Get the free Fixed Income Trading

Show details

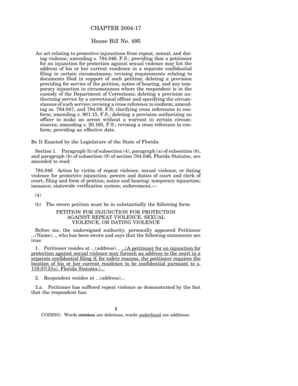

Mashed Fixed Income Trading Daily Market Update Monday, March 16, 2015Market Update UK backing for Islamic bonds to begin with Emirates Airlines deal Britain is stepping up its commitment to expanding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed income trading

Edit your fixed income trading form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed income trading form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed income trading online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fixed income trading. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed income trading

How to fill out fixed income trading:

Research and Understand the Market:

Before diving into fixed income trading, it is essential to conduct thorough research and gain a solid understanding of the market. Familiarize yourself with different types of fixed income securities, such as bonds, treasury bills, and corporate debt instruments.

Determine Your Investment Objectives:

It is crucial to identify your investment objectives when engaging in fixed income trading. Consider factors such as desired returns, risk tolerance, and investment time horizon. This will help you make informed decisions and choose suitable fixed income assets.

Assess Risk and Return:

Evaluate the risk and return characteristics of various fixed income securities. High-risk securities may offer potential for higher returns but also come with increased volatility. On the other hand, lower-risk securities may offer more stable returns but with potentially lower yields. Assess your risk appetite and make investment choices accordingly.

Set Up a Brokerage Account:

To engage in fixed income trading, you will need to set up a brokerage account. Choose a reliable brokerage firm that offers a wide range of fixed income products and has competitive pricing and trading platforms. Research and compare different options to find the best fit for your needs.

Build a Diversified Portfolio:

Diversification is key in fixed income trading as it helps to spread risk across various securities. Consider investing in a mix of different fixed income assets, such as government bonds, corporate bonds, and municipal bonds. This diversification can provide a balance between stability and potential returns.

Monitor Market Trends and Perform Due Diligence:

Stay updated on market trends and economic indicators that can impact fixed income securities. Regularly monitor interest rate changes, credit rating updates, and news that can affect the market. Furthermore, perform due diligence on any fixed income security before investing, including analyzing issuer financials, credit ratings, and bond features.

Who needs fixed income trading?

Individuals seeking a regular stream of income:

Fixed income trading is suitable for individuals who want to generate a steady income from their investments. This can be especially beneficial for individuals who are retired or rely on investment income to meet their financial obligations.

Investors looking for portfolio diversification:

Investors aiming to diversify their portfolios beyond just stocks may consider fixed income trading. Adding fixed income securities to a portfolio can help reduce volatility and provide stability, especially during periods of market turbulence.

Institutional investors and financial institutions:

Financial institutions, such as banks, insurance companies, and pension funds, typically engage in fixed income trading to manage their assets and match liabilities. Institutional investors often have sophisticated fixed income trading strategies and expertise to optimize their investment returns.

Remember to consult with a financial advisor or professional before making any investment decisions. The information provided is for educational purposes only and should not be considered as financial advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fixed income trading in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign fixed income trading and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send fixed income trading to be eSigned by others?

Once you are ready to share your fixed income trading, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in fixed income trading without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing fixed income trading and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is fixed income trading?

Fixed income trading is the buying and selling of fixed income securities such as bonds, treasury bills, and other debt instruments.

Who is required to file fixed income trading?

Financial institutions, investment firms, and individuals involved in fixed income trading are required to file reports on their trading activities.

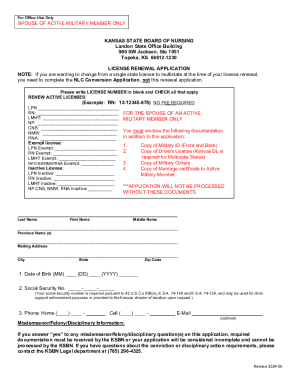

How to fill out fixed income trading?

The filing of fixed income trading reports typically involves providing details on the securities traded, the amount of the trades, and the parties involved.

What is the purpose of fixed income trading?

The purpose of fixed income trading is to generate returns on investments through the buying and selling of debt securities.

What information must be reported on fixed income trading?

Information such as trade date, security type, quantity traded, price, and counterparty details must be reported on fixed income trading.

Fill out your fixed income trading online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Income Trading is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.