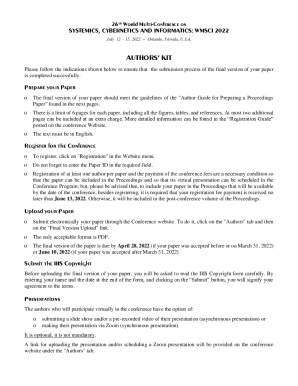

Get the free Monthly Gas Tax Return - troyal

Show details

This document serves as a monthly gas tax return that businesses operating in Troy, Alabama must complete and submit, detailing fuel sales and taxes due.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign monthly gas tax return

Edit your monthly gas tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your monthly gas tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing monthly gas tax return online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit monthly gas tax return. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out monthly gas tax return

How to fill out Monthly Gas Tax Return

01

Gather all necessary documentation related to gas sales for the month.

02

Calculate the total gallons of gas sold during the month.

03

Determine the applicable tax rate for the gas sold.

04

Multiply the total gallons sold by the tax rate to find the total tax due.

05

Fill out the Monthly Gas Tax Return form with the relevant information, including your business details.

06

Report the total gallons sold and the total tax calculated on the form.

07

Review the completed form for accuracy.

08

Submit the form and payment to the appropriate tax authority by the due date.

Who needs Monthly Gas Tax Return?

01

Businesses that sell gasoline or other motor fuels.

02

Gas retailers and distributors.

03

Any entity responsible for collecting and remitting gas taxes.

Fill

form

: Try Risk Free

People Also Ask about

How much tax is on gas in the UK?

The fuel drivers buy at the pumps is taxed in two ways: fuel duty and VAT. Fuel duty is currently levied at a flat rate of 52.95p per litre whilst VAT is charged at 20% on both the underlying product price and the duty. This chart shows, over time, the amount per litre which has gone to the chancellor.

What is Illinois gas tax?

Illinois motor fuel tax hit 48.3 cents on July 1, 2025 Illinois Gov. J.B. Pritzker doubled the state's gasoline tax from 19 cents in 2019 and added automatic annual increases. The state motor fuel tax increased to 48.3 cents on July 1.

What is the easiest way to fill out a tax return?

The IRS recommends using tax preparation software to e-file for the easiest and most accurate returns and fastest refunds. You may be able to file free online through IRS Direct File if you are in one of 25 participating states and have a simple tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Monthly Gas Tax Return?

The Monthly Gas Tax Return is a form that records the amount of gasoline sold and the corresponding gas taxes owed to the government, typically filed on a monthly basis by entities engaged in the sale of gasoline.

Who is required to file Monthly Gas Tax Return?

Businesses that sell gasoline, including retailers and distributors, are required to file the Monthly Gas Tax Return to report their sales and pay the applicable gas taxes.

How to fill out Monthly Gas Tax Return?

To fill out the Monthly Gas Tax Return, one must provide details such as the total gallons of gasoline sold, the applicable tax rate, calculations of total taxes owed, and any adjustments for prior periods, ensuring accurate reporting based on sales records.

What is the purpose of Monthly Gas Tax Return?

The purpose of the Monthly Gas Tax Return is to ensure compliance with gas tax regulations, facilitate the collection of taxes owed on gasoline sales, and provide necessary information for government revenue.

What information must be reported on Monthly Gas Tax Return?

Information that must be reported includes total gallons of gasoline sold, tax rates, total tax calculated, any credits or adjustments, and the reporting period for which the return is being filed.

Fill out your monthly gas tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Monthly Gas Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.