What information must be reported on level term life insurance?

Information such as personal details, medical history, coverage amount, beneficiaries, and term length must be reported on level term life insurance.

Fill out your level term life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Level Term Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.